Instructions For Form W-4mn - Minnesota Employee Withholding Allowance - Minnesota Department Of Revenue

ADVERTISEMENT

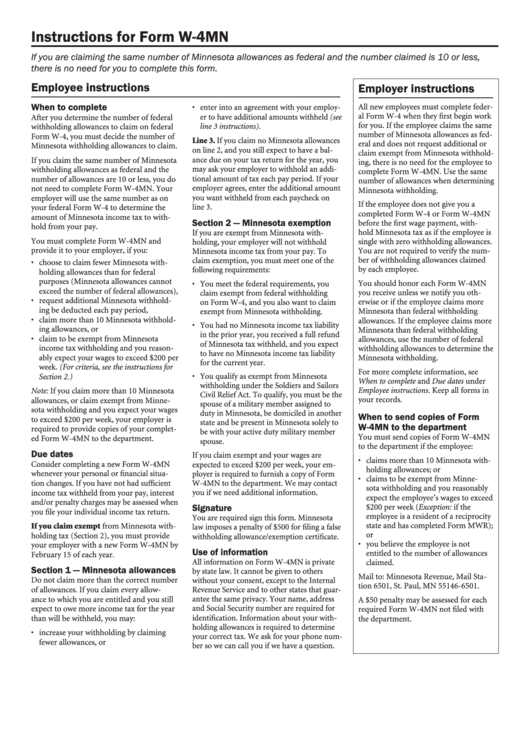

Instructions for Form W-4MN

If you are claiming the same number of Minnesota allowances as federal and the number claimed is 10 or less,

there is no need for you to complete this form.

Employee instructions

Employer instructions

When to complete

All new employees must complete feder-

• enter into an agreement with your employ-

al Form W-4 when they first begin work

er to have additional amounts withheld (see

After you determine the number of federal

for you. If the employee claims the same

line 3 instructions).

withholding allowances to claim on federal

number of Minnesota allowances as fed-

Form W-4, you must decide the number of

Line 3. If you claim no Minnesota allowances

eral and does not request additional or

Minnesota withholding allowances to claim.

on line 2, and you still expect to have a bal-

claim exempt from Minnesota withhold-

ance due on your tax return for the year, you

If you claim the same number of Minnesota

ing, there is no need for the employee to

may ask your employer to withhold an addi-

withholding allowances as federal and the

complete Form W-4MN. Use the same

tional amount of tax each pay period. If your

number of allowances are 10 or less, you do

number of allowances when determining

employer agrees, enter the additional amount

not need to complete Form W-4MN. Your

Minnesota withholding.

you want withheld from each paycheck on

employer will use the same number as on

If the employee does not give you a

line 3.

your federal Form W-4 to determine the

completed Form W-4 or Form W-4MN

amount of Minnesota income tax to with-

Section 2 — Minnesota exemption

before the first wage payment, with-

hold from your pay.

If you are exempt from Minnesota with-

hold Minnesota tax as if the employee is

You must complete Form W-4MN and

single with zero withholding allowances.

holding, your employer will not withhold

provide it to your employer, if you:

You are not required to verify the num-

Minnesota income tax from your pay. To

ber of withholding allowances claimed

claim exemption, you must meet one of the

• choose to claim fewer Minnesota with-

by each employee.

following requirements:

holding allowances than for federal

purposes (Minnesota allowances cannot

You should honor each Form W-4MN

• You meet the federal requirements, you

exceed the number of federal allowances),

you receive unless we notify you oth-

claim exempt from federal withholding

• request additional Minnesota withhold-

erwise or if the employee claims more

on Form W-4, and you also want to claim

ing be deducted each pay period,

Minnesota than federal withholding

exempt from Minnesota withholding.

• claim more than 10 Minnesota withhold-

allowances. If the employee claims more

• You had no Minnesota income tax liability

ing allowances, or

Minnesota than federal withholding

in the prior year, you received a full refund

• claim to be exempt from Minnesota

allowances, use the number of federal

of Minnesota tax withheld, and you expect

income tax withholding and you reason-

withholding allowances to determine the

to have no Minnesota income tax liability

ably expect your wages to exceed $200 per

Minnesota withholding.

for the current year.

week. (For criteria, see the instructions for

For more complete information, see

• You qualify as exempt from Minnesota

Section 2.)

When to complete and Due dates under

withholding under the Soldiers and Sailors

Employee instructions. Keep all forms in

Note: If you claim more than 10 Minnesota

Civil Relief Act. To qualify, you must be the

your records.

allowances, or claim exempt from Minne-

spouse of a military member assigned to

sota withholding and you expect your wages

duty in Minnesota, be domiciled in another

When to send copies of Form

to exceed $200 per week, your employer is

state and be present in Minnesota solely to

W-4MN to the department

required to provide copies of your complet-

be with your active duty military member

You must send copies of Form W-4MN

ed Form W-4MN to the department.

spouse.

to the department if the employee:

Due dates

If you claim exempt and your wages are

• claims more than 10 Minnesota with-

Consider completing a new Form W-4MN

expected to exceed $200 per week, your em-

holding allowances; or

whenever your personal or financial situa-

ployer is required to furnish a copy of Form

• claims to be exempt from Minne-

tion changes. If you have not had sufficient

W-4MN to the department. We may contact

sota withholding and you reasonably

income tax withheld from your pay, interest

you if we need additional information.

expect the employee’s wages to exceed

and/or penalty charges may be assessed when

Signature

$200 per week (Exception: if the

you file your individual income tax return.

employee is a resident of a reciprocity

You are required sign this form. Minnesota

If you claim exempt from Minnesota with-

state and has completed Form MWR);

law imposes a penalty of $500 for filing a false

or

holding tax (Section 2), you must provide

withholding allowance/exemption certificate.

• you believe the employee is not

your employer with a new Form W-4MN by

Use of information

entitled to the number of allowances

February 15 of each year.

All information on Form W-4MN is private

claimed.

Section 1 — Minnesota allowances

by state law. It cannot be given to others

Mail to: Minnesota Revenue, Mail Sta-

Do not claim more than the correct number

without your consent, except to the Internal

tion 6501, St. Paul, MN 55146-6501.

of allowances. If you claim every allow-

Revenue Service and to other states that guar-

ance to which you are entitled and you still

antee the same privacy. Your name, address

A $50 penalty may be assessed for each

and Social Security number are required for

expect to owe more income tax for the year

required Form W-4MN not filed with

identification. Information about your with-

than will be withheld, you may:

the department.

holding allowances is required to determine

• increase your withholding by claiming

your correct tax. We ask for your phone num-

fewer allowances, or

ber so we can call you if we have a question.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1