TC-34_1.ai

Rev. 6/04

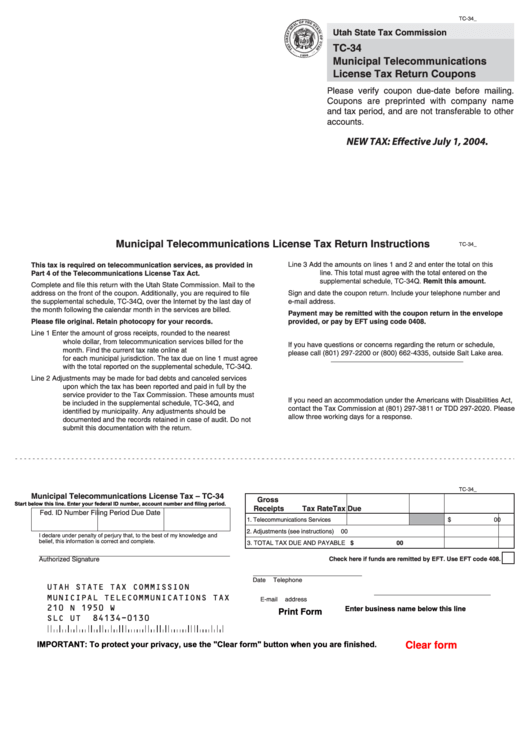

Utah State Tax Commission

TC-34

Municipal Telecommunications

License Tax Return Coupons

Please verify coupon due-date before mailing.

Coupons are preprinted with company name

and tax period, and are not transferable to other

accounts.

NEW TAX: Effective July 1, 2004.

Municipal Telecommunications License Tax Return Instructions

TC-34_2.ai

Rev. 6/04

This tax is required on telecommunication services, as provided in

Line 3

Add the amounts on lines 1 and 2 and enter the total on this

line. This total must agree with the total entered on the

Part 4 of the Telecommunications License Tax Act.

supplemental schedule, TC-34Q. Remit this amount.

Complete and file this return with the Utah State Commission. Mail to the

address on the front of the coupon. Additionally, you are required to file

Sign and date the coupon return. Include your telephone number and

e-mail address.

the supplemental schedule, TC-34Q, over the Internet by the last day of

the month following the calendar month in the services are billed.

Payment may be remitted with the coupon return in the envelope

Please file original. Retain photocopy for your records.

provided, or pay by EFT using code 0408.

Line 1

Enter the amount of gross receipts, rounded to the nearest

whole dollar, from telecommunication services billed for the

If you have questions or concerns regarding the return or schedule,

month. Find the current tax rate online at tax.utah.gov/taxes

please call (801) 297-2200 or (800) 662-4335, outside Salt Lake area.

for each municipal jurisdiction. The tax due on line 1 must agree

with the total reported on the supplemental schedule, TC-34Q.

Line 2

Adjustments may be made for bad debts and canceled services

upon which the tax has been reported and paid in full by the

service provider to the Tax Commission. These amounts must

If you need an accommodation under the Americans with Disabilities Act,

be included in the supplemental schedule, TC-34Q, and

contact the Tax Commission at (801) 297-3811 or TDD 297-2020. Please

identified by municipality. Any adjustments should be

allow three working days for a response.

documented and the records retained in case of audit. Do not

submit this documentation with the return.

TC-34_3.ai

Rev. 6/04

Municipal Telecommunications License Tax – TC-34

Gross

Start below this line. Enter your federal ID number, account number and filing period.

Receipts

Tax Rate

Tax Due

Fed. ID Number

Filing Period

Due Date

1. Telecommunications Services

$

00

2. Adjustments (see instructions)

00

I declare under penalty of perjury that, to the best of my knowledge and

belief, this information is correct and complete.

3. TOTAL TAX DUE AND PAYABLE

$

00

Authorized Signature

Check here if funds are remitted by EFT. Use EFT code 408.

Date

Telephone

UTAH STATE TAX COMMISSION

MUNICIPAL TELECOMMUNICATIONS TAX

E-mail address

210 N 1950 W

Enter business name below this line

Print Form

SLC UT

84134-0130

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1