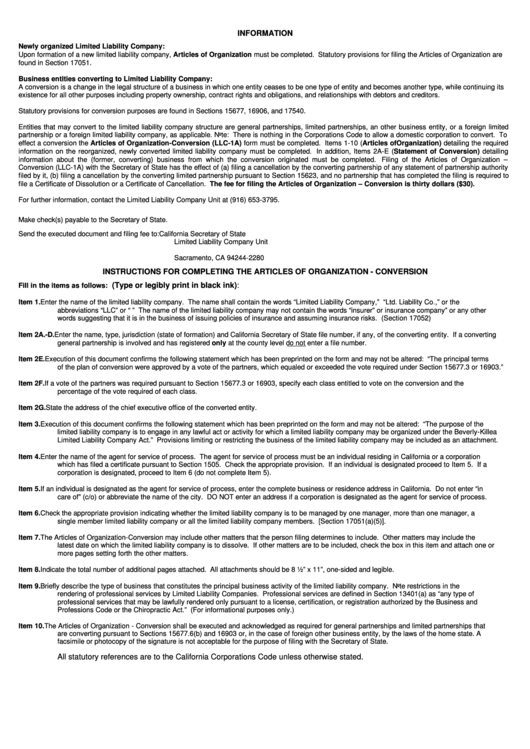

Instructions For Completing The Articles Of Organization - Conversion

ADVERTISEMENT

INFORMATION

Newly organized Limited Liability Company:

Upon formation of a new limited liability company, Articles of Organization must be completed. Statutory provisions for filing the Articles of Organization are

found in Section 17051.

Business entities converting to Limited Liability Company:

A conversion is a change in the legal structure of a business in which one entity ceases to be one type of entity and becomes another type, while continuing its

existence for all other purposes including property ownership, contract rights and obligations, and relationships with debtors and creditors.

Statutory provisions for conversion purposes are found in Sections 15677, 16906, and 17540.

Entities that may convert to the limited liability company structure are general partnerships, limited partnerships, an other business entity, or a foreign limited

partnership or a foreign limited liability company, as applicable. Note: There is nothing in the Corporations Code to allow a domestic corporation to convert. To

effect a conversion the Articles of Organization-Conversion (LLC-1A) form must be completed. Items 1-10 (Articles of Organization) detailing the required

information on the reorganized, newly converted limited liability company must be completed. In addition, Items 2A-E (Statement of Conversion) detailing

information about the (former, converting) business from which the conversion originated must be completed.

Filing of the Articles of Organization –

Conversion (LLC-1A) with the Secretary of State has the effect of (a) filing a cancellation by the converting partnership of any statement of partnership authority

filed by it, (b) filing a cancellation by the converting limited partnership pursuant to Section 15623, and no partnership that has completed the filing is required to

file a Certificate of Dissolution or a Certificate of Cancellation. The fee for filing the Articles of Organization – Conversion is thirty dollars ($30).

For further information, contact the Limited Liability Company Unit at (916) 653-3795.

Make check(s) payable to the Secretary of State.

Send the executed document and filing fee to:

California Secretary of State

Limited Liability Company Unit

P.O. Box 944228

Sacramento, CA 94244-2280

INSTRUCTIONS FOR COMPLETING THE ARTICLES OF ORGANIZATION - CONVERSION

(Type or legibly print in black ink):

Fill in the items as follows:

Item 1.

Enter the name of the limited liability company. The name shall contain the words “Limited Liability Company,” “Ltd. Liability Co.,” or the

abbreviations “LLC” or “L.L.C.” The name of the limited liability company may not contain the words “insurer” or insurance company” or any other

words suggesting that it is in the business of issuing policies of insurance and assuming insurance risks. (Section 17052)

Item 2A.-D. Enter the name, type, jurisdiction (state of formation) and California Secretary of State file number, if any, of the converting entity. If a converting

general partnership is involved and has registered only at the county level do not enter a file number.

Item 2E.

Execution of this document confirms the following statement which has been preprinted on the form and may not be altered: “The principal terms

of the plan of conversion were approved by a vote of the partners, which equaled or exceeded the vote required under Section 15677.3 or 16903.”

Item 2F.

If a vote of the partners was required pursuant to Section 15677.3 or 16903, specify each class entitled to vote on the conversion and the

percentage of the vote required of each class.

Item 2G.

State the address of the chief executive office of the converted entity.

Item 3.

Execution of this document confirms the following statement which has been preprinted on the form and may not be altered: “The purpose of the

limited liability company is to engage in any lawful act or activity for which a limited liability company may be organized under the Beverly-Killea

Limited Liability Company Act.” Provisions limiting or restricting the business of the limited liability company may be included as an attachment.

Item 4.

Enter the name of the agent for service of process. The agent for service of process must be an individual residing in California or a corporation

which has filed a certificate pursuant to Section 1505. Check the appropriate provision. If an individual is designated proceed to Item 5. If a

corporation is designated, proceed to Item 6 (do not complete Item 5).

Item 5.

If an individual is designated as the agent for service of process, enter the complete business or residence address in California. Do not enter “in

care of” (c/o) or abbreviate the name of the city. DO NOT enter an address if a corporation is designated as the agent for service of process.

Item 6.

Check the appropriate provision indicating whether the limited liability company is to be managed by one manager, more than one manager, a

single member limited liability company or all the limited liability company members. [Section 17051(a)(5)].

Item 7.

The Articles of Organization-Conversion may include other matters that the person filing determines to include. Other matters may include the

latest date on which the limited liability company is to dissolve. If other matters are to be included, check the box in this item and attach one or

more pages setting forth the other matters.

Item 8.

Indicate the total number of additional pages attached. All attachments should be 8 ½” x 11”, one-sided and legible.

Item 9.

Briefly describe the type of business that constitutes the principal business activity of the limited liability company. Note restrictions in the

rendering of professional services by Limited Liability Companies. Professional services are defined in Section 13401(a) as “any type of

professional services that may be lawfully rendered only pursuant to a license, certification, or registration authorized by the Business and

Professions Code or the Chiropractic Act.” (For informational purposes only.)

Item 10.

The Articles of Organization - Conversion shall be executed and acknowledged as required for general partnerships and limited partnerships that

are converting pursuant to Sections 15677.6(b) and 16903 or, in the case of foreign other business entity, by the laws of the home state. A

facsimile or photocopy of the signature is not acceptable for the purpose of filing with the Secretary of State.

All statutory references are to the California Corporations Code unless otherwise stated.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1