Instructions For Form K-120el - Kansas Department Of Revenue

ADVERTISEMENT

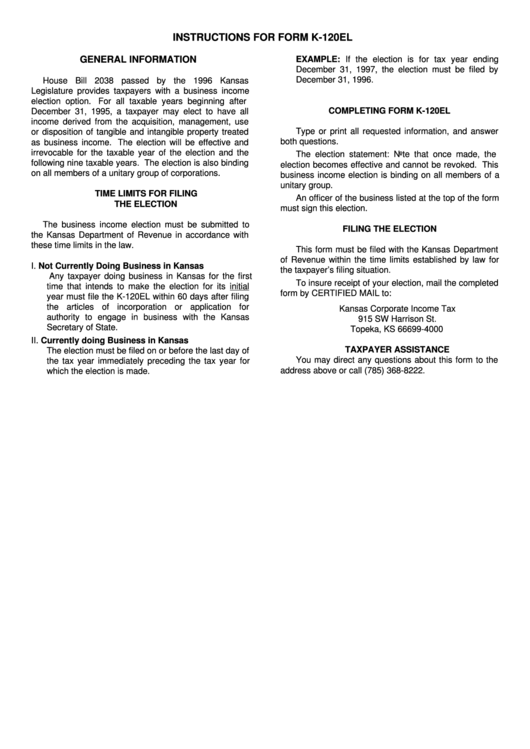

INSTRUCTIONS FOR FORM K-120EL

GENERAL INFORMATION

EXAMPLE: If the election is for tax year ending

December 31, 1997, the election must be filed by

December 31, 1996.

House Bill 2038 passed by the 1996 Kansas

Legislature provides taxpayers with a business income

election option.

For all taxable years beginning after

COMPLETING FORM K-120EL

December 31, 1995, a taxpayer may elect to have all

income derived from the acquisition, management, use

Type or print all requested information, and answer

or disposition of tangible and intangible property treated

both questions.

as business income. The election will be effective and

irrevocable for the taxable year of the election and the

The election statement: Note that once made, the

following nine taxable years. The election is also binding

election becomes effective and cannot be revoked. This

on all members of a unitary group of corporations.

business income election is binding on all members of a

unitary group.

TIME LIMITS FOR FILING

An officer of the business listed at the top of the form

THE ELECTION

must sign this election.

The business income election must be submitted to

FILING THE ELECTION

the Kansas Department of Revenue in accordance with

these time limits in the law.

This form must be filed with the Kansas Department

of Revenue within the time limits established by law for

I.

Not Currently Doing Business in Kansas

the taxpayer’s filing situation.

Any taxpayer doing business in Kansas for the first

To insure receipt of your election, mail the completed

time that intends to make the election for its initial

form by CERTIFIED MAIL to:

year must file the K-120EL within 60 days after filing

the articles of incorporation or application for

Kansas Corporate Income Tax

authority to engage in business with the Kansas

915 SW Harrison St.

Secretary of State.

Topeka, KS 66699-4000

II.

Currently doing Business in Kansas

TAXPAYER ASSISTANCE

The election must be filed on or before the last day of

You may direct any questions about this form to the

the tax year immediately preceding the tax year for

address above or call (785) 368-8222.

which the election is made.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1