Hotel/motel Occupancy Tax Report Form

ADVERTISEMENT

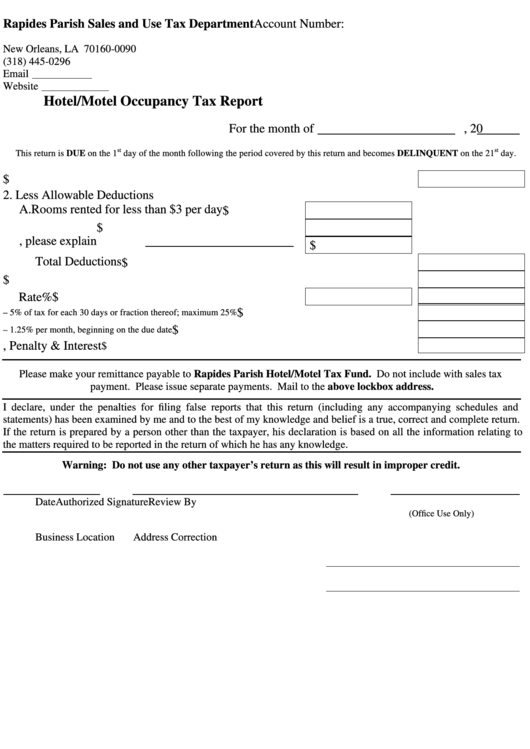

Rapides Parish Sales and Use Tax Department

Account Number:

P.O. Box 60090

New Orleans, LA 70160-0090

(318) 445-0296

Email

Website

Hotel/Motel Occupancy Tax Report

For the month of

, 20

st

st

This return is DUE on the 1

day of the month following the period covered by this return and becomes DELINQUENT on the 21

day.

1. Gross Rentals

$

2. Less Allowable Deductions

A. Rooms rented for less than $3 per day

$

B. Rooms rented to government

$

C. Other, please explain

$

Total Deductions

$

3. Amount Taxable

$

4. Total Amount of Tax Due

Rate

%

$

5. Specific Penalty

$

– 5% of tax for each 30 days or fraction thereof; maximum 25%

6. Interest

$

– 1.25% per month, beginning on the due date

7. Total Tax, Penalty & Interest

$

Please make your remittance payable to Rapides Parish Hotel/Motel Tax Fund. Do not include with sales tax

payment. Please issue separate payments. Mail to the above lockbox address.

I declare, under the penalties for filing false reports that this return (including any accompanying schedules and

statements) has been examined by me and to the best of my knowledge and belief is a true, correct and complete return.

If the return is prepared by a person other than the taxpayer, his declaration is based on all the information relating to

the matters required to be reported in the return of which he has any knowledge.

Warning: Do not use any other taxpayer’s return as this will result in improper credit.

Date

Authorized Signature

Review By

(Office Use Only)

Business Location

Address Correction

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1