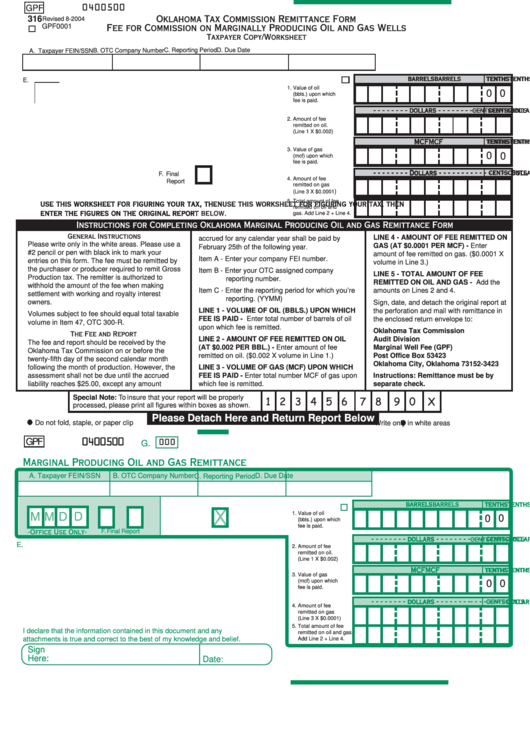

Form Gpf 316 - Oklahoma Tax Commission Remittance Form Fee For Commission On Marginally Producing Oil And Gas Wells

ADVERTISEMENT

0400500

GPF

316

Revised 8-2004

Oklahoma Tax Commission Remittance Form

GPF0001

Fee for Commission on Marginally Producing Oil and Gas Wells

Taxpayer Copy/Worksheet

B. OTC Company Number

C. Reporting Period

D. Due Date

A. Taxpayer FEIN/SSN

barrels

barrels

tenths

tenths

barrels

barrels

barrels

tenths

tenths

tenths

E.

1. Value of oil

0 0

(bbls.) upon which

fee is paid.

- - - - - - - - dollars - - - - - - - -

- - - - - - - - dollars - - - - - - - -

- - - - - - - - dollars - - - - - - - -

- - - - - - - - dollars - - - - - - - -

- - - - - - - - dollars - - - - - - - -

cents

cents

cents

cents

cents

2. Amount of fee

remitted on oil.

(Line 1 X $0.002)

tenths

tenths

tenths

tenths

tenths

MCF

MCF

MCF

MCF

MCF

3. Value of gas

0 0

(mcf) upon which

fee is paid.

cents

cents

cents

cents

cents

- - - - - - - - Dollars - - - - - - - -

- - - - - - - - Dollars - - - - - - - -

- - - - - - - - Dollars - - - - - - - -

- - - - - - - - Dollars - - - - - - - -

- - - - - - - - Dollars - - - - - - - -

F. Final

4. Amount of fee

Report

remitted on gas

)

(Line 3 X $0.0001

5. Total amount of fee

use this worksheet for figuring your tax, then

use this worksheet for figuring your tax, then

use this worksheet for figuring your tax, then

use this worksheet for figuring your tax, then

use this worksheet for figuring your tax, then

remitted on oil and

enter the figures on the original report below.

enter the figures on the original report below.

enter the figures on the original report below.

enter the figures on the original report below.

enter the figures on the original report below.

gas. Add Line 2 + Line 4.

Instructions for Completing Oklahoma Marginal Producing Oil and Gas Remittance Form

General Instructions

LINE 4 - AMOUNT OF FEE REMITTED ON

accrued for any calendar year shall be paid by

Please write only in the white areas. Please use a

GAS (AT $0.0001 PER MCF) - Enter

February 25th of the following year.

#2 pencil or pen with black ink to mark your

amount of fee remitted on gas. ($0.0001 X

Item A - Enter your company FEI number.

entries on this form. The fee must be remitted by

volume in Line 3.)

the purchaser or producer required to remit Gross

Item B - Enter your OTC assigned company

LINE 5 - TOTAL AMOUNT OF FEE

Production tax. The remitter is authorized to

reporting number.

REMITTED ON OIL AND GAS - Add the

withhold the amount of the fee when making

Item C - Enter the reporting period for which you’re

amounts on Lines 2 and 4.

settlement with working and royalty interest

reporting. (YYMM)

owners.

Sign, date, and detach the original report at

LINE 1 - VOLUME OF OIL (BBLS.) UPON WHICH

the perforation and mail with remittance in

Volumes subject to fee should equal total taxable

FEE IS PAID - Enter total number of barrels of oil

the enclosed return envelope to:

volume in Item 47, OTC 300-R.

upon which fee is remitted.

Oklahoma Tax Commission

The Fee and Report

LINE 2 - AMOUNT OF FEE REMITTED ON OIL

Audit Division

The fee and report should be received by the

(AT $0.002 PER BBL.) - Enter amount of fee

Marginal Well Fee (GPF)

Oklahoma Tax Commission on or before the

remitted on oil. ($0.002 X volume in Line 1.)

Post Office Box 53423

twenty-fifth day of the second calendar month

Oklahoma City, Oklahoma 73152-3423

following the month of production. However, the

LINE 3 - VOLUME OF GAS (MCF) UPON WHICH

assessment shall not be due until the accrued

FEE IS PAID - Enter total number MCF of gas upon

Instructions: Remittance must be by

liability reaches $25.00, except any amount

which fee is remitted.

separate check.

Special Note: To insure that your report will be properly

1 2 3 4 5 6

7 8

9 0

X

processed, please print all figures within boxes as shown.

Please Detach Here and Return Report Below

Do not fold, staple, or paper clip

Write only in white areas

0400500

GPF

000

G.

Marginal Producing Oil and Gas Remittance

A. Taxpayer FEIN/SSN

B. OTC Company Number

D. Due Date

C. Reporting Period

barrels

barrels

barrels

barrels

barrels

tenths

tenths

tenths

tenths

tenths

1. Value of oil

M

M D

D

0 0

(bbls.) upon which

fee is paid.

F. Final Report

-Office Use Only-

f.c.

p.t

- - - - - - - - dollars - - - - - - - -

- - - - - - - - dollars - - - - - - - -

- - - - - - - - dollars - - - - - - - -

- - - - - - - - dollars - - - - - - - -

- - - - - - - - dollars - - - - - - - -

cents

cents

cents

cents

cents

E.

2. Amount of fee

remitted on oil.

(Line 1 X $0.002)

tenths

tenths

tenths

MCF

MCF

MCF

MCF

MCF

tenths

tenths

3. Value of gas

(mcf) upon which

0 0

fee is paid.

- - - - - - - - dollars - - - - - - - -

- - - - - - - - dollars - - - - - - - -

cents

cents

cents

cents

cents

- - - - - - - - dollars - - - - - - - -

- - - - - - - - dollars - - - - - - - -

- - - - - - - - dollars - - - - - - - -

4. Amount of fee

remitted on gas

(Line 3 X $0.0001)

5. Total amount of fee

I declare that the information contained in this document and any

remitted on oil and gas.

attachments is true and correct to the best of my knowledge and belief.

Add Line 2 + Line 4.

Sign

Here:

Date:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2