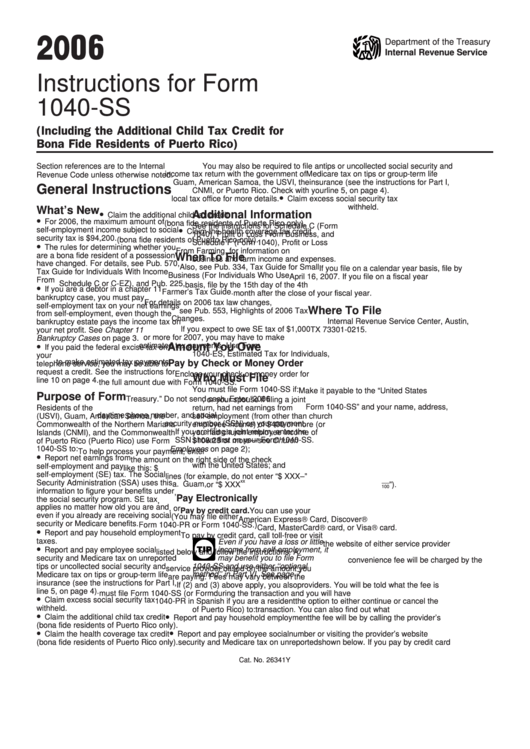

Instructions For Form 1040-Ss - U.s. Self-Employment Tax Return (Including The Additional Child Tax Credit For Bona Fide Residents Of Puerto Rico) - Internal Revenue Service - 2006

ADVERTISEMENT

2006

Department of the Treasury

Internal Revenue Service

Instructions for Form

1040-SS

U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for

Bona Fide Residents of Puerto Rico)

You may also be required to file an

tips or uncollected social security and

Section references are to the Internal

income tax return with the government of

Medicare tax on tips or group-term life

Revenue Code unless otherwise noted.

Guam, American Samoa, the USVI, the

insurance (see the instructions for Part I,

General Instructions

CNMI, or Puerto Rico. Check with your

line 5, on page 4).

•

local tax office for more details.

Claim excess social security tax

withheld.

What’s New

•

Additional Information

Claim the additional child tax credit

•

For 2006, the maximum amount of

(bona fide residents of Puerto Rico only).

See the instructions for Schedule C (Form

•

self-employment income subject to social

Claim the health coverage tax credit

1040), Profit or Loss From Business, and

security tax is $94,200.

(bona fide residents of Puerto Rico only).

Schedule F (Form 1040), Profit or Loss

•

The rules for determining whether you

From Farming, for information on

are a bona fide resident of a possession

When To File

business and farm income and expenses.

have changed. For details, see Pub. 570,

Also, see Pub. 334, Tax Guide for Small

If you file on a calendar year basis, file by

Tax Guide for Individuals With Income

Business (For Individuals Who Use

April 16, 2007. If you file on a fiscal year

From U.S. Possessions.

Schedule C or C-EZ), and Pub. 225,

basis, file by the 15th day of the 4th

•

If you are a debtor in a chapter 11

Farmer’s Tax Guide.

month after the close of your fiscal year.

bankruptcy case, you must pay

For details on 2006 tax law changes,

self-employment tax on your net earnings

Where To File

see Pub. 553, Highlights of 2006 Tax

from self-employment, even though the

Changes.

Internal Revenue Service Center, Austin,

bankruptcy estate pays the income tax on

If you expect to owe SE tax of $1,000

your net profit. See Chapter 11

TX 73301-0215.

or more for 2007, you may have to make

Bankruptcy Cases on page 3.

•

estimated tax payments. Use Form

Amount You Owe

If you paid the federal excise tax on

1040-ES, Estimated Tax for Individuals,

your U.S. long distance or bundled

to make estimated tax payments.

Pay by Check or Money Order

telephone service, you may be able to

request a credit. See the instructions for

Enclose your check or money order for

Who Must File

line 10 on page 4.

the full amount due with Form 1040-SS.

You must file Form 1040-SS if:

Make it payable to the “United States

Purpose of Form

Treasury.” Do not send cash. Enter “2006

1. You, or your spouse if filing a joint

Form 1040-SS” and your name, address,

Residents of the U.S. Virgin Islands

return, had net earnings from

daytime phone number, and social

(USVI), Guam, American Samoa, the

self-employment (from other than church

security number (SSN) on your payment.

Commonwealth of the Northern Mariana

employee income) of $400 or more (or

If you are filing a joint return, enter the

Islands (CNMI), and the Commonwealth

you had church employee income of

SSN shown first on your Form 1040-SS.

$108.28 or more — see Church

of Puerto Rico (Puerto Rico) use Form

1040-SS to:

Employees on page 2);

To help process your payment, enter

•

2. You do not have to file Form 1040

Report net earnings from

the amount on the right side of the check

with the United States; and

self-employment and pay

like this: $ XXX.XX. Do not use dashes or

3. You are a resident of:

self-employment (SE) tax. The Social

lines (for example, do not enter “$ XXX – ”

Security Administration (SSA) uses this

xx

a. Guam,

or “$ XXX

”).

100

information to figure your benefits under

b. American Samoa,

Pay Electronically

the social security program. SE tax

c. The USVI,

applies no matter how old you are and

d. The CNMI, or

Pay by credit card. You can use your

even if you already are receiving social

e. Puerto Rico. (You may file either

American Express Card, Discover

security or Medicare benefits.

Form 1040-PR or Form 1040-SS.)

Card, MasterCard card, or Visa card.

•

Report and pay household employment

To pay by credit card, call toll-free or visit

taxes.

Even if you have a loss or little

the website of either service provider

•

TIP

Report and pay employee social

income from self-employment, it

listed below and follow the instructions. A

may benefit you to file Form

security and Medicare tax on unreported

convenience fee will be charged by the

tips or uncollected social security and

1040-SS and use either ‘‘optional

service provider based on the amount you

Medicare tax on tips or group-term life

method’’ in Part VI. See page 7.

are paying. Fees may vary between the

insurance (see the instructions for Part I,

If (2) and (3) above apply, you also

providers. You will be told what the fee is

line 5, on page 4).

must file Form 1040-SS (or Form

during the transaction and you will have

•

Claim excess social security tax

1040-PR in Spanish if you are a resident

the option to either continue or cancel the

withheld.

of Puerto Rico) to:

transaction. You can also find out what

•

•

Claim the additional child tax credit

Report and pay household employment

the fee will be by calling the provider’s

(bona fide residents of Puerto Rico only).

taxes.

toll-free automated customer service

•

•

Claim the health coverage tax credit

Report and pay employee social

number or visiting the provider’s website

(bona fide residents of Puerto Rico only).

security and Medicare tax on unreported

shown below. If you pay by credit card

Cat. No. 26341Y

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8