Instructions For Form Sev. O-1s - Department Of Revenue

ADVERTISEMENT

Instructions for Form Sev. O-1s

Reporting company name/address - Self-explanatory.

Reporting company number - Producer code number or transporter code number assigned by the

Louisiana Office of Conservation, or the number assigned by the Department of Revenue (Severance Tax

Division) to taxpayers who are not producers or transporters.

Report submitted during month of - Month during which return is submitted.

Revenue Account Number - This is your 10-digit Louisiana Tax Number for Corporation Income and

Franchise tax, Sales tax, Withholding tax, or Oilfield Site Restoration fee. If you are not registered for any

of these taxes, please write or call the Department of Revenue for a registration application, Form R-16018.

Parish name - Self-explanatory.

Parish code - Code assigned by the Louisiana Office of Conservation.

Taxable period - Period for which tax is due. Volumes and taxes for more than one taxable period must

not be combined; they are to be reported separately.

Tax rate code - Code assigned by the Department of Revenue to designate the percentage of value tax

rate applicable to each category of oil and/or condensate. (See Tax Rate Code Legend below.)

Taxable barrels - Total taxable barrels by parish, taxable period, and applicable tax rate as shown on Form

SEV. O-1d. Do not include schedule code 2 or 5 data on Form SEV. O-1s.

Tax, penalty, and interest - Total amount remitted by parish, taxable period, and applicable tax rate as

shown on Form SEV. O-1d. (Penalty and/or interest due and included in remittance should be entered in

this column under Tax Rate Code 6.)

Summary section - Recap, by tax rate, of totals (barrels and money amounts). To be completed on last

sheet of Parish Summary (Form SEV. O-1s) only.

Grand total - Total taxable barrels and money submitted with return.

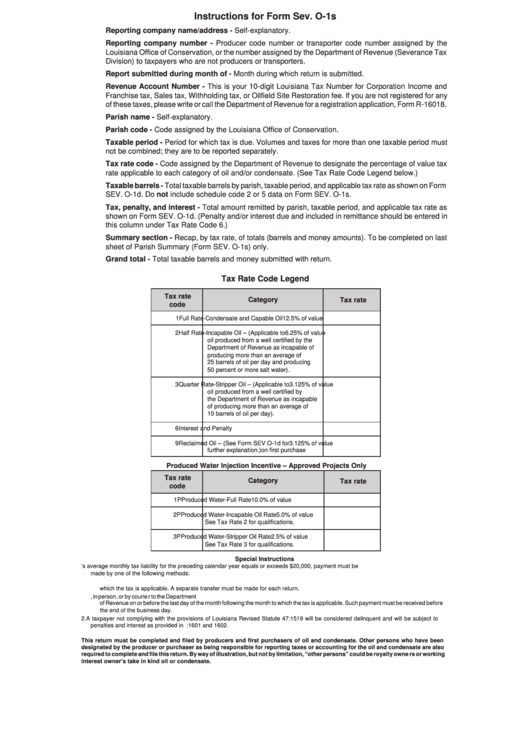

Tax Rate Code Legend

Tax rate

Category

Tax rate

code

1

Full Rate-Condensate and Capable Oil

12.5% of value

2

Half Rate-Incapable Oil – (Applicable to

6.25% of value

oil produced from a well certified by the

Department of Revenue as incapable of

producing more than an average of

25 barrels of oil per day and producing

50 percent or more salt water).

3

Quarter Rate-Stripper Oil – (Applicable to

3.125% of value

oil produced from a well certified by

the Department of Revenue as incapable

of producing more than an average of

10 barrels of oil per day).

6

Interest and Penalty

9

Reclaimed Oil – (See Form SEV O-1d for

3.125% of value

further explanation.)

on first purchase

Produced Water Injection Incentive – Approved Projects Only

Tax rate

Category

Tax rate

code

1P

Produced Water-Full Rate

10.0% of value

2P

Produced Water-Incapable Oil Rate

5.0% of value

See Tax Rate 2 for qualifications.

3P

Produced Water-Stripper Oil Rate

2.5% of value

See Tax Rate 3 for qualifications.

Special Instructions

1. In any case where a taxpayer’s average monthly tax liability for the preceding calendar year equals or exceeds $20,000, payme nt must be

made by one of the following methods:

a. By electronic funds transfer to be received by the Department of Revenue on or before the last day of the month following the month to

which the tax is applicable. A separate transfer must be made for each return.

b. By delivery of the tax return and full payment in investible funds of the amount shown on the return, in person, or by courie r to the Department

of Revenue on or before the last day of the month following the month to which the tax is applicable. Such payment must be rece ived before

the end of the business day.

2. A taxpayer not complying with the provisions of Louisiana Revised Statute 47:1519 will be considered delinquent and will be s ubject to

penalties and interest as provided in R.S. 47:1601 and 1602.

This return must be completed and filed by producers and first purchasers of oil and condensate. Other persons who have been

designated by the producer or purchaser as being responsible for reporting taxes or accounting for the oil and condensate are a lso

required to complete and file this return. By way of illustration, but not by limitation, “other persons” could be royalty owne rs or working

interest owner’s take in kind oil or condensate.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1