Managed Audit Application

Download a blank fillable Managed Audit Application in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Managed Audit Application with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Reset This Form

State of Washington

Department of Revenue

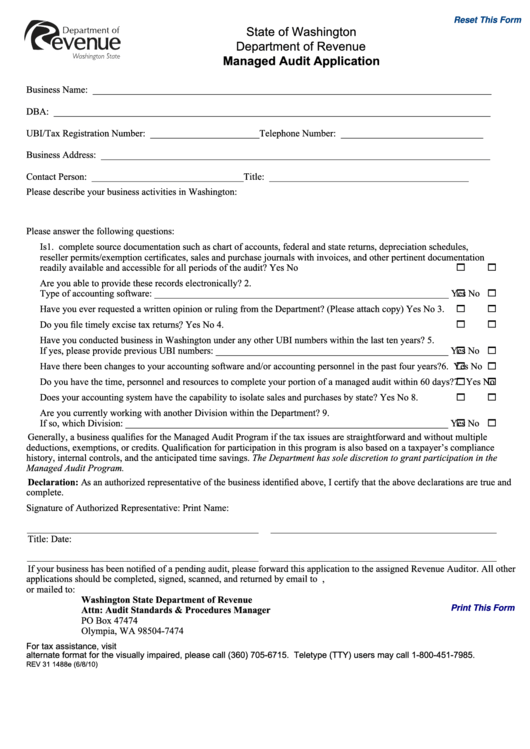

Managed Audit Application

Business Name: ____________________________________________________________________________________

DBA: ____________________________________________________________________________________________

UBI/Tax Registration Number: _______________________ Telephone Number: ______________________________

Business Address: __________________________________________________________________________________

Contact Person: ________________________________

Title: __________________________________________

Please describe your business activities in Washington:

Please answer the following questions:

1.

Is

complete source documentation such as chart of accounts, federal and state returns, depreciation schedules,

reseller permits/exemption certificates, sales and purchase journals with invoices, and other pertinent documentation

readily available and accessible for all periods of the audit?

Yes

No

1

1

2.

Are you able to provide these records electronically?

Type of accounting software: ______________________________________________________________

1

Yes

1

No

3.

Have you ever requested a written opinion or ruling from the Department? (Please attach copy)

Yes

No

1

1

4.

Do you file timely excise tax returns?

1

Yes

1

No

5.

Have you conducted business in Washington under any other UBI numbers within the last ten years?

If yes, please provide previous UBI numbers: _________________________________________________

Yes

No

1

1

6.

Have there been changes to your accounting software and/or accounting personnel in the past four years?

1

Yes

1

No

7.

Do you have the time, personnel and resources to complete your portion of a managed audit within 60 days?

Yes

No

1

1

8.

Does your accounting system have the capability to isolate sales and purchases by state?

1

Yes

1

No

9.

Are you currently working with another Division within the Department?

If so, which Division: ____________________________________________________________________

Yes

No

1

1

Generally, a business qualifies for the Managed Audit Program if the tax issues are straightforward and without multiple

deductions, exemptions, or credits. Qualification for participation in this program is also based on a taxpayer’s compliance

history, internal controls, and the anticipated time savings. The Department has sole discretion to grant participation in the

Managed Audit Program.

Declaration: As an authorized representative of the business identified above, I certify that the above declarations are true and

complete.

Signature of Authorized Representative:

Print Name:

Title:

Date:

If your business has been notified of a pending audit, please forward this application to the assigned Revenue Auditor. All other

applications should be completed, signed, scanned, and returned by email to dormanagedauditappli@dor.wa.gov,

or mailed to:

Washington State Department of Revenue

Attn: Audit Standards & Procedures Manager

Print This Form

PO Box 47474

Olympia, WA 98504-7474

For tax assistance, visit dor.wa.gov or call 1-800-647-7706. To inquire about the availability of this document in an

alternate format for the visually impaired, please call (360) 705-6715. Teletype (TTY) users may call 1-800-451-7985.

REV 31 1488e (6/8/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1