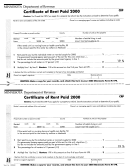

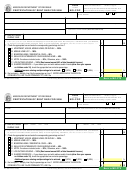

Form Crp - Certificate Of Rent Paid - 2000 Instructions

ADVERTISEMENT

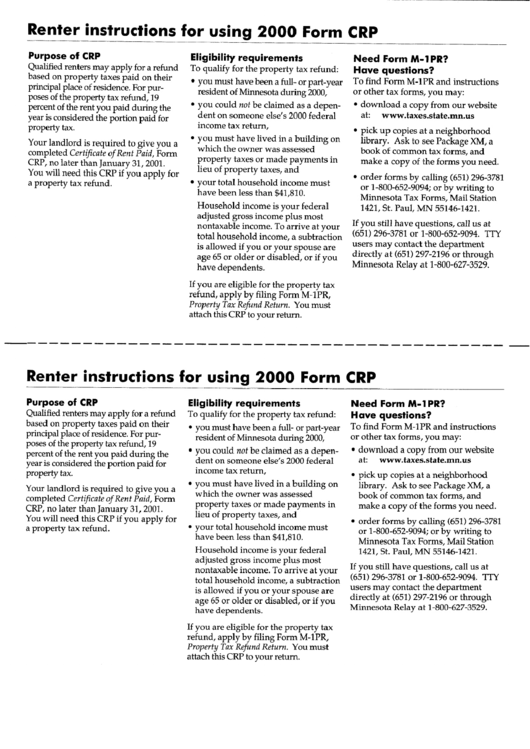

Renter instructions for using 2000 Form CRP

Purpose of CRP

Qualified renters may apply for a refund

based on property taxes paid on their

principal place of residence. For pur-

poses of the property tax refund, 19

percent of the rent you paid during the

year is considered the portion paid for

property tax.

Your landlord is required to give you a

completed

Certificate of Rent Paid,

Form

CRP, no later than January 31, 2001.

You will need this CRP if you apply for

a property tax refund.

Eligibility requirements

To qualify for the property tax refund:

• you must have been a full- or part-year

resident of Minnesota during 2000,

• you could

not

be claimed as a depen-

dent on someone else's 2000 federal

income tax return,

• you must have lived in a building on

which the owner was assessed

property taxes or made payments in

lieu of property taxes, and

• your total household income must

have been less than $41,810.

Household income is your federal

adjusted gross income plus most

nontaxable income. To arrive at your

total household income, a subtraction

is allowed if you or y o u r s p o u s e are

age 65 or older or disabled, or if you

have dependents.

If you are eligible for the property tax

refund, apply by filing Form M-1PR,

Property Tax Refund Return.

You must

attach this CRP to your return.

Need Form M-1PR?

Have

questions?

To find Form M-1PR and instructions

or other tax forms, you may:

• download a copy from our website

at:

w w w . t a x e s . s t a t e . m n . u s

• pick up copies at a neighborhood

library. Ask to see Package XM, a

book of common tax forms, and

make a copy of the forms you need.

• order forms by calling (651) 296-3781

or 1-800-652-9094; or by writing to

Minnesota Tax Forms, Mail Station

1421, St. Paul, MN 55146-1421.

If you still have questions, call us at

(651) 296-3781 or 1-800-652-9094. TTY

users m a y contact the department

directly at (651) 297-2196 or through

Minnesota Relay at 1-800-627-3529.

Renter instructions for using 2000 Form CRP

Purpose of CRP

Qualified renters may apply for a refund

based on property taxes paid on their

principal place of residence. For pur-

poses of the property tax refund, 19

percent of the rent you paid during the

year is considered the portion paid for

property tax.

Your landlord is required to give you a

completed

Certificate of Rent Paid,

Form

CRP, no later than January 31, 2001.

You will need this CRP if you apply for

a property tax refund.

Eligibility requirements

To qualify for the property tax refund:

• you must have been a full- or part-year

resident of Minnesota during 2000,

• you could

not

be claimed as a depen-

dent on someone else's 2000 federal

income tax return,

• you must have lived in a building on

which the owner was assessed

property taxes or made payments in

lieu of property taxes, and

• your total household income must

have been less than $41,810.

Household income is your federal

adjusted gross income plus most

nontaxable income. To arrive at your

total household income, a subtraction

is allowed if you or your spouse are

age 65 or older or disabled, or if you

have dependents.

If you are eligible for the property tax

refund, apply by filing Form M-1PR,

Property Tax Refund Return.

You must

attach this CRP to your return.

Need Form M-1PR?

Have questions?

To find Form M-1PR and instructions

or other tax forms, you may:

• download a copy from our website

at:

w w w . t a x e s . s t a t e . m n . u s

• pick up copies at a neighborhood

library. Ask to see Package XM, a

book of common tax forms, and

make a copy of the forms you need.

• order forms by calling (651) 296-3781

or 1-800-652-9094; or by writing to

Minnesota Tax Forms, Mail Station

1421, St. Paul, MN 55146-1421.

If you still have questions, call us

at

(651) 296-3781 or 1-800-652-9094. TTY

users m a y contact the department

directly at (651) 297-2196 or through

Minnesota Relay at 1-800-627-3529.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3