Form Ct-100 - Instructions Wisconsin Distributor'S Cigarette Tax Return

ADVERTISEMENT

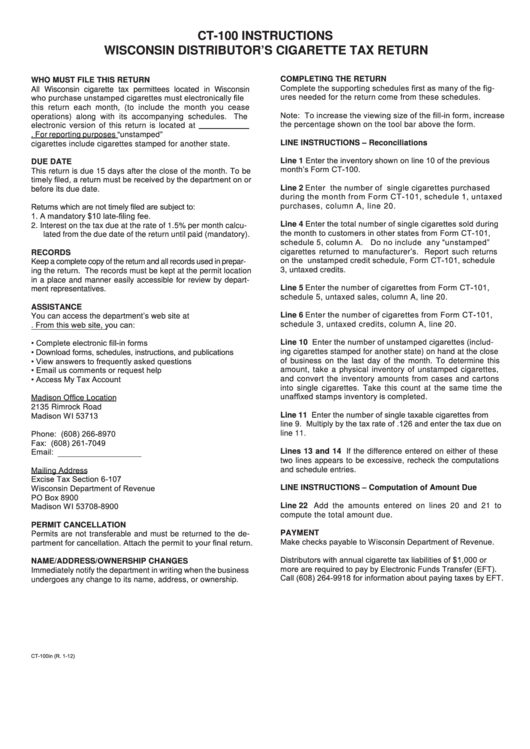

CT-100 INSTRUCTIONS

WISCONSIN DISTRIBUTOR’S CIGARETTE TAX RETURN

COMPLETING THE RETURN

WHO MUST FILE THIS RETURN

Complete the supporting schedules first as many of the fig-

All Wisconsin cigarette tax permittees located in Wisconsin

who purchase unstamped cigarettes must electronically file

ures needed for the return come from these schedules.

this return each month, (to include the month you cease

Note: To increase the viewing size of the fill-in form, increase

operations) along with its accompanying schedules.

The

the percentage shown on the tool bar above the form.

electronic version of this return is located at

wi.gov/html/cigtob1.html. For reporting purposes “unstamped”

LINE INSTRUCTIONS – Reconciliations

cigarettes include cigarettes stamped for another state.

Line 1 Enter the inventory shown on line 10 of the previous

DUE DATE

month’s Form CT-100.

This return is due 15 days after the close of the month. To be

timely filed, a return must be received by the department on or

Line 2 Enter the number of single cigarettes purchased

before its due date.

during the month from Form CT-101, schedule 1, untaxed

Returns which are not timely filed are subject to:

purchases, column A, line 20.

1. A mandatory $10 late-filing fee.

Line 4 Enter the total number of single cigarettes sold during

2. Interest on the tax due at the rate of 1.5% per month calcu-

the month to customers in other states from Form CT-101,

lated from the due date of the return until paid (mandatory).

schedule 5, column A.

Do no include any “unstamped”

cigarettes returned to manufacturer’s. Report such returns

RECORDS

on the unstamped credit schedule, Form CT-101, schedule

Keep a complete copy of the return and all records used in prepar-

3, untaxed credits.

ing the return. The records must be kept at the permit location

in a place and manner easily accessible for review by depart-

Line 5 Enter the number of cigarettes from Form CT-101,

ment representatives.

schedule 5, untaxed sales, column A, line 20.

ASSISTANCE

Line 6 Enter the number of cigarettes from Form CT-101,

You can access the department’s web site at

wi.gov. From this web site, you can:

schedule 3, untaxed credits, column A, line 20.

Line 10 Enter the number of unstamped cigarettes (includ-

• Complete electronic fill-in forms

• Download forms, schedules, instructions, and publications

ing cigarettes stamped for another state) on hand at the close

• View answers to frequently asked questions

of business on the last day of the month. To determine this

• Email us comments or request help

amount, take a physical inventory of unstamped cigarettes,

• Access My Tax Account

and convert the inventory amounts from cases and cartons

into single cigarettes. Take this count at the same time the

unaffixed stamps inventory is completed.

Madison Office Location

2135 Rimrock Road

Line 11 Enter the number of single taxable cigarettes from

Madison WI 53713

line 9. Multiply by the tax rate of .126 and enter the tax due on

Phone: (608) 266-8970

line 11.

Fax: (608) 261-7049

Email: excise@revenue.wi.gov

Lines 13 and 14 If the difference entered on either of these

two lines appears to be excessive, recheck the computations

Mailing Address

and schedule entries.

Excise Tax Section 6-107

Wisconsin Department of Revenue

LINE INSTRUCTIONS – Computation of Amount Due

PO Box 8900

Madison WI 53708-8900

Line 22 Add the amounts entered on lines 20 and 21 to

compute the total amount due.

PERMIT CANCELLATION

PAYMENT

Permits are not transferable and must be returned to the de-

Make checks payable to Wisconsin Department of Revenue.

partment for cancellation. Attach the permit to your final return.

Distributors with annual cigarette tax liabilities of $1,000 or

NAME/ADDRESS/OWNERSHIP CHANGES

more are required to pay by Electronic Funds Transfer (EFT).

Immediately notify the department in writing when the business

Call (608) 264-9918 for information about paying taxes by EFT.

undergoes any change to its name, address, or ownership.

CT-100in (R. 1-12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1