Instructions For Amending Tax Returns - South Dakota Department Of Revenue

ADVERTISEMENT

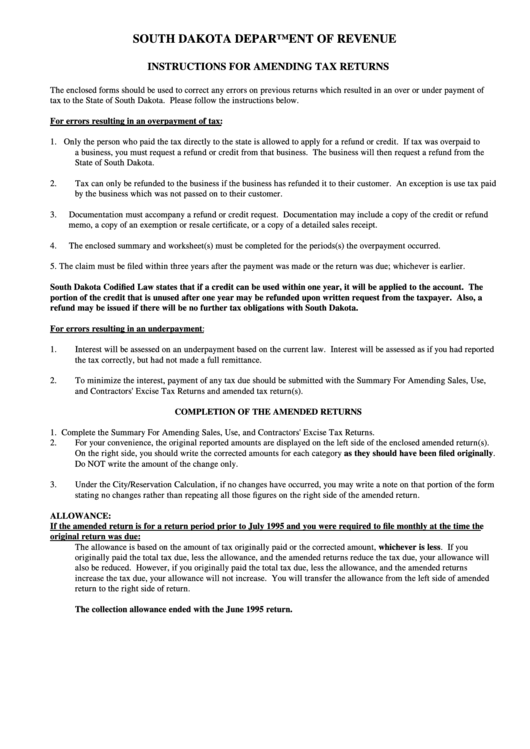

SOUTH DAKOTA DEPARTMENT OF REVENUE

INSTRUCTIONS FOR AMENDING TAX RETURNS

The enclosed forms should be used to correct any errors on previous returns which resulted in an over or under payment of

tax to the State of South Dakota. Please follow the instructions below.

For errors resulting in an overpayment of tax:

1.

Only the person who paid the tax directly to the state is allowed to apply for a refund or credit. If tax was overpaid to

a business, you must request a refund or credit from that business. The business will then request a refund from the

State of South Dakota.

2.

Tax can only be refunded to the business if the business has refunded it to their customer. An exception is use tax paid

by the business which was not passed on to their customer.

3.

Documentation must accompany a refund or credit request. Documentation may include a copy of the credit or refund

memo, a copy of an exemption or resale certificate, or a copy of a detailed sales receipt.

4.

The enclosed summary and worksheet(s) must be completed for the periods(s) the overpayment occurred.

5.

The claim must be filed within three years after the payment was made or the return was due; whichever is earlier.

South Dakota Codified Law states that if a credit can be used within one year, it will be applied to the account. The

portion of the credit that is unused after one year may be refunded upon written request from the taxpayer. Also, a

refund may be issued if there will be no further tax obligations with South Dakota.

For errors resulting in an underpayment:

1.

Interest will be assessed on an underpayment based on the current law. Interest will be assessed as if you had reported

the tax correctly, but had not made a full remittance.

2.

To minimize the interest, payment of any tax due should be submitted with the Summary For Amending Sales, Use,

and Contractors' Excise Tax Returns and amended tax return(s).

COMPLETION OF THE AMENDED RETURNS

1.

Complete the Summary For Amending Sales, Use, and Contractors' Excise Tax Returns.

2.

For your convenience, the original reported amounts are displayed on the left side of the enclosed amended return(s).

On the right side, you should write the corrected amounts for each category as they should have been filed originally.

Do NOT write the amount of the change only.

3.

Under the City/Reservation Calculation, if no changes have occurred, you may write a note on that portion of the form

stating no changes rather than repeating all those figures on the right side of the amended return.

ALLOWANCE:

If the amended return is for a return period prior to July 1995 and you were required to file monthly at the time the

original return was due:

The allowance is based on the amount of tax originally paid or the corrected amount, whichever is less. If you

originally paid the total tax due, less the allowance, and the amended returns reduce the tax due, your allowance will

also be reduced. However, if you originally paid the total tax due, less the allowance, and the amended returns

increase the tax due, your allowance will not increase. You will transfer the allowance from the left side of amended

return to the right side of return.

The collection allowance ended with the June 1995 return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2