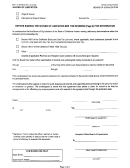

Form Boe-122 - Waiver Of Limitation - State Of California

ADVERTISEMENT

BOE-122 (BACK) REV. 18 (10-02)

WAIVER OF LIMITATION

PLEASE READ BEFORE SIGNING THIS DOCUMENT

What is this document?

The Waiver of Limitation is a legal agreement that you can voluntarily enter into with the Board of Equalization (Board). By

signing this document, you will extend the three-year statute of limitations for the period indicated. This will allow the Board

of Equalization to examine your records, and possibly assess additional tax, for periods which otherwise would expire under

the three-year statute of limitations. By signing this document you will also extend the period within which you may file a

timely Claim for Refund and will allow any credits in the period indicated to be offset against any tax liability.

Can a Waiver of Limitation be extended?

Yes. Waivers may be extended by mutual consent. The date the Waiver of Limitation will expire can be extended for the

period covered by the waiver. A new waiver of limitation will be prepared for previous periods and any new periods to be

included.

Do I have to sign this document?

No. The Waiver of Limitation provides an extension of the statute of limitations for periods which would otherwise expire.

This extension may result in a tax assessment for the period in question. However, the Waiver of Limitation will also extend

the period of time in which you may file a Claim for Refund and will allow any credit arising from that period to be offset

against a tax liability.

What will happen if I choose not to sign this document?

A billing may be issued under some circumstances. A billing will be issued only when the Board has knowledge of any

transaction(s) that appear to be subject to tax, or a good indication that additional tax may be due for the period in question.

If there is insufficient time in which to complete the audit or address specific concerns, a billing will usually be issued based

on an estimated amount of tax believed, at the time, to be due for the expiring periods. If an estimated billing is issued, it is

separate and distinct from any billing which may result from an audit. If you do not agree with the estimated billing you must

file a Petition for Redetermination within 30 days of the date of the billing.

Why does the Board of Equalization ask for this document?

Generally, a waiver is requested when the taxpayer needs to delay the start or the completion of an audit. A waiver is also

requested when the Board has information or a good indication that additional tax may be due, but there is insufficient time

in which to complete the audit or thoroughly review the issue or issues in question.

What benefit do I gain by signing this document?

The Waiver of Limitation holds the period(s) in question open for filing a Claim for Refund or for offsetting any overpayment

of tax against an existing tax liability.

A Waiver of Limitation provides you and the Board with the ability to adapt to both foreseen and unforeseen time

constraints. Often, transactions may appear taxable on the surface; however, given a detailed analysis, additional

documentation and/or dialogue with you or a company representative, these transactions in part or in their entirety result in

no tax assessment. The waiver gives you and the Board the time necessary to thoroughly address difficult audit issues

before those issues result in a billing.

The waiver can at times actually expedite the audit process by providing you and the Board the time necessary to resolve

audit issues before the audit is finished and a billing, if applicable, results. Allowing time to resolve audit issues “up front,”

rather than during the appeals process may eliminate the necessity to appeal the audit findings.

The Waiver of Limitation will eliminate needless “red tape” resulting from a billing issued with good intentions, but possibly

overstated, due to time constraints which did not allow for the detailed review necessary to reach a fair and equitable

conclusion.

Page 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1