Clear form

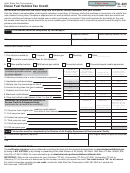

Utah State Tax Commission

TC-40V

Clean Fuel Vehicle Tax Credit

Get forms online - tax.utah.gov

Rev. 1/14

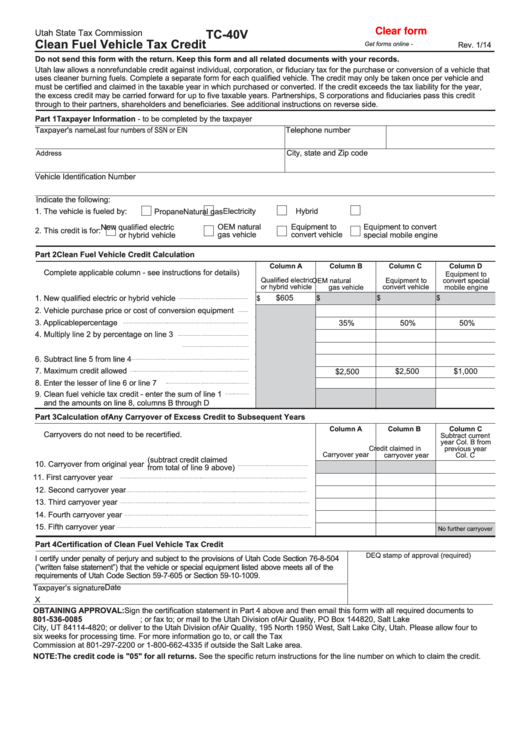

Do not send this form with the return. Keep this form and all related documents with your records.

Utah law allows a nonrefundable credit against individual, corporation, or fiduciary tax for the purchase or conversion of a vehicle that

uses cleaner burning fuels. Complete a separate form for each qualified vehicle. The credit may only be taken once per vehicle and

must be certified and claimed in the taxable year in which purchased or converted. If the credit exceeds the tax liability for the year,

the excess credit may be carried forward for up to five taxable years. Partnerships, S corporations and fiduciaries pass this credit

through to their partners, shareholders and beneficiaries. See additional instructions on reverse side.

Part 1 Taxpayer Information - to be completed by the taxpayer

Last four numbers of SSN or EIN

Taxpayer's name

Telephone number

City, state and Zip code

Address

Vehicle Identification Number

Indicate the following:

1. The vehicle is fueled by:

Electricity

Hybrid

Propane

Natural gas

New qualified electric

OEM natural

Equipment to

Equipment to convert

2. This credit is for:

or hybrid vehicle

gas vehicle

convert vehicle

special mobile engine

Part 2 Clean Fuel Vehicle Credit Calculation

Column A

Column B

Column C

Column D

Complete applicable column - see instructions for details)

Equipment to

Qualified electric

OEM natural

Equipment to

convert special

or hybrid vehicle

gas vehicle

convert vehicle

mobile engine

1. New qualified electric or hybrid vehicle

$605

$

$

$

$

2. Vehicle purchase price or cost of conversion equipment

3. Applicable percentage

50%

35%

50%

4. Multiply line 2 by percentage on line 3

5. Amount of any clean fuel grant received

6. Subtract line 5 from line 4

7. Maximum credit allowed

$2,500

$2,500

$1,000

8. Enter the lesser of line 6 or line 7

9. Clean fuel vehicle tax credit - enter the sum of line 1

and the amounts on line 8, columns B through D

Part 3 Calculation of Any Carryover of Excess Credit to Subsequent Years

Column A

Column B

Column C

Carryovers do not need to be recertified.

Subtract current

year Col. B from

Credit claimed in

previous year

Carryover year

carryover year

Col. C

(subtract credit claimed

10. Carryover from original year

from total of line 9 above)

11. First carryover year

12. Second carryover year

13. Third carryover year

14. Fourth carryover year

15. Fifth carryover year

No further carryover

Part 4 Certification of Clean Fuel Vehicle Tax Credit

DEQ stamp of approval (required)

I certify under penalty of perjury and subject to the provisions of Utah Code Section 76-8-504

(”written false statement”) that the vehicle or special equipment listed above meets all of the

requirements of Utah Code Section 59-7-605 or Section 59-10-1009.

Date

Taxpayer’s signature

X

OBTAINING APPROVAL: Sign the certification statement in Part 4 above and then email this form with all required documents to

cleanfueltaxcredit@utah.gov

; or fax to

801-536-0085

; or mail to the Utah Division of Air Quality, PO Box 144820, Salt Lake

City, UT 84114-4820; or deliver to the Utah Division of Air Quality, 195 North 1950 West, Salt Lake City, Utah. Please allow four to

six weeks for processing time. For more information go to

cleanfuels.utah.gov/taxcredits/taxcreditsintro.htm

, or call the Tax

Commission at 801-297-2200 or 1-800-662-4335 if outside the Salt Lake area.

NOTE: The credit code is "05" for all returns. See the specific return instructions for the line number on which to claim the credit.

1

1