Form 4251 - C-102: Schedule Of Cigarette Credits (Adjustments)

ADVERTISEMENT

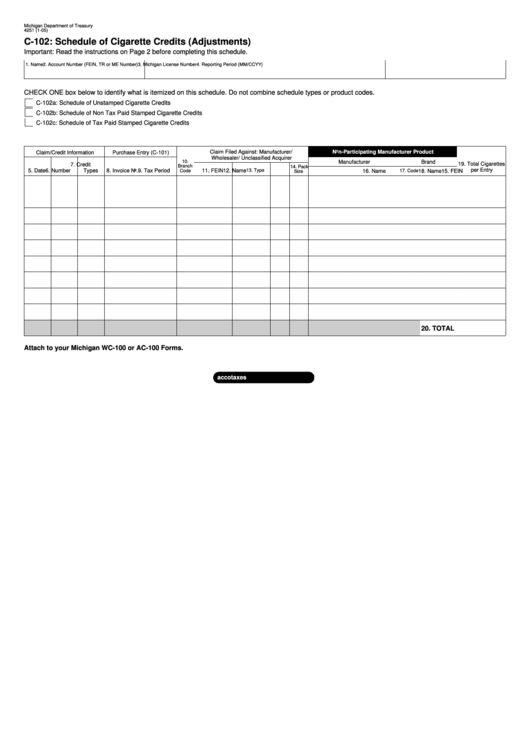

Michigan Department of Treasury

4251 (1-05)

C-102: Schedule of Cigarette Credits (Adjustments)

Important: Read the instructions on Page 2 before completing this schedule.

1. Name

2. Account Number (FEIN, TR or ME Number)

3. Michigan License Number

4. Reporting Period (MM/CCYY)

CHECK ONE box below to identify what is itemized on this schedule. Do not combine schedule types or product codes.

C-102a: Schedule of Unstamped Cigarette Credits

C-102b: Schedule of Non Tax Paid Stamped Cigarette Credits

C-102c: Schedule of Tax Paid Stamped Cigarette Credits

Claim Filed Against: Manufacturer/

Non-Participating Manufacturer Product

Claim/Credit Information

Purchase Entry (C-101)

Wholesaler/ Unclassified Acquirer

10.

Manufacturer

Brand

19. Total Cigarettes

7. Credit

Branch

14. Pack

per Entry

5. Date

6. Number

Types

8. Invoice No. 9. Tax Period

11. FEIN

12. Name

13. Type

Code

17. Code

15. FEIN

16. Name

18. Name

Size

20. TOTAL

Attach to your Michigan WC-100 or AC-100 Forms.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2