Form 102c - Soft Drinks And Other Beverages Fact Sheet

ADVERTISEMENT

Soft Drinks and Other Beverages

102C

Taxable Subcategory of Food—See Fact Sheet 102A

Sales Tax

Fact Sheet

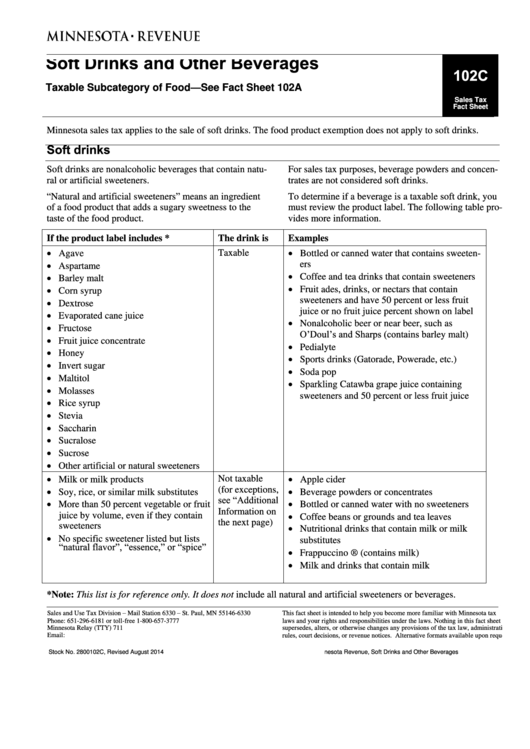

Minnesota sales tax applies to the sale of soft drinks. The food product exemption does not apply to soft drinks.

Soft drinks

Soft drinks are nonalcoholic beverages that contain natu-

For sales tax purposes, beverage powders and concen-

ral or artificial sweeteners.

trates are not considered soft drinks.

“Natural and artificial sweeteners” means an ingredient

To determine if a beverage is a taxable soft drink, you

of a food product that adds a sugary sweetness to the

must review the product label. The following table pro-

taste of the food product.

vides more information.

If the product label includes *

The drink is

Examples

Agave

Bottled or canned water that contains sweeten-

Taxable

Aspartame

ers

Coffee and tea drinks that contain sweeteners

Barley malt

Fruit ades, drinks, or nectars that contain

Corn syrup

Dextrose

sweeteners and have 50 percent or less fruit

juice or no fruit juice percent shown on label

Evaporated cane juice

Nonalcoholic beer or near beer, such as

Fructose

O’Doul’s and Sharps (contains barley malt)

Fruit juice concentrate

Pedialyte

Honey

Sports drinks (Gatorade, Powerade, etc.)

Invert sugar

Soda pop

Maltitol

Sparkling Catawba grape juice containing

Molasses

sweeteners and 50 percent or less fruit juice

Rice syrup

Stevia

Saccharin

Sucralose

Sucrose

Other artificial or natural sweeteners

Milk or milk products

Apple cider

Not taxable

Soy, rice, or similar milk substitutes

Beverage powders or concentrates

(for exceptions,

see “Additional

More than 50 percent vegetable or fruit

Bottled or canned water with no sweeteners

Information on

Coffee beans or grounds and tea leaves

juice by volume, even if they contain

the next page)

sweeteners

Nutritional drinks that contain milk or milk

No specific sweetener listed but lists

substitutes

“natural flavor”, “essence,” or “spice”

Frappuccino ® (contains milk)

Milk and drinks that contain milk

* Note: This list is for reference only. It does not include all natural and artificial sweeteners or beverages.

Sales and Use Tax Division – Mail Station 6330 – St. Paul, MN 55146-6330

This fact sheet is intended to help you become more familiar with Minnesota tax

Phone: 651-296-6181 or toll-free 1-800-657-3777

laws and your rights and responsibilities under the laws. Nothing in this fact sheet

Minnesota Relay (TTY) 711

supersedes, alters, or otherwise changes any provisions of the tax law, administrative

Email: salesuse.tax@state.mn.us

rules, court decisions, or revenue notices. Alternative formats available upon request.

Stock No. 2800102C, Revised August 2014

Minnesota Revenue, Soft Drinks and Other Beverages

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2