Form 61a200(N) - Report Of Leased Real Property

ADVERTISEMENT

61A200(N) (11-07)

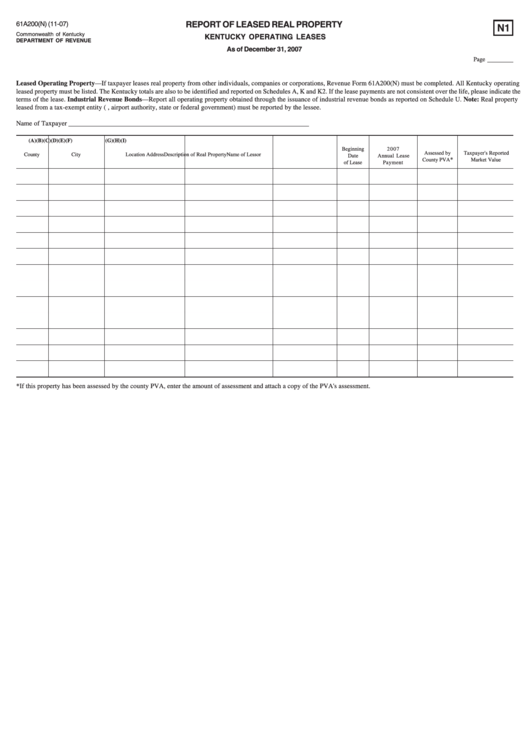

REPORT OF LEASED REAL PROPERTY

N1

Commonwealth of Kentucky

KENTUCKY OPERATING LEASES

DEPARTMENT OF REVENUE

As of December 31, 2007

Page

Leased Operating Property—If taxpayer leases real property from other individuals, companies or corporations, Revenue Form 61A200(N) must be completed. All Kentucky operating

leased property must be listed. The Kentucky totals are also to be identified and reported on Schedules A, K and K2. If the lease payments are not consistent over the life, please indicate the

terms of the lease. Industrial Revenue Bonds—Report all operating property obtained through the issuance of industrial revenue bonds as reported on Schedule U. Note: Real property

leased from a tax-exempt entity (i.e., airport authority, state or federal government) must be reported by the lessee.

Name of Taxpayer

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

(I)

Beginning

2007

Assessed by

Taxpayer's Reported

County

City

Location Address

Description of Real Property

Name of Lessor

Date

Annual Lease

County PVA

*

Market Value

of Lease

Payment

*If this property has been assessed by the county PVA, enter the amount of assessment and attach a copy of the PVA's assessment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3