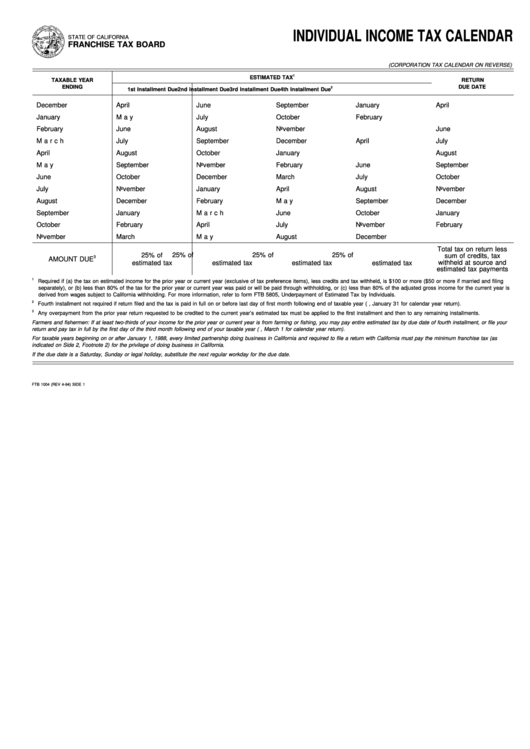

Form Ftb 1004 - Individual/corporation Income Tax Calendar

ADVERTISEMENT

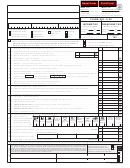

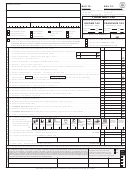

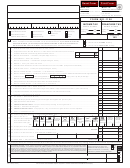

INDIVIDUAL INCOME TAX CALENDAR

STATE OF CALIFORNIA

FRANCHISE TAX BOARD

(CORPORATION TAX CALENDAR ON REVERSE)

1

ESTIMATED TAX

TAXABLE YEAR

RETURN

ENDING

DUE DATE

2

1st Installment Due

2nd Installment Due

3rd Installment Due

4th Installment Due

December . . . . .

31

April . . . . . . . . . .

15

June

. . . . . . . . .

15

September . . . . .

15

January . . . . . . . .

15

April. . . . . . . . . . .

15

January . . . . . . .

31

May . . . . . . . . . .

15

July . . . . . . . . . .

15

October . . . . . . .

15

February . . . . . . .

15

May . . . . . . . . . . .

15

February . . . . . .

28

June

. . . . . . . . .

15

August . . . . . . . .

15

November . . . . .

15

March . . . . . . . . .

15

June . . . . . . . . . .

15

March

. . . . . . . .

31

July . . . . . . . . . .

15

September . . . . .

15

December . . . . .

15

April. . . . . . . . . . .

15

July . . . . . . . . . . .

15

April . . . . . . . . . .

30

August . . . . . . . .

15

October . . . . . . .

15

January . . . . . . .

15

May . . . . . . . . . . .

15

August . . . . . . . . .

15

May . . . . . . . . . .

31

September . . . . .

15

November . . . . .

15

February . . . . . .

15

June . . . . . . . . . .

15

September . . . . . .

15

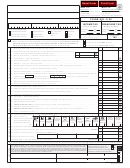

June

. . . . . . . . .

30

October . . . . . . .

15

December . . . . .

15

March

. . . . . . . .

15

July . . . . . . . . . . .

15

October . . . . . . . .

15

July . . . . . . . . . .

31

November . . . . .

15

January . . . . . . .

15

April . . . . . . . . . .

15

August . . . . . . . . .

15

November . . . . . .

15

August . . . . . . . .

31

December . . . . .

15

February . . . . . .

15

May . . . . . . . . . .

15

September . . . . . .

15

December . . . . . .

15

September . . . . .

30

January . . . . . . .

15

March

. . . . . . . .

15

June

. . . . . . . . .

15

October . . . . . . . .

15

January . . . . . . . .

15

October . . . . . . .

31

February . . . . . .

15

April . . . . . . . . . .

15

July . . . . . . . . . .

15

November . . . . . .

15

February . . . . . . .

15

November . . . . .

30

March

. . . . . . . .

15

May . . . . . . . . . .

15

August . . . . . . . .

15

December . . . . . .

15

March . . . . . . . . .

15

Total tax on return less

25% of

25% of

25% of

25% of

sum of credits, tax

3

AMOUNT DUE

withheld at source and

estimated tax

estimated tax

estimated tax

estimated tax

estimated tax payments

1

Required if (a) the tax on estimated income for the prior year or current year (exclusive of tax preference items), less credits and tax withheld, is $100 or more ($50 or more if married and filing

separately), or (b) less than 80% of the tax for the prior year or current year was paid or will be paid through withholding, or (c) less than 80% of the adjusted gross income for the current year is

derived from wages subject to California withholding. For more information, refer to form FTB 5805, Underpayment of Estimated Tax by Individuals.

2

Fourth installment not required if return filed and the tax is paid in full on or before last day of first month following end of taxable year (e.g., January 31 for calendar year return).

3

Any overpayment from the prior year return requested to be credited to the current year’s estimated tax must be applied to the first installment and then to any remaining installments.

Farmers and fishermen: If at least two-thirds of your income for the prior year or current year is from farming or fishing, you may pay entire estimated tax by due date of fourth installment, or file your

return and pay tax in full by the first day of the third month following end of your taxable year (e.g., March 1 for calendar year return).

For taxable years beginning on or after January 1, 1988, every limited partnership doing business in California and required to file a return with California must pay the minimum franchise tax (as

indicated on Side 2, Footnote 2) for the privilege of doing business in California.

If the due date is a Saturday, Sunday or legal holiday, substitute the next regular workday for the due date.

FTB 1004 (REV 4-94) SIDE 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2