Form Rv-114 - Instructions For Wisconsin Rental Vehicle Fee Return

ADVERTISEMENT

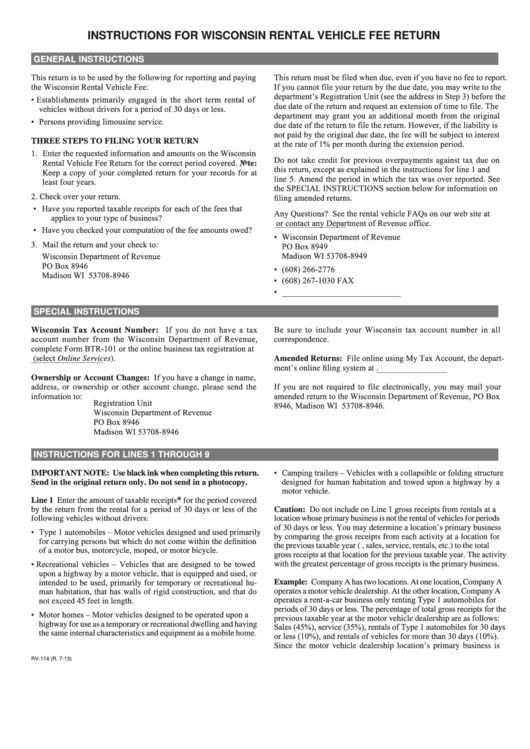

INSTRUCTIONS FOR WISCONSIN RENTAL VEHICLE FEE RETURN

GENERAL INSTRUCTIONS

This return is to be used by the following for reporting and paying

This return must be filed when due, even if you have no fee to report.

the Wisconsin Rental Vehicle Fee:

If you cannot file your return by the due date, you may write to the

department’s Registration Unit (see the address in Step 3) before the

• Establishments primarily engaged in the short term rental of

due date of the return and request an extension of time to file. The

vehicles without drivers for a period of 30 days or less.

department may grant you an additional month from the original

• Persons providing limousine service.

due date of the return to file the return. However, if the liability is

not paid by the original due date, the fee will be subject to interest

THREE STEPS TO FILING YOUR RETURN

at the rate of 1% per month during the extension period.

1. Enter the requested information and amounts on the Wisconsin

Do not take credit for previous overpayments against tax due on

Rental Vehicle Fee Return for the correct period covered. Note:

this return, except as explained in the instructions for line 1 and

Keep a copy of your completed return for your records for at

line 5. Amend the period in which the tax was over reported. See

least four years.

the SPECIAL INSTRUCTIONS section below for information on

2. Check over your return.

filing amended returns.

• Have you reported taxable receipts for each of the fees that

Any Questions? See the rental vehicle FAQs on our web site at

applies to your type of business?

or contact any Department of Revenue office.

• Have you checked your computation of the fee amounts owed?

• Wisconsin Department of Revenue

3. Mail the return and your check to:

PO Box 8949

Wisconsin Department of Revenue

Madison WI 53708-8949

PO Box 8946

• (608) 266-2776

Madison WI 53708-8946

• (608) 267-1030 FAX

• DORBusinessTax@revenue.wi.gov

SPECIAL INSTRUCTIONS

Wisconsin Tax Account Number: If you do not have a tax

Be sure to include your Wisconsin tax account number in all

account number from the Wisconsin Department of Revenue,

correspondence.

complete Form BTR-101 or the online business tax registration at

(select Online Services).

Amended Returns: File online using My Tax Account, the depart-

ment’s online filing system at .

Ownership or Account Changes: If you have a change in name,

If you are not required to file electronically, you may mail your

address, or ownership or other account change, please send the

amended return to the Wisconsin Department of Revenue, PO Box

information to:

Registration Unit

8946, Madison WI 53708-8946.

Wisconsin Department of Revenue

PO Box 8946

Madison WI 53708-8946

INSTRUCTIONS FOR LINES 1 THROUGH 9

• Camping trailers – Vehicles with a collapsible or folding structure

IMPORTANT NOTE: Use black ink when completing this return.

Send in the original return only. Do not send in a photocopy.

designed for human habitation and towed upon a highway by a

motor vehicle.

*

Line 1 Enter the amount of taxable receipts

for the period covered

by the return from the rental for a period of 30 days or less of the

Caution: Do not include on Line 1 gross receipts from rentals at a

following vehicles without drivers:

location whose primary business is not the rental of vehicles for periods

of 30 days or less. You may determine a location’s primary business

• Type 1 automobiles – Motor vehicles designed and used primarily

by comparing the gross receipts from each activity at a location for

for carrying persons but which do not come within the definition

the previous taxable year (e.g., sales, service, rentals, etc.) to the total

of a motor bus, motorcycle, moped, or motor bicycle.

gross receipts at that location for the previous taxable year. The activity

• Recreational vehicles – Vehicles that are designed to be towed

with the greatest percentage of gross receipts is the primary business.

upon a highway by a motor vehicle, that is equipped and used, or

Example: Company A has two locations. At one location, Company A

intended to be used, primarily for temporary or recreational hu-

operates a motor vehicle dealership. At the other location, Company A

man habitation, that has walls of rigid construction, and that do

operates a rent-a-car business only renting Type 1 automobiles for

not exceed 45 feet in length.

periods of 30 days or less. The percentage of total gross receipts for the

• Motor homes – Motor vehicles designed to be operated upon a

previous taxable year at the motor vehicle dealership are as follows:

highway for use as a temporary or recreational dwelling and having

Sales (45%), service (35%), rentals of Type 1 automobiles for 30 days

the same internal characteristics and equipment as a mobile home.

or less (10%), and rentals of vehicles for more than 30 days (10%).

Since the motor vehicle dealership location’s primary business is

RV-114 (R. 7-13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2