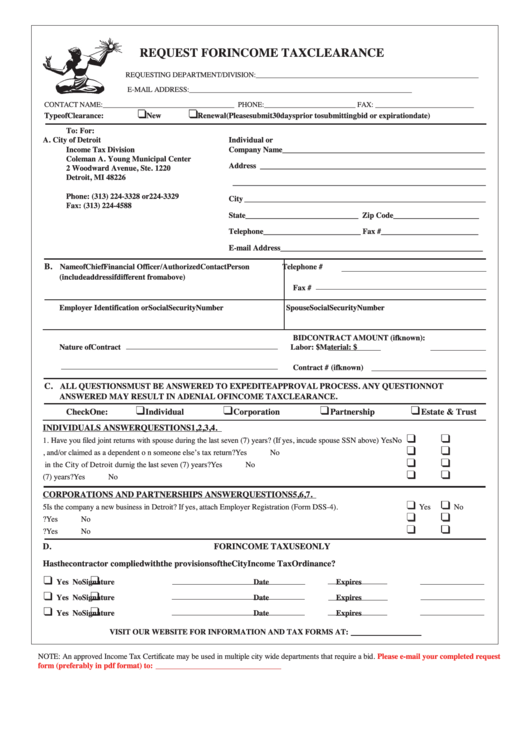

REQUEST FOR INCOME TAX CLEARANCE

REQUESTING DEPARTMENT/DIVISION: _____________________________________________________________

E-MAIL ADDRESS: _____________________________________________________________

CONTACT NAME: ____________________________________ PHONE: _________________________ FAX: ___________________________

Type of Clearance:

New

Renewal (Please submit 30 days prior to submitting bid or expiration date)

To:

For:

A.

City of Detroit

Individual or

Income Tax Division

Company Name____________________________________________________

Coleman A. Young Municipal Center

Address __________________________________________________________

2 Woodward Avenue, Ste. 1220

Detroit, MI 48226

_________________________________________________________________

Phone: (313) 224-3328 or224-3329

City ______________________________________________________________

Fax: (313) 224-4588

State _____________________________ Zip Code ______________________

Telephone_________________________ Fax # _________________________

E-mail Address ____________________________________________________

B.

Name of Chief Financial Officer/Authorized Contact Person

Telephone #

(include address if different from above)

Fax #

Employer Identification or Social Security Number

Spouse Social Security Number

BID CONTRACT AMOUNT (if known):

Nature of Contract

Labor: $

Material: $

Contract # (if known)

C.

ALL QUESTIONS MUST BE ANSWERED TO EXPEDITE APPROVAL PROCESS. ANY QUESTION NOT

ANSWERED MAY RESULT IN A DENIAL OF INCOME TAX CLEARANCE.

Check One:

Individual

Corporation

Partnership

Estate & Trust

INDIVIDUALS ANSWER QUESTIONS 1,2,3,4.

1.

Have you filed joint returns with spouse during the last seven (7) years? (If yes, incude spouse SSN above)

Yes

No

2.

Are you a student, and/or claimed as a dependent o n someone else’s tax return?

Yes

No

3.

Were you employed in the City of Detroit durnig the last seven (7) years?

Yes

No

4.

Were you a resident of Detroit during the last seven (7) years?

Yes

No

CORPORATIONS AND PARTNERSHIPS ANSWER QUESTIONS 5,6,7.

5

Is the company a new business in Detroit? If yes, attach Employer Registration (Form DSS-4).

Yes

No

6.

Will the company have employees working in Detroit?

Yes

No

7.

Will the company use sub-contractors or independent contractors in Detroit?

Yes

No

D.

FOR INCOME TAX USE ONLY

Has the contractor complied with the provisions of the City Income Tax Ordinance?

Yes

No

Signature

Date

Expires

Yes

No

Signature

Date

Expires

Yes

No

Signature

Date

Expires

VISIT OUR WEBSITE FOR INFORMATION AND TAX FORMS AT:

Please e-mail your completed request

NOTE: An approved Income Tax Certificate may be used in multiple city wide departments that require a bid.

form (preferably in pdf format) to: IncomeTaxClearance@detroitmi.gov

1

1 2

2