Bank Draft Information And Application Form For Participation In The Automatic Bank Draft Program

ADVERTISEMENT

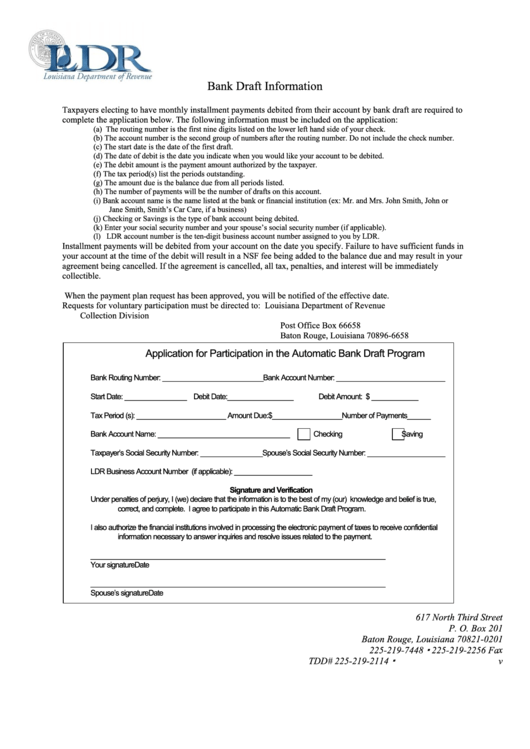

Bank Draft Information

Taxpayers electing to have monthly installment payments debited from their account by bank draft are required to

complete the application below. The following information must be included on the application:

(a) The routing number is the first nine digits listed on the lower left hand side of your check.

(b) The account number is the second group of numbers after the routing number. Do not include the check number.

(c) The start date is the date of the first draft.

(d) The date of debit is the date you indicate when you would like your account to be debited.

(e) The debit amount is the payment amount authorized by the taxpayer.

(f) The tax period(s) list the periods outstanding.

(g) The amount due is the balance due from all periods listed.

(h) The number of payments will be the number of drafts on this account.

(i)

Bank account name is the name listed at the bank or financial institution (ex: Mr. and Mrs. John Smith, John or

Jane Smith, Smith’s Car Care, if a business)

(j)

Checking or Savings is the type of bank account being debited.

(k) Enter your social security number and your spouse’s social security number (if applicable).

(l) LDR account number is the ten-digit business account number assigned to you by LDR.

Installment payments will be debited from your account on the date you specify. Failure to have sufficient funds in

your account at the time of the debit will result in a NSF fee being added to the balance due and may result in your

agreement being cancelled. If the agreement is cancelled, all tax, penalties, and interest will be immediately

collectible.

When the payment plan request has been approved, you will be notified of the effective date.

Requests for voluntary participation must be directed to: Louisiana Department of Revenue

Collection Division

Post Office Box 66658

Baton Rouge, Louisiana 70896-6658

Application for Participation in the Automatic Bank Draft Program

Bank Routing Number: __________________________Bank Account Number: ____________________________

Start Date: ________________

Debit Date:_________________

Debit Amount: $ ____________

Tax Period (s): _______________________ Amount Due:$__________________Number of Payments______

Bank Account Name: __________________________________

Checking

Saving

Taxpayer’s Social Security Number: ________________Spouse’s Social Security Number: ____________________

LDR Business Account Number (if applicable): ____________________

Signature and Verification

Under penalties of perjury, I (we) declare that the information is to the best of my (our) knowledge and belief is true,

correct, and complete. I agree to participate in this Automatic Bank Draft Program.

I also authorize the financial institutions involved in processing the electronic payment of taxes to receive confidential

information necessary to answer inquiries and resolve issues related to the payment.

____________________________________________________________________________

Your signature

Date

____________________________________________________________________________

Spouse’s signature

Date

617 North Third Street

P. O. Box 201

Baton Rouge, Louisiana 70821-0201

225-219-7448 225-219-2256 Fax

TDD# 225-219-2114

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1