Instructions For Form Cf-2210, Underpayment Of Estimated Tax - 2004

ADVERTISEMENT

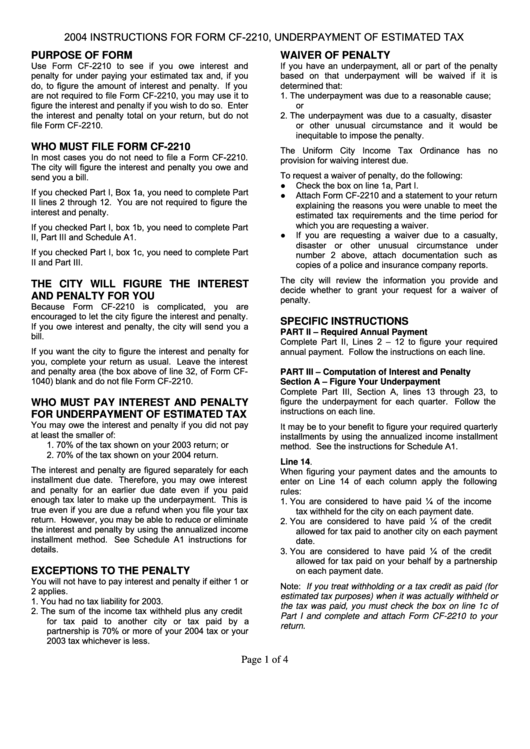

2004 INSTRUCTIONS FOR FORM CF-2210, UNDERPAYMENT OF ESTIMATED TAX

PURPOSE OF FORM

WAIVER OF PENALTY

Use Form CF-2210 to see if you owe interest and

If you have an underpayment, all or part of the penalty

penalty for under paying your estimated tax and, if you

based on that underpayment will be waived if it is

do, to figure the amount of interest and penalty. If you

determined that:

are not required to file Form CF-2210, you may use it to

1. The underpayment was due to a reasonable cause;

figure the interest and penalty if you wish to do so. Enter

or

the interest and penalty total on your return, but do not

2. The underpayment was due to a casualty, disaster

file Form CF-2210.

or other unusual circumstance and it would be

inequitable to impose the penalty.

WHO MUST FILE FORM CF-2210

The Uniform City Income Tax Ordinance has no

In most cases you do not need to file a Form CF-2210.

provision for waiving interest due.

The city will figure the interest and penalty you owe and

To request a waiver of penalty, do the following:

send you a bill.

●

Check the box on line 1a, Part I.

If you checked Part I, Box 1a, you need to complete Part

●

Attach Form CF-2210 and a statement to your return

II lines 2 through 12. You are not required to figure the

explaining the reasons you were unable to meet the

interest and penalty.

estimated tax requirements and the time period for

which you are requesting a waiver.

If you checked Part I, box 1b, you need to complete Part

●

If you are requesting a waiver due to a casualty,

II, Part III and Schedule A1.

disaster or other unusual circumstance under

If you checked Part I, box 1c, you need to complete Part

number 2 above, attach documentation such as

II and Part III.

copies of a police and insurance company reports.

The city will review the information you provide and

THE CITY WILL FIGURE THE INTEREST

decide whether to grant your request for a waiver of

AND PENALTY FOR YOU

penalty.

Because Form CF-2210 is complicated, you are

encouraged to let the city figure the interest and penalty.

SPECIFIC INSTRUCTIONS

If you owe interest and penalty, the city will send you a

PART II – Required Annual Payment

bill.

Complete Part II, Lines 2 – 12 to figure your required

If you want the city to figure the interest and penalty for

annual payment. Follow the instructions on each line.

you, complete your return as usual. Leave the interest

and penalty area (the box above of line 32, of Form CF-

PART III – Computation of Interest and Penalty

1040) blank and do not file Form CF-2210.

Section A – Figure Your Underpayment

Complete Part III, Section A, lines 13 through 23, to

figure the underpayment for each quarter. Follow the

WHO MUST PAY INTEREST AND PENALTY

instructions on each line.

FOR UNDERPAYMENT OF ESTIMATED TAX

You may owe the interest and penalty if you did not pay

It may be to your benefit to figure your required quarterly

at least the smaller of:

installments by using the annualized income installment

1. 70% of the tax shown on your 2003 return; or

method. See the instructions for Schedule A1.

2. 70% of the tax shown on your 2004 return.

Line 14.

The interest and penalty are figured separately for each

When figuring your payment dates and the amounts to

installment due date. Therefore, you may owe interest

enter on Line 14 of each column apply the following

and penalty for an earlier due date even if you paid

rules:

enough tax later to make up the underpayment. This is

1. You are considered to have paid ¼ of the income

true even if you are due a refund when you file your tax

tax withheld for the city on each payment date.

return. However, you may be able to reduce or eliminate

2. You are considered to have paid ¼ of the credit

the interest and penalty by using the annualized income

allowed for tax paid to another city on each payment

installment method. See Schedule A1 instructions for

date.

details.

3. You are considered to have paid ¼ of the credit

allowed for tax paid on your behalf by a partnership

on each payment date.

EXCEPTIONS TO THE PENALTY

You will not have to pay interest and penalty if either 1 or

Note: If you treat withholding or a tax credit as paid (for

2 applies.

estimated tax purposes) when it was actually withheld or

1. You had no tax liability for 2003.

the tax was paid, you must check the box on line 1c of

2. The sum of the income tax withheld plus any credit

Part I and complete and attach Form CF-2210 to your

for tax paid to another city or tax paid by a

return.

partnership is 70% or more of your 2004 tax or your

2003 tax whichever is less.

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4