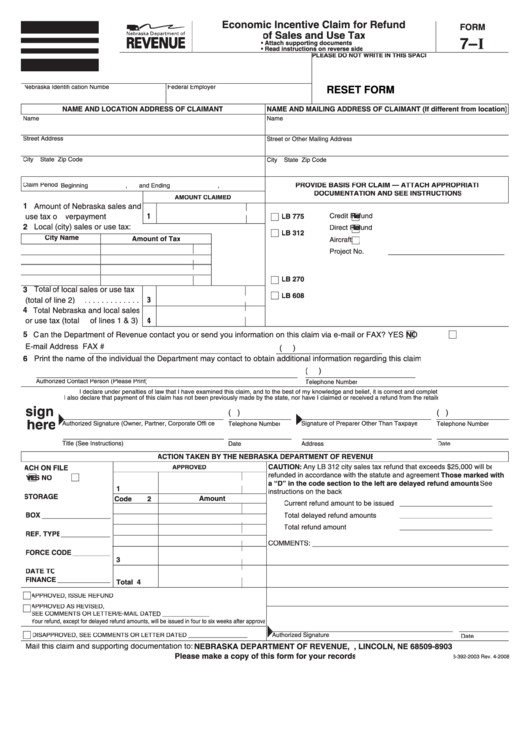

Economic Incentive Claim for Refund

FORM

of Sales and Use Tax

7–I

• Attach supporting documents

• Read instructions on reverse side

PLEASE DO NOT WRITE IN THIS SPACE

Nebraska Identification Number

Federal Employer I.D. or Social Security Number

RESET FORM

NAME AND LOCATION ADDRESS OF CLAIMANT

NAME AND MAILING ADDRESS OF CLAIMANT (If different from location)

Name

Name

Street Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

PROVIDE BASIS FOR CLAIM — ATTACH APPROPRIATE

Claim Period

Beginning

,

and Ending

,

DOCUMENTATION AND SEE INSTRUCTIONS

AMOUNT CLAIMED

1 Amount of Nebraska sales and

use tax overpayment .............

1

LB 775

Credit Refund

Credit Refund

Credit Refund

Credit Refund

2 Local (city) sales or use tax:

Local (city) sales or use tax:

Local (city) sales or use tax:

Local (city) sales or use tax:

Direct Refund

Direct Refund

Direct Refund

Direct Refund

LB 312

City Name

Amount of Tax

Aircraft

Aircraft

Aircraft

Aircraft

Project No.

LB 270

3 Total of local sales or use tax

LB 608

3

(total of line 2). . . . . . . . . . . . .

4 Total Nebraska and local sales

or use tax (total of lines 1 & 3)

4

5 Can the Department of Revenue contact you or send you information on this claim via e-mail or FAX?

an the Department of Revenue contact you or send you information on this claim via e-mail or FAX?

an the Department of Revenue contact you or send you information on this claim via e-mail or FAX?

YES

YES

YES

NO

NO

NO

E-mail Address

FAX #

(

)

6 Print the name of the individual the Department may contact to obtain additional information regarding this claim:

(

)

Authorized Contact Person (Please Print)

Telephone Number

I declare under penalties of law that I have examined this claim, and to the best of my knowledge and belief, it is correct and complete.

I also declare that payment of this claim has not been previously made by the state, nor have I claimed or received a refund from the retailer.

sign

(

)

(

)

here

Authorized Signature (Owner, Partner, Corporate Officer)

Telephone Number

Signature of Preparer Other Than Taxpayer

Signature of Preparer Other Than Taxpayer

Telephone Number

Title (See Instructions)

Date

Address

Date

ACTION TAKEN BY THE NEBRASKA DEPARTMENT OF REVENUE

CAUTION: Any LB 312 city sales tax refund that exceeds $25,000 will be

ACH ON FILE

APPROVED

refunded in accordance with the statute and agreement. Those marked with

YES

YES

YES

NO

NO

NO

a “D” in the code section to the left are delayed refund amounts. See

1

instructions on the back.

STORAGE

Amount

Code

2

Current refund amount to be issued ________________________

BOX __________________

Total delayed refund amounts

________________________

Total refund amount

________________________

REF. TYPE_____________

COMMENTS:

FORCE CODE__________

3

DATE TO

FINANCE______________

Total

4

APPROVED, ISSUE REFUND

APPROVED AS REVISED,

SEE COMMENTS OR LETTER/E-MAIL DATED ___________________

Your refund, except for delayed refund amounts, will be issued in four to six weeks after approval.

DISAPPROVED, SEE COMMENTS OR LETTER DATED __________________

Authorized Signature

Date

Mail this claim and supporting documentation to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 98903, LINCOLN, NE 68509-8903

Please make a copy of this form for your records

6-392-2003 Rev. 4-2008

1

1