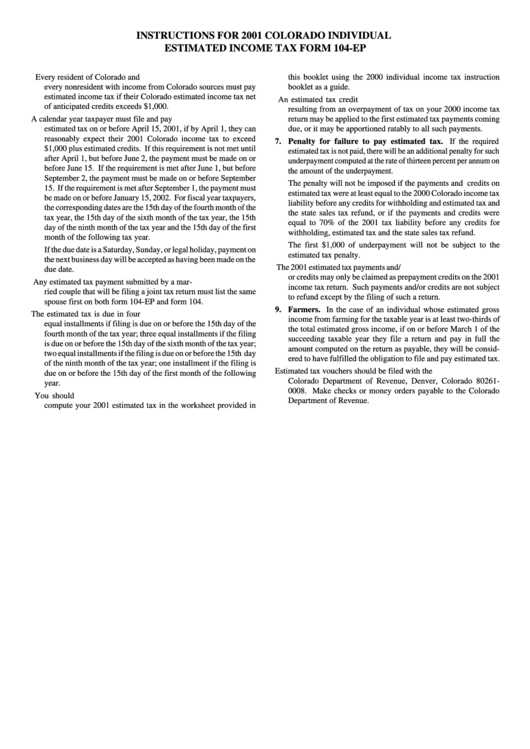

Instructions For 2001 Colorado Individual Estimated Income Tax Form 104-Ep

ADVERTISEMENT

INSTRUCTIONS FOR 2001 COLORADO INDIVIDUAL

ESTIMATED INCOME TAX FORM 104-EP

1. Who must pay estimated tax. Every resident of Colorado and

this booklet using the 2000 individual income tax instruction

every nonresident with income from Colorado sources must pay

booklet as a guide.

estimated income tax if their Colorado estimated income tax net

6. Application of 2000 overpayment. An estimated tax credit

of anticipated credits exceeds $1,000.

resulting from an overpayment of tax on your 2000 income tax

2. Due date for filing. A calendar year taxpayer must file and pay

return may be applied to the first estimated tax payments coming

estimated tax on or before April 15, 2001, if by April 1, they can

due, or it may be apportioned ratably to all such payments.

reasonably expect their 2001 Colorado income tax to exceed

7. Penalty for failure to pay estimated tax. If the required

$1,000 plus estimated credits. If this requirement is not met until

estimated tax is not paid, there will be an additional penalty for such

after April 1, but before June 2, the payment must be made on or

underpayment computed at the rate of thirteen percent per annum on

before June 15. If the requirement is met after June 1, but before

the amount of the underpayment.

September 2, the payment must be made on or before September

The penalty will not be imposed if the payments and credits on

15. If the requirement is met after September 1, the payment must

estimated tax were at least equal to the 2000 Colorado income tax

be made on or before January 15, 2002. For fiscal year taxpayers,

liability before any credits for withholding and estimated tax and

the corresponding dates are the 15th day of the fourth month of the

the state sales tax refund, or if the payments and credits were

tax year, the 15th day of the sixth month of the tax year, the 15th

equal to 70% of the 2001 tax liability before any credits for

day of the ninth month of the tax year and the 15th day of the first

withholding, estimated tax and the state sales tax refund.

month of the following tax year.

The first $1,000 of underpayment will not be subject to the

If the due date is a Saturday, Sunday, or legal holiday, payment on

estimated tax penalty.

the next business day will be accepted as having been made on the

8. Refund of estimated tax. The 2001 estimated tax payments and/

due date.

or credits may only be claimed as prepayment credits on the 2001

3. Joint Returns. Any estimated tax payment submitted by a mar-

income tax return. Such payments and/or credits are not subject

ried couple that will be filing a joint tax return must list the same

to refund except by the filing of such a return.

spouse first on both form 104-EP and form 104.

9. Farmers. In the case of an individual whose estimated gross

4. Payments of estimated tax. The estimated tax is due in four

income from farming for the taxable year is at least two-thirds of

equal installments if filing is due on or before the 15th day of the

the total estimated gross income, if on or before March 1 of the

fourth month of the tax year; three equal installments if the filing

succeeding taxable year they file a return and pay in full the

is due on or before the 15th day of the sixth month of the tax year;

amount computed on the return as payable, they will be consid-

two equal installments if the filing is due on or before the 15th day

ered to have fulfilled the obligation to file and pay estimated tax.

of the ninth month of the tax year; one installment if the filing is

10. Where to file. Estimated tax vouchers should be filed with the

due on or before the 15th day of the first month of the following

Colorado Department of Revenue, Denver, Colorado 80261-

year.

0008. Make checks or money orders payable to the Colorado

5. How to compute your estimated tax for 2001. You should

Department of Revenue.

compute your 2001 estimated tax in the worksheet provided in

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1