Instructions For Form It-254 - Claim For Residential Fuel Oil Storage Tank Credit Personal Income Tax - New York State Department Of Taxation And Finance - 2003

ADVERTISEMENT

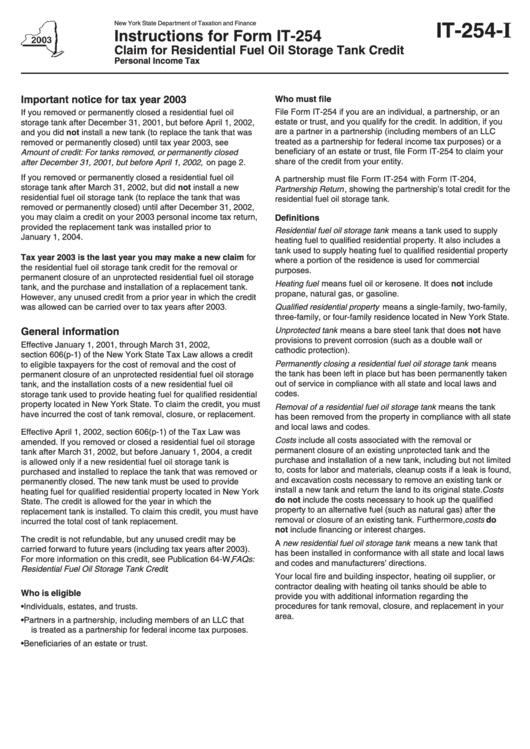

New York State Department of Taxation and Finance

IT-254- I

Instructions for Form IT-254

Claim for Residential Fuel Oil Storage Tank Credit

Personal Income Tax

Important notice for tax year 2003

Who must file

File Form IT-254 if you are an individual, a partnership, or an

If you removed or permanently closed a residential fuel oil

estate or trust, and you qualify for the credit. In addition, if you

storage tank after December 31, 2001, but before April 1, 2002,

are a partner in a partnership (including members of an LLC

and you did not install a new tank (to replace the tank that was

treated as a partnership for federal income tax purposes) or a

removed or permanently closed) until tax year 2003, see

beneficiary of an estate or trust, file Form IT-254 to claim your

Amount of credit: For tanks removed, or permanently closed

share of the credit from your entity.

after December 31, 2001, but before April 1, 2002, on page 2.

If you removed or permanently closed a residential fuel oil

A partnership must file Form IT-254 with Form IT-204,

storage tank after March 31, 2002, but did not install a new

Partnership Return , showing the partnership’s total credit for the

residential fuel oil storage tank (to replace the tank that was

residential fuel oil storage tank.

removed or permanently closed) until after December 31, 2002,

you may claim a credit on your 2003 personal income tax return,

Definitions

provided the replacement tank was installed prior to

Residential fuel oil storage tank means a tank used to supply

January 1, 2004.

heating fuel to qualified residential property. It also includes a

tank used to supply heating fuel to qualified residential property

Tax year 2003 is the last year you may make a new claim for

where a portion of the residence is used for commercial

the residential fuel oil storage tank credit for the removal or

purposes.

permanent closure of an unprotected residential fuel oil storage

Heating fuel means fuel oil or kerosene. It does not include

tank, and the purchase and installation of a replacement tank.

propane, natural gas, or gasoline.

However, any unused credit from a prior year in which the credit

was allowed can be carried over to tax years after 2003.

Qualified residential property means a single-family, two-family,

three-family, or four-family residence located in New York State.

General information

Unprotected tank means a bare steel tank that does not have

provisions to prevent corrosion (such as a double wall or

Effective January 1, 2001, through March 31, 2002,

cathodic protection).

section 606(p-1) of the New York State Tax Law allows a credit

Permanently closing a residential fuel oil storage tank means

to eligible taxpayers for the cost of removal and the cost of

the tank has been left in place but has been permanently taken

permanent closure of an unprotected residential fuel oil storage

out of service in compliance with all state and local laws and

tank, and the installation costs of a new residential fuel oil

codes.

storage tank used to provide heating fuel for qualified residential

property located in New York State. To claim the credit, you must

Removal of a residential fuel oil storage tank means the tank

have incurred the cost of tank removal, closure, or replacement.

has been removed from the property in compliance with all state

and local laws and codes.

Effective April 1, 2002, section 606(p-1) of the Tax Law was

Costs include all costs associated with the removal or

amended. If you removed or closed a residential fuel oil storage

permanent closure of an existing unprotected tank and the

tank after March 31, 2002, but before January 1, 2004, a credit

purchase and installation of a new tank, including but not limited

is allowed only if a new residential fuel oil storage tank is

to, costs for labor and materials, cleanup costs if a leak is found,

purchased and installed to replace the tank that was removed or

and excavation costs necessary to remove an existing tank or

permanently closed. The new tank must be used to provide

install a new tank and return the land to its original state. Costs

heating fuel for qualified residential property located in New York

do not include the costs necessary to hook up the qualified

State. The credit is allowed for the year in which the

property to an alternative fuel (such as natural gas) after the

replacement tank is installed. To claim this credit, you must have

removal or closure of an existing tank. Furthermore, costs do

incurred the total cost of tank replacement.

not include financing or interest charges.

The credit is not refundable, but any unused credit may be

A new residential fuel oil storage tank means a new tank that

carried forward to future years (including tax years after 2003).

has been installed in conformance with all state and local laws

For more information on this credit, see Publication 64-W, FAQs:

and codes and manufacturers’ directions.

Residential Fuel Oil Storage Tank Credit .

Your local fire and building inspector, heating oil supplier, or

contractor dealing with heating oil tanks should be able to

Who is eligible

provide you with additional information regarding the

• Individuals, estates, and trusts.

procedures for tank removal, closure, and replacement in your

area.

• Partners in a partnership, including members of an LLC that

is treated as a partnership for federal income tax purposes.

• Beneficiaries of an estate or trust.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4