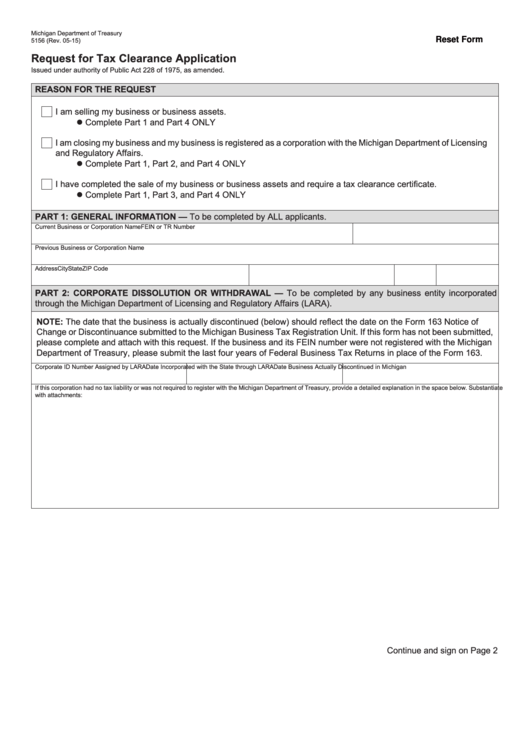

Michigan Department of Treasury

Reset Form

5156 (Rev. 05-15)

Request for Tax Clearance Application

Issued under authority of Public Act 228 of 1975, as amended.

ReAson foR The RequesT

I am selling my business or business assets.

l Complete Part 1 and Part 4 ONLY

I am closing my business and my business is registered as a corporation with the Michigan Department of Licensing

and Regulatory Affairs.

l Complete Part 1, Part 2, and Part 4 ONLY

I have completed the sale of my business or business assets and require a tax clearance certificate.

l Complete Part 1, Part 3, and Part 4 ONLY

PART 1: GeneRAl InfoRmATIon — To be completed by ALL applicants.

Current Business or Corporation Name

FEIN or TR Number

Previous Business or Corporation Name

Address

City

State

ZIP Code

PART 2: CoRPoRATe DIssoluTIon oR WIThDRAWAl — To be completed by any business entity incorporated

through the Michigan Department of Licensing and Regulatory Affairs (LARA).

noTe: The date that the business is actually discontinued (below) should reflect the date on the Form 163 Notice of

Change or Discontinuance submitted to the Michigan Business Tax Registration Unit. If this form has not been submitted,

please complete and attach with this request. If the business and its FEIN number were not registered with the Michigan

Department of Treasury, please submit the last four years of Federal Business Tax Returns in place of the Form 163.

Corporate ID Number Assigned by LARA

Date Incorporated with the State through LARA

Date Business Actually Discontinued in Michigan

If this corporation had no tax liability or was not required to register with the Michigan Department of Treasury, provide a detailed explanation in the space below. Substantiate

with attachments:

Continue and sign on Page 2

1

1 2

2