Instructions For Form It-215 - Claim For Earned Income Credit - New York State Department Of Taxation And Finance - 2004

ADVERTISEMENT

New York State Department of Taxation and Finance

IT-215-I

Instructions for Form IT-215

Claim for Earned Income Credit

(NY State and City of NY)

• complete Form IT-215 using the

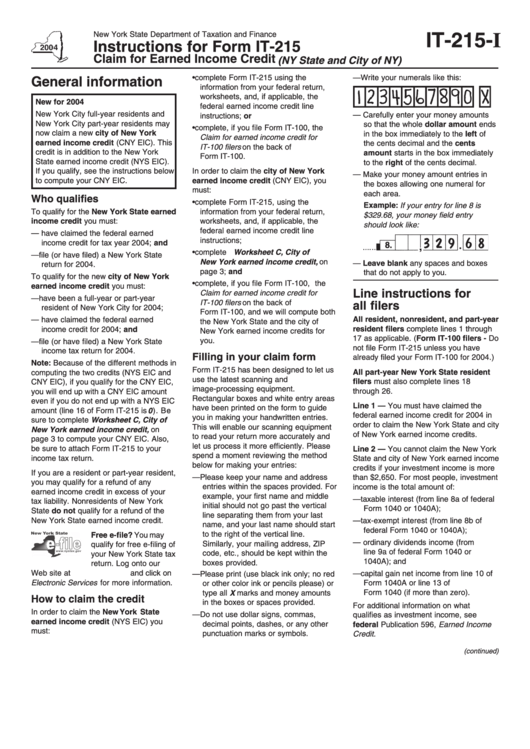

— Write your numerals like this:

General information

information from your federal return,

worksheets, and, if applicable, the

New for 2004

federal earned income credit line

New York City full-year residents and

— Carefully enter your money amounts

instructions; or

New York City part-year residents may

so that the whole dollar amount ends

• complete, if you file Form IT-100, the

now claim a new city of New York

in the box immediately to the left of

Claim for earned income credit for

earned income credit (CNY EIC). This

the cents decimal and the cents

IT-100 filers on the back of

credit is in addition to the New York

amount starts in the box immediately

Form IT-100.

State earned income credit (NYS EIC).

to the right of the cents decimal.

If you qualify, see the instructions below

In order to claim the city of New York

— Make your money amount entries in

to compute your CNY EIC.

earned income credit (CNY EIC), you

the boxes allowing one numeral for

must:

each area.

Who qualifies

• complete Form IT-215, using the

Example: If your entry for line 8 is

To qualify for the New York State earned

information from your federal return,

$329.68, your money field entry

income credit you must:

worksheets, and, if applicable, the

should look like:

federal earned income credit line

— have claimed the federal earned

3 2 9 6 8

instructions;

income credit for tax year 2004; and

8.

• complete Worksheet C, City of

— file (or have filed) a New York State

New York earned income credit, on

— Leave blank any spaces and boxes

return for 2004.

page 3; and

that do not apply to you.

To qualify for the new city of New York

• complete, if you file Form IT-100, the

earned income credit you must:

Line instructions for

Claim for earned income credit for

— have been a full-year or part-year

IT-100 filers on the back of

all filers

resident of New York City for 2004;

Form IT-100, and we will compute both

All resident, nonresident, and part-year

— have claimed the federal earned

the New York State and the city of

resident filers complete lines 1 through

income credit for 2004; and

New York earned income credits for

17 as applicable. (Form IT-100 filers - Do

you.

— file (or have filed) a New York State

not file Form IT-215 unless you have

income tax return for 2004.

Filling in your claim form

already filed your Form IT-100 for 2004.)

Note: Because of the different methods in

Form IT-215 has been designed to let us

All part-year New York State resident

computing the two credits (NYS EIC and

use the latest scanning and

filers must also complete lines 18

CNY EIC), if you qualify for the CNY EIC,

image-processing equipment.

through 26.

you will end up with a CNY EIC amount

Rectangular boxes and white entry areas

even if you do not end up with a NYS EIC

Line 1 — You must have claimed the

have been printed on the form to guide

amount (line 16 of Form IT-215 is 0 ). Be

federal earned income credit for 2004 in

you in making your handwritten entries.

sure to complete Worksheet C, City of

order to claim the New York State and city

This will enable our scanning equipment

New York earned income credit, on

of New York earned income credits.

to read your return more accurately and

page 3 to compute your CNY EIC. Also,

let us process it more efficiently. Please

be sure to attach Form IT-215 to your

Line 2 — You cannot claim the New York

spend a moment reviewing the method

income tax return.

State and city of New York earned income

below for making your entries:

credits if your investment income is more

If you are a resident or part-year resident,

— Please keep your name and address

than $2,650. For most people, investment

you may qualify for a refund of any

entries within the spaces provided. For

income is the total amount of:

earned income credit in excess of your

example, your first name and middle

— taxable interest (from line 8a of federal

tax liability. Nonresidents of New York

initial should not go past the vertical

Form 1040 or 1040A);

State do not qualify for a refund of the

line separating them from your last

New York State earned income credit.

— tax-exempt interest (from line 8b of

name, and your last name should start

federal Form 1040 or 1040A);

to the right of the vertical line.

Free e-file? You may

— ordinary dividends income (from

Similarly, your mailing address, ZIP

qualify for free e-filing of

line 9a of federal Form 1040 or

code, etc., should be kept within the

your New York State tax

1040A); and

boxes provided.

return. Log onto our

Web site at and click on

— capital gain net income from line 10 of

— Please print (use black ink only; no red

Electronic Services for more information.

Form 1040A or line 13 of

or other color ink or pencils please) or

Form 1040 (if more than zero).

type all X marks and money amounts

How to claim the credit

in the boxes or spaces provided.

For additional information on what

In order to claim the New York State

— Do not use dollar signs, commas,

qualifies as investment income, see

earned income credit (NYS EIC) you

decimal points, dashes, or any other

federal Publication 596, Earned Income

must:

punctuation marks or symbols.

Credit.

(continued)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4