STATE OF TENNESSEE

DEPARTMENT OF COMMERCE AND INSURANCE

Surplus Lines Division

500 James Robertson Parkway, 4th Floor

Nashville, TN 37243

(615) 741-1756

PROCEDURES FOR PAYING SURPLUS LINES TAXES

Note: Filings for zero or no business written not required

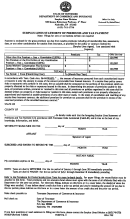

Form SL 3 Surplus Lines Statement of Premiums and Tax Payments (IN-0129) must be completed and mailed

with all tax payments. The agency that fills out and files the Form SL 2 Affidavit for Placing Surplus Lines

Insurance is the agency that fills out and files the Form SL 3 Surplus Lines Statement of Premiums and Tax

Payments and submits the taxes to Tennessee (see Procedures for Paying Surplus Lines Taxes for detailed

instructions).

The link for the form is located at

Taxes are due by September 1 for all filings with an effective date of January 1 through June 30

Taxes are due by March 1 for all filings with an effective date of July 1 through December 31

Optional: you have the option of remitting the tax payment when the affidavit is filed or on a monthly basis

If you believe there's credit due from a prior tax period and you're reducing the amount of tax due in this tax

period, please indicate on the Form SL 3 or in a cover letter the amount of tax credit due and the prior tax period.

Paper filings: If you file paper affidavits, the reconciliation must be attached to the Form SL 3 when remitting the

tax payment. Total premiums and tax amounts shown must agree with the sums of all affidavits filed with this

Department for the same tax period. The reconciliation should include the name of the policyholder, policy

number, effective date, amount of premium, and amount of tax. If you wish to receive information regarding the

electronic spreadsheet, send an email to Surplus.Lines@tn.gov requesting the information.

Electronic spreadsheet filings: If you file electronic affidavits, indicate on the SL 3 the date(s) of when the

filings were emailed. If some of the filings during the tax period included paper affidavits, indicate on the SL 3

that there were paper affidavits filed also (attach reconciliation to the Form SL 3 - see above for detailed

instructions).

Make check payable to:

Tennessee Department of Commerce & Insurance

Mail check to:

State of Tennessee

The Department of Commerce & Insurance

P.O. Box 198983

Nashville, TN 37219-8983

If you have any questions concerning this matter or need assistance in filling out the forms, please contact the Surplus

Lines Division at (615) 741-1756 or Surplus. Lines(a).tn. gov.

Revised 7-2010

1

1 2

2