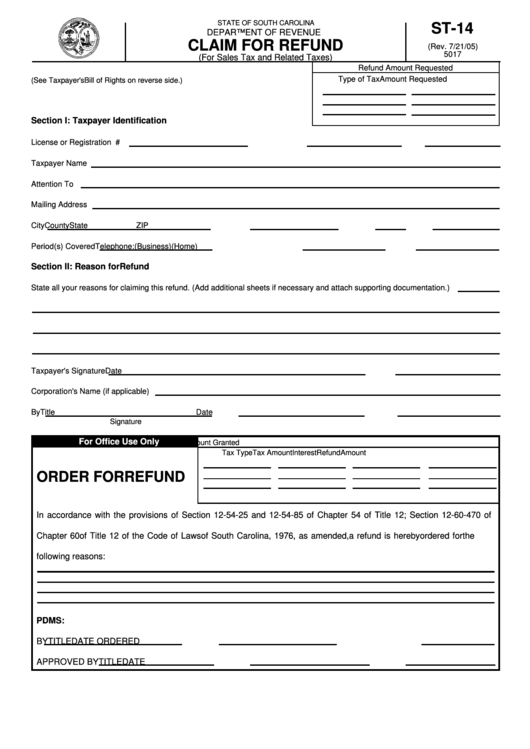

Form St-14 - Claim For Refund

ADVERTISEMENT

STATE OF SOUTH CAROLINA

ST-14

DEPARTMENT OF REVENUE

CLAIM FOR REFUND

(Rev. 7/21/05)

5017

(For Sales Tax and Related Taxes)

Refund Amount Requested

Type of Tax

Amount Requested

(See Taxpayer's Bill of Rights on reverse side.)

Section I: Taxpayer Identification

License or Registration No.

SSN or FEI No.

SID#

Taxpayer Name

Attention To

Mailing Address

City

County

State

ZIP

Period(s) Covered

Telephone: (Business)

(Home)

Section II: Reason for Refund

State all your reasons for claiming this refund. (Add additional sheets if necessary and attach supporting documentation.)

Taxpayer's Signature

Date

Corporation's Name (if applicable)

By

Title

Date

Signature

For Office Use Only

Refund Amount Granted

Tax Type

Tax Amount

Interest

Refund Amount

ORDER FOR REFUND

In accordance with the provisions of Section 12-54-25 and 12-54-85 of Chapter 54 of Title 12; Section 12-60-470 of

Chapter 60 of Title 12 of the Code of Laws of South Carolina, 1976, as amended, a refund is hereby ordered for the

following reasons:

PDMS:

BY

TITLE

DATE ORDERED

APPROVED BY

TITLE

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1