Form Il-8453 Instructions - Electronic Return Originators' (Eros) - Illinois Department Of Revenue

ADVERTISEMENT

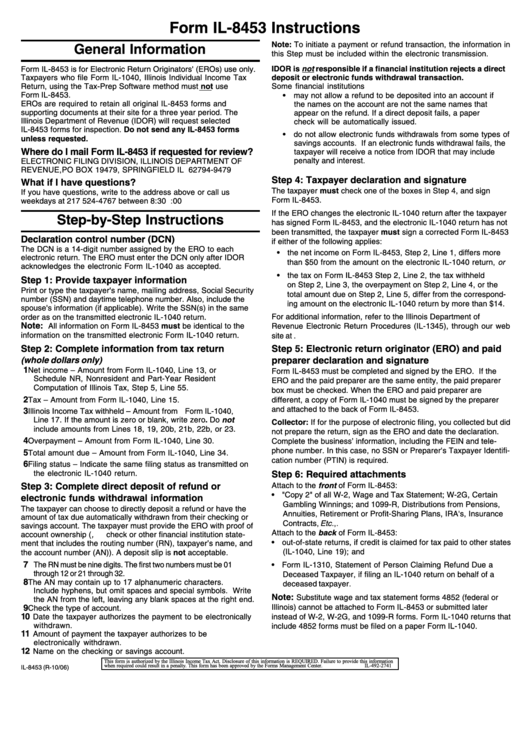

Form IL-8453 Instructions

Note: To initiate a payment or refund transaction, the information in

General Information

this Step must be included within the electronic transmission.

Form IL-8453 is for Electronic Return Originators' (EROs) use only.

IDOR is not responsible if a financial institution rejects a direct

Taxpayers who file Form IL-1040, Illinois Individual Income Tax

deposit or electronic funds withdrawal transaction.

Some financial institutions

Return, using the Tax-Prep Software method must not use

Form IL-8453.

• may not allow a refund to be deposited into an account if

EROs are required to retain all original IL-8453 forms and

the names on the account are not the same names that

supporting documents at their site for a three year period. The

appear on the refund. If a direct deposit fails, a paper

Illinois Department of Revenue (IDOR) will request selected

check will be automatically issued.

IL-8453 forms for inspection. Do not send any IL-8453 forms

• do not allow electronic funds withdrawals from some types of

unless requested.

savings accounts. If an electronic funds withdrawal fails, the

Where do I mail Form IL-8453 if requested for review?

taxpayer will receive a notice from IDOR that may include

penalty and interest.

ELECTRONIC FILING DIVISION, ILLINOIS DEPARTMENT OF

REVENUE,PO BOX 19479, SPRINGFIELD IL 62794-9479

Step 4: Taxpayer declaration and signature

What if I have questions?

The taxpayer must check one of the boxes in Step 4, and sign

If you have questions, write to the address above or call us

Form IL-8453.

weekdays at 217 524-4767 between 8:30 a.m. and 5:00 p.m.

If the ERO changes the electronic IL-1040 return after the taxpayer

Step-by-Step Instructions

has signed Form IL-8453, and the electronic IL-1040 return has not

been transmitted, the taxpayer must sign a corrected Form IL-8453

Declaration control number (DCN)

if either of the following applies:

The DCN is a 14-digit number assigned by the ERO to each

• the net income on Form IL-8453, Step 2, Line 1, differs more

electronic return. The ERO must enter the DCN only after IDOR

than $50 from the amount on the electronic IL-1040 return, or

acknowledges the electronic Form IL-1040 as accepted.

• the tax on Form IL-8453 Step 2, Line 2, the tax withheld

Step 1: Provide taxpayer information

on Step 2, Line 3, the overpayment on Step 2, Line 4, or the

Print or type the taxpayer's name, mailing address, Social Security

total amount due on Step 2, Line 5, differ from the correspond-

number (SSN) and daytime telephone number. Also, include the

ing amount on the electronic IL-1040 return by more than $14.

spouse's information (if applicable). Write the SSN(s) in the same

order as on the transmitted electronic IL-1040 return.

For additional information, refer to the Illinois Department of

Note:

All information on Form IL-8453 must be identical to the

Revenue Electronic Return Procedures (IL-1345), through our web

information on the transmitted electronic Form IL-1040 return.

site at tax.Illinois.gov.

Step 2: Complete information from tax return

Step 5: Electronic return originator (ERO) and paid

(whole dollars only)

preparer declaration and signature

1

Net income – Amount from Form IL-1040, Line 13, or

Form IL-8453 must be completed and signed by the ERO. If the

Schedule NR, Nonresident and Part-Year Resident

ERO and the paid preparer are the same entity, the paid preparer

Computation of Illinois Tax, Step 5, Line 55.

box must be checked. When the ERO and paid preparer are

2

Tax – Amount from Form IL-1040, Line 15.

different, a copy of Form IL-1040 must be signed by the preparer

and attached to the back of Form IL-8453.

3

Illinois Income Tax withheld – Amount from Form IL-1040,

Line 17. If the amount is zero or blank, write zero. Do not

Collector: If for the purpose of electronic filing, you collected but did

include amounts from Lines 18, 19, 20b, 21b, 22b, or 23.

not prepare the return, sign as the ERO and date the declaration.

4

Overpayment – Amount from Form IL-1040, Line 30.

Complete the business’ information, including the FEIN and tele-

phone number. In this case, no SSN or Preparer's Taxpayer Identifi-

5

Total amount due – Amount from Form IL-1040, Line 34.

cation number (PTIN) is required.

6

Filing status – Indicate the same filing status as transmitted on

the electronic IL-1040 return.

Step 6: Required attachments

Step 3: Complete direct deposit of refund or

Attach to the front of Form IL-8453:

• "Copy 2" of all W-2, Wage and Tax Statement; W-2G, Certain

electronic funds withdrawal information

Gambling Winnings; and 1099-R, Distributions from Pensions,

The taxpayer can choose to directly deposit a refund or have the

Annuities, Retirement or Profit-Sharing Plans, IRA's, Insurance

amount of tax due automatically withdrawn from their checking or

Contracts, Etc. ,.

savings account. The taxpayer must provide the ERO with proof of

Attach to the back of Form IL-8453:

account ownership ( i.e., check or other financial institution state-

• out-of-state returns, if credit is claimed for tax paid to other states

ment that includes the routing number (RN), taxpayer’s name, and

(IL-1040, Line 19); and

the account number (AN)). A deposit slip is not acceptable.

7

The RN must be nine digits. The first two numbers must be 01

• Form IL-1310, Statement of Person Claiming Refund Due a

through 12 or 21 through 32.

Deceased Taxpayer, if filing an IL-1040 return on behalf of a

8

The AN may contain up to 17 alphanumeric characters.

deceased taxpayer.

Include hyphens, but omit spaces and special symbols. Write

Note:

Substitute wage and tax statement forms 4852 (federal or

the AN from the left, leaving any blank spaces at the right end.

9

Illinois) cannot be attached to Form IL-8453 or submitted later

Check the type of account.

10

Date the taxpayer authorizes the payment to be electronically

instead of W-2, W-2G, and 1099-R forms. Form IL-1040 returns that

withdrawn.

include 4852 forms must be filed on a paper Form IL-1040.

11

Amount of payment the taxpayer authorizes to be

electronically withdrawn.

12

Name on the checking or savings account.

This form is authorized by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide this information

when required could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-2741

IL-8453 (R-10/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1