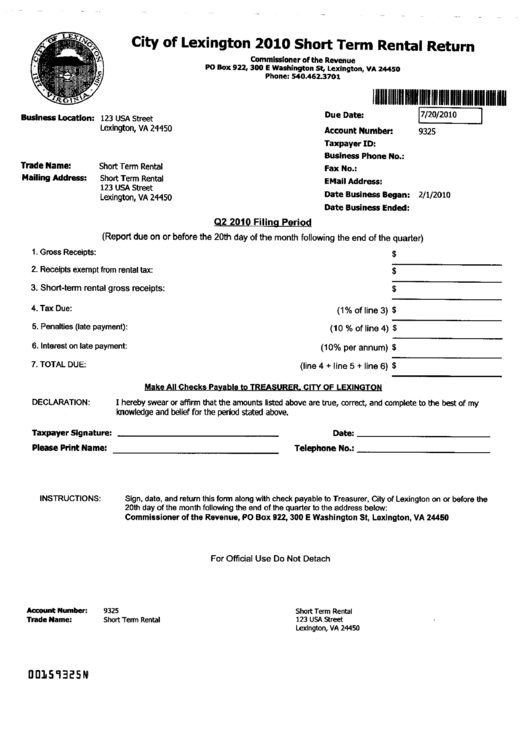

Short Term Rental Return Form - City Of Lexington 2010

ADVERTISEMENT

Due Date:

9325

Trade Name:

Mailing Address:

Short Term Rental

Short Term Rental

123 USA Street

Lexington, VA 24450

7/20/2010

1

Account Number:

Taxpayer ID:

Business Phone No.:

Fax No.:

EMail Address:

Date Business Began: 2/1/2010

Date Business Ended:

Business Location: 123 USA Street

Lexington, VA 24450

City of Lexington 2010 Short Term Rental Return

Commissioner of the Revenue

PO Box 922, 300 E Washington St, Lexington, VA 24450

Phone: 540.462.3701

111111111111111111111111111111111111111111111111

02 2010 Filing Period

(Report due on or before the 20th day of the month following the end of the quarter)

1. Gross Receipts:

2. Receipts exempt from rental tax:

3. Short-term rental gross receipts:

4. Tax Due:

5. Penalties (late payment):

6. Interest on late payment:

7. TOTAL DUE:

(1% of line 3) $

(10 % of line 4) $

(10% per annum) $

(line 4 + line 5 + line 6) $

Make All Checks Payable to TREASURER. CITY OF LEXINGTON

DECLARATION:

I hereby swear or affirm that the amounts listed above are true, correct, and complete to the best of my

knowledge and belief for the period stated above.

Taxpayer Signature:

Date:

Please Print Name:

Telephone No.:

INSTRUCTIONS:

Sign, date, and return this form along with check payable to Treasurer City of Lexington on or before the

20th day of the month following the end of the quarter to the address below:

Commissioner of the Revenue, PO Box 922, 300 E Washington St, Lexington, VA 24450

For Official Use Do Not Detach

Account Number:

9325

Short Term Rental

Trade Name:

Short Term Rental

123 USA Street

Lexington, VA 24450

00159325 N

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1