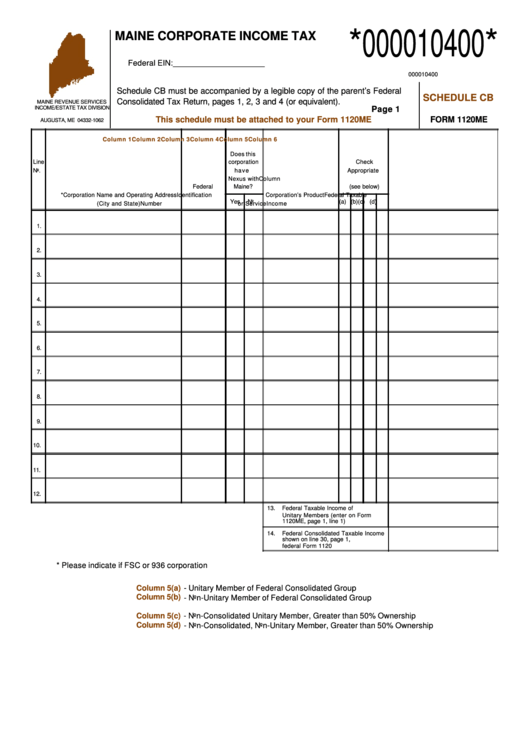

Schedule Cb Form 1120me - Maine Corporate Income Tax

ADVERTISEMENT

*000010400*

MAINE CORPORATE INCOME TAX

Federal EIN:____________________

000010400

Schedule CB must be accompanied by a legible copy of the parent’s Federal

SCHEDULE CB

Consolidated Tax Return, pages 1, 2, 3 and 4 (or equivalent).

MAINE REVENUE SERVICES

INCOME/ESTATE TAX DIVISION

Page 1

P.O. BOX 1062

This schedule must be attached to your Form 1120ME

FORM 1120ME

AUGUSTA, ME 04332-1062

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Does this

Line

corporation

Check

No.

have

Appropriate

Nexus with

Column

Federal

Maine?

(see below)

*Corporation Name and Operating Address

Identification

Corporation’s Product

Federal Taxable

Yes

No

(a) (b)

(c) (d)

(City and State)

Number

or Service

Income

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

Federal Taxable Income of

Unitary Members (enter on Form

1120ME, page 1, line 1)

14.

Federal Consolidated Taxable Income

shown on line 30, page 1,

federal Form 1120

* Please indicate if FSC or 936 corporation

Column 5(a)

- Unitary Member of Federal Consolidated Group

Column 5(b)

- Non-Unitary Member of Federal Consolidated Group

Column 5(c)

- Non-Consolidated Unitary Member, Greater than 50% Ownership

Column 5(d)

- Non-Consolidated, Non-Unitary Member, Greater than 50% Ownership

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2