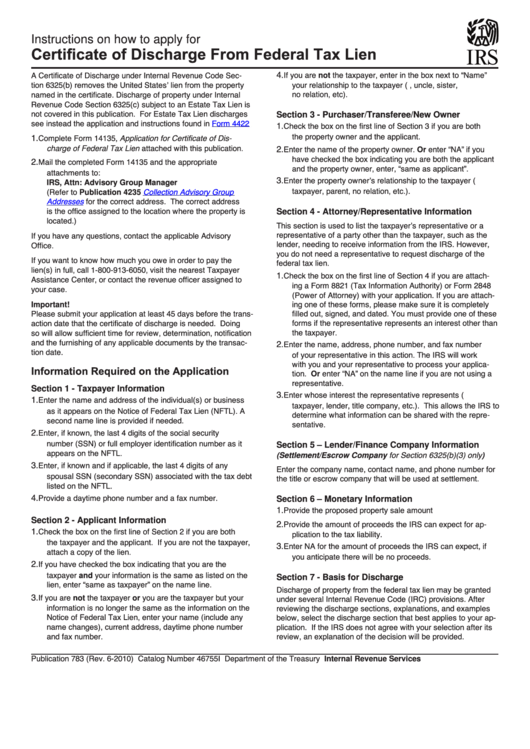

Instructions On How To Apply For Certificate Of Discharge From Federal Tax Lien

ADVERTISEMENT

Instructions on how to apply for

Certificate of Discharge From Federal Tax Lien

4.

A Certificate of Discharge under Internal Revenue Code Sec-

If you are not the taxpayer, enter in the box next to “Name”

tion 6325(b) removes the United States’ lien from the property

your relationship to the taxpayer (e.g. parent, uncle, sister,

no relation, etc).

named in the certificate. Discharge of property under Internal

Revenue Code Section 6325(c) subject to an Estate Tax Lien is

not covered in this publication. For Estate Tax Lien discharges

Section 3 - Purchaser/Transferee/New Owner

see instead the application and instructions found in

Form 4422

1.

Check the box on the first line of Section 3 if you are both

the property owner and the applicant.

1.

Complete Form 14135, Application for Certificate of Dis-

charge of Federal Tax Lien attached with this publication.

2.

Enter the name of the property owner. Or enter “NA” if you

have checked the box indicating you are both the applicant

2.

Mail the completed Form 14135 and the appropriate

and the property owner, enter, “same as applicant”.

attachments to:

3.

Enter the property owner’s relationship to the taxpayer (e.g.

IRS, Attn: Advisory Group Manager

taxpayer, parent, no relation, etc.).

(Refer to Publication 4235

Collection Advisory Group

Addresses

for the correct address. The correct address

is the office assigned to the location where the property is

Section 4 - Attorney/Representative Information

located.)

This section is used to list the taxpayer’s representative or a

representative of a party other than the taxpayer, such as the

If you have any questions, contact the applicable Advisory

lender, needing to receive information from the IRS. However,

Office.

you do not need a representative to request discharge of the

If you want to know how much you owe in order to pay the

federal tax lien.

lien(s) in full, call 1-800-913-6050, visit the nearest Taxpayer

1.

Check the box on the first line of Section 4 if you are attach-

Assistance Center, or contact the revenue officer assigned to

ing a Form 8821 (Tax Information Authority) or Form 2848

your case.

(Power of Attorney) with your application. If you are attach-

ing one of these forms, please make sure it is completely

Important!

Please submit your application at least 45 days before the trans-

filled out, signed, and dated. You must provide one of these

forms if the representative represents an interest other than

action date that the certificate of discharge is needed. Doing

the taxpayer.

so will allow sufficient time for review, determination, notification

and the furnishing of any applicable documents by the transac-

2.

Enter the name, address, phone number, and fax number

tion date.

of your representative in this action. The IRS will work

with you and your representative to process your applica-

Information Required on the Application

tion. Or enter “NA” on the name line if you are not using a

representative.

Section 1 - Taxpayer Information

3.

Enter whose interest the representative represents (e.g.

1.

Enter the name and address of the individual(s) or business

taxpayer, lender, title company, etc.). This allows the IRS to

as it appears on the Notice of Federal Tax Lien (NFTL). A

determine what information can be shared with the repre-

second name line is provided if needed.

sentative.

2.

Enter, if known, the last 4 digits of the social security

number (SSN) or full employer identification number as it

Section 5 – Lender/Finance Company Information

appears on the NFTL.

(Settlement/Escrow Company for Section 6325(b)(3) only)

3.

Enter, if known and if applicable, the last 4 digits of any

Enter the company name, contact name, and phone number for

spousal SSN (secondary SSN) associated with the tax debt

the title or escrow company that will be used at settlement.

listed on the NFTL.

4.

Provide a daytime phone number and a fax number.

Section 6 – Monetary Information

1.

Provide the proposed property sale amount

Section 2 - Applicant Information

2.

Provide the amount of proceeds the IRS can expect for ap-

1.

Check the box on the first line of Section 2 if you are both

plication to the tax liability.

the taxpayer and the applicant. If you are not the taxpayer,

3.

Enter NA for the amount of proceeds the IRS can expect, if

attach a copy of the lien.

you anticipate there will be no proceeds.

2.

If you have checked the box indicating that you are the

taxpayer and your information is the same as listed on the

Section 7 - Basis for Discharge

lien, enter “same as taxpayer” on the name line.

Discharge of property from the federal tax lien may be granted

3.

If you are not the taxpayer or you are the taxpayer but your

under several Internal Revenue Code (IRC) provisions. After

information is no longer the same as the information on the

reviewing the discharge sections, explanations, and examples

Notice of Federal Tax Lien, enter your name (include any

below, select the discharge section that best applies to your ap-

name changes), current address, daytime phone number

plication. If the IRS does not agree with your selection after its

and fax number.

review, an explanation of the decision will be provided.

Publication 783 (Rev. 6-2010)

Catalog Number 46755I

Department of the Treasury Internal Revenue Services

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4