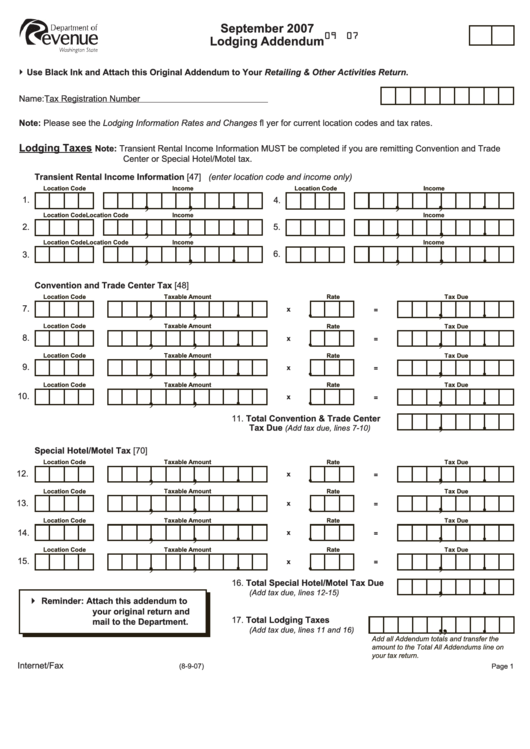

September 2007 Lodging Addendum Form

ADVERTISEMENT

September 2007

09 07

Lodging Addendum

Use Black Ink and Attach this Original Addendum to Your Retailing & Other Activities Return.

Name:

Tax Registration Number

Note: Please see the Lodging Information Rates and Changes fl yer for current location codes and tax rates.

Lodging Taxes

Note: Transient Rental Income Information MUST be completed if you are remitting Convention and Trade

Center or Special Hotel/Motel tax.

Transient Rental Income Information [47] (enter location code and income only)

Location Code

Income

Location Code

Income

,

.

,

,

,

.

1.

4.

Location Code

Income

Location Code

Income

,

,

.

,

.

,

2.

5.

Location Code

Income

Location Code

Income

,

.

,

.

,

,

6.

3.

Convention and Trade Center Tax [48]

Location Code

Taxable Amount

Rate

Tax Due

,

.

,

.

,

.

7.

x

=

Location Code

Taxable Amount

Rate

Tax Due

,

,

.

.

.

,

8.

x

=

Location Code

Taxable Amount

Rate

Tax Due

,

,

.

.

.

,

9.

x

=

Location Code

Taxable Amount

Rate

Tax Due

,

,

,

.

.

.

10.

x

=

11. Total Convention & Trade Center

,

.

Tax Due

(Add tax due, lines 7-10)

Special Hotel/Motel Tax [70]

Location Code

Taxable Amount

Rate

Tax Due

,

,

.

.

.

,

12.

x

=

Location Code

Taxable Amount

Rate

Tax Due

,

,

,

.

.

.

13.

x

=

Location Code

Taxable Amount

Rate

Tax Due

,

.

,

.

,

.

14.

x

=

Location Code

Taxable Amount

Rate

Tax Due

,

,

.

.

.

,

15.

x

=

16. Total Special Hotel/Motel Tax Due

,

.

(Add tax due, lines 12-15)

Reminder: Attach this addendum to

your original return and

17. Total Lodging Taxes

,

,

mail to the Department.

.

(Add tax due, lines 11 and 16)

Add all Addendum totals and transfer the

amount to the Total All Addendums line on

your tax return.

Internet/Fax

(8-9-07)

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24