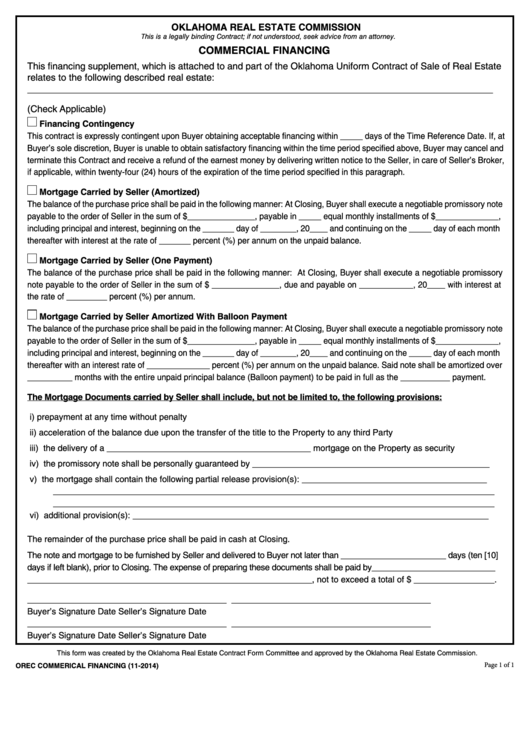

OKLAHOMA REAL ESTATE COMMISSION

This is a legally binding Contract; if not understood, seek advice from an attorney.

COMMERCIAL FINANCING

This financing supplement, which is attached to and part of the Oklahoma Uniform Contract of Sale of Real Estate

relates to the following described real estate:

�����������������������������������������������������������������������������������������

(Check Applicable)

Financing Contingency

This contract is expressly contingent upon Buyer obtaining acceptable financing within ����� days of the Time Reference Date. If, at

Buyer’s sole discretion, Buyer is unable to obtain satisfactory financing within the time period specified above, Buyer may cancel and

terminate this Contract and receive a refund of the earnest money by delivering written notice to the Seller, in care of Seller’s Broker,

if applicable, within twenty-four (24) hours of the expiration of the time period specified in this paragraph.

Mortgage Carried by Seller (Amortized)

The balance of the purchase price shall be paid in the following manner: At Closing, Buyer shall execute a negotiable promissory note

payable to the order of Seller in the sum of $���������������, payable in ����� equal monthly installments of $��������������,

including principal and interest, beginning on the ������� day of ��������, 20���� and continuing on the ����� day of each month

thereafter with interest at the rate of ������� percent (%) per annum on the unpaid balance.

Mortgage Carried by Seller (One Payment)

The balance of the purchase price shall be paid in the following manner: At Closing, Buyer shall execute a negotiable promissory

note payable to the order of Seller in the sum of $ ���������������, due and payable on ������������, 20���� with interest at

the rate of ��������� percent (%) per annum.

Mortgage Carried by Seller Amortized With Balloon Payment

The balance of the purchase price shall be paid in the following manner: At Closing, Buyer shall execute a negotiable promissory note

payable to the order of Seller in the sum of $���������������, payable in ����� equal monthly installments of $��������������,

including principal and interest, beginning on the ������� day of ��������, 20���� and continuing on the ����� day of each month

thereafter with an interest rate of �������������� percent (%) per annum on the unpaid balance. Said note shall be amortized over

���������� months with the entire unpaid principal balance (Balloon payment) to be paid in full as the ����������� payment.

The Mortgage Documents carried by Seller shall include, but not be limited to, the following provisions:

i) prepayment at any time without penalty

ii) acceleration of the balance due upon the transfer of the title to the Property to any third Party

iii) the delivery of a ������������������������������������������� mortgage on the Property as security

iv) the promissory note shall be personally guaranteed by ��������������������������������������������������

v) the mortgage shall contain the following partial release provision(s): ���������������������������������������

���������������������������������������������������������������������������������������������

���������������������������������������������������������������������������������������������

vi) additional provision(s): ���������������������������������������������������������������������������

The remainder of the purchase price shall be paid in cash at Closing.

The note and mortgage to be furnished by Seller and delivered to Buyer not later than ����������������������� days (ten [10]

days if left blank), prior to Closing. The expense of preparing these documents shall be paid by���������������������������

������������������������������������������������������������, not to exceed a total of $ �����������������.

������������������������������������������

������������������������������������������

Buyer’s Signature

Date

Seller’s Signature

Date

������������������������������������������

������������������������������������������

Buyer’s Signature

Date

Seller’s Signature

Date

This form was created by the Oklahoma Real Estate Contract Form Committee and approved by the Oklahoma Real Estate Commission.

Page 1 of 1

OREC COMMERICAL FINANCING (11-2014)

1

1