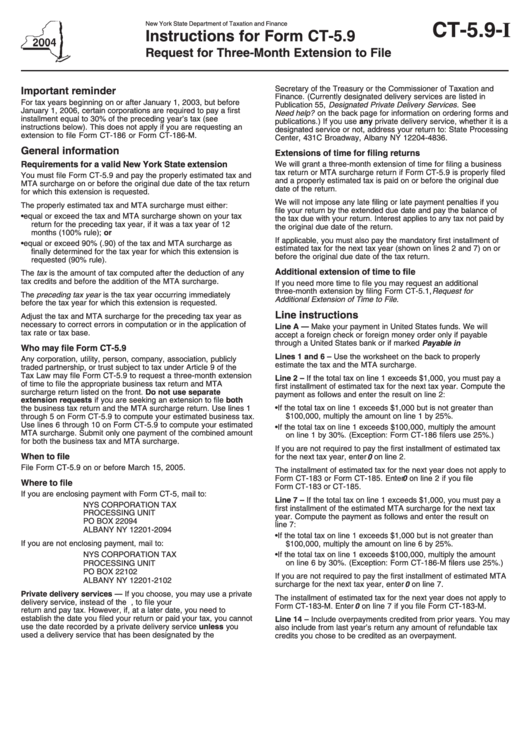

Instructions For Form Ct-5.9 - Request For Three-Month Extension To File - New York State Department Of Taxation And Finance - 2004

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-5.9-I

Instructions for Form CT-5.9

Request for Three-Month Extension to File

Secretary of the Treasury or the Commissioner of Taxation and

Important reminder

Finance. (Currently designated delivery services are listed in

For tax years beginning on or after January 1, 2003, but before

Publication 55, Designated Private Delivery Services. See

January 1, 2006, certain corporations are required to pay a first

Need help? on the back page for information on ordering forms and

installment equal to 30% of the preceding year’s tax (see

publications.) If you use any private delivery service, whether it is a

instructions below). This does not apply if you are requesting an

designated service or not, address your return to: State Processing

extension to file Form CT-186 or Form CT-186-M.

Center, 431C Broadway, Albany NY 12204-4836.

General information

Extensions of time for filing returns

Requirements for a valid New York State extension

We will grant a three-month extension of time for filing a business

tax return or MTA surcharge return if Form CT-5.9 is properly filed

You must file Form CT-5.9 and pay the properly estimated tax and

and a properly estimated tax is paid on or before the original due

MTA surcharge on or before the original due date of the tax return

date of the return.

for which this extension is requested.

We will not impose any late filing or late payment penalties if you

The properly estimated tax and MTA surcharge must either:

file your return by the extended due date and pay the balance of

• equal or exceed the tax and MTA surcharge shown on your tax

the tax due with your return. Interest applies to any tax not paid by

return for the preceding tax year, if it was a tax year of 12

the original due date of the return.

months (100% rule); or

If applicable, you must also pay the mandatory first installment of

• equal or exceed 90% (.90) of the tax and MTA surcharge as

estimated tax for the next tax year (shown on lines 2 and 7) on or

finally determined for the tax year for which this extension is

before the original due date of the tax return.

requested (90% rule).

Additional extension of time to file

The tax is the amount of tax computed after the deduction of any

tax credits and before the addition of the MTA surcharge.

If you need more time to file you may request an additional

three-month extension by filing Form CT-5.1, Request for

The preceding tax year is the tax year occurring immediately

Additional Extension of Time to File.

before the tax year for which this extension is requested.

Line instructions

Adjust the tax and MTA surcharge for the preceding tax year as

necessary to correct errors in computation or in the application of

Line A — Make your payment in United States funds. We will

tax rate or tax base.

accept a foreign check or foreign money order only if payable

through a United States bank or if marked Payable in U.S. funds.

Who may file Form CT-5.9

Lines 1 and 6 – Use the worksheet on the back to properly

Any corporation, utility, person, company, association, publicly

estimate the tax and the MTA surcharge.

traded partnership, or trust subject to tax under Article 9 of the

Tax Law may file Form CT-5.9 to request a three-month extension

Line 2 – If the total tax on line 1 exceeds $1,000, you must pay a

of time to file the appropriate business tax return and MTA

first installment of estimated tax for the next tax year. Compute the

surcharge return listed on the front. Do not use separate

payment as follows and enter the result on line 2:

extension requests if you are seeking an extension to file both

• If the total tax on line 1 exceeds $1,000 but is not greater than

the business tax return and the MTA surcharge return. Use lines 1

$100,000, multiply the amount on line 1 by 25%.

through 5 on Form CT-5.9 to compute your estimated business tax.

Use lines 6 through 10 on Form CT-5.9 to compute your estimated

• If the total tax on line 1 exceeds $100,000, multiply the amount

MTA surcharge. Submit only one payment of the combined amount

on line 1 by 30%. (Exception: Form CT-186 filers use 25%.)

for both the business tax and MTA surcharge.

If you are not required to pay the first installment of estimated tax

When to file

for the next tax year, enter 0 on line 2.

File Form CT-5.9 on or before March 15, 2005.

The installment of estimated tax for the next year does not apply to

Form CT-183 or Form CT-185. Enter 0 on line 2 if you file

Where to file

Form CT-183 or CT-185.

If you are enclosing payment with Form CT-5, mail to:

Line 7 – If the total tax on line 1 exceeds $1,000, you must pay a

NYS CORPORATION TAX

first installment of the estimated MTA surcharge for the next tax

PROCESSING UNIT

year. Compute the payment as follows and enter the result on

PO BOX 22094

line 7:

ALBANY NY 12201-2094

• If the total tax on line 1 exceeds $1,000 but is not greater than

If you are not enclosing payment, mail to:

$100,000, multiply the amount on line 6 by 25%.

NYS CORPORATION TAX

• If the total tax on line 1 exceeds $100,000, multiply the amount

on line 6 by 30%. (Exception: Form CT-186-M filers use 25%.)

PROCESSING UNIT

PO BOX 22102

If you are not required to pay the first installment of estimated MTA

ALBANY NY 12201-2102

surcharge for the next tax year, enter 0 on line 7.

Private delivery services — If you choose, you may use a private

The installment of estimated tax for the next year does not apply to

delivery service, instead of the U.S. Postal Service, to file your

Form CT-183-M. Enter 0 on line 7 if you file Form CT-183-M.

return and pay tax. However, if, at a later date, you need to

establish the date you filed your return or paid your tax, you cannot

Line 14 – Include overpayments credited from prior years. You may

use the date recorded by a private delivery service unless you

also include from last year’s return any amount of refundable tax

used a delivery service that has been designated by the U.S.

credits you chose to be credited as an overpayment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2