Direct Deposit Authorization Form

ADVERTISEMENT

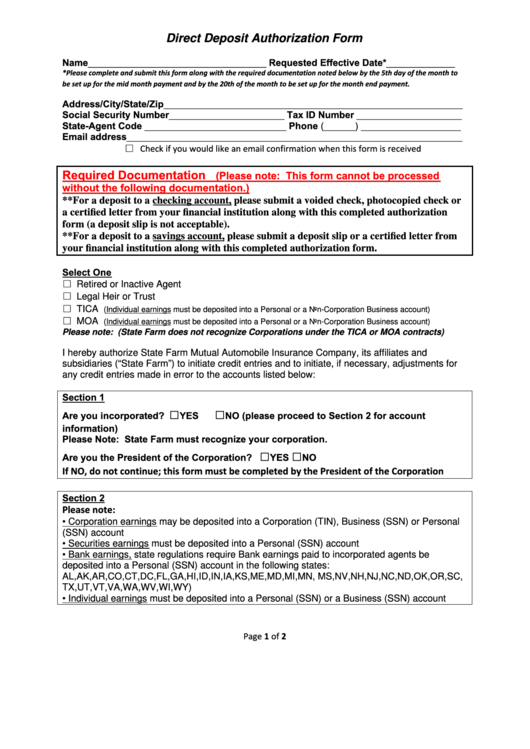

Direct Deposit Authorization Form

Name__________________________________ Requested Effective Date*_____________

*Please complete and submit this form along with the required documentation noted below by the 5th day of the month to

be set up for the mid month payment and by the 20th of the month to be set up for the month end payment.

Address/City/State/Zip_________________________________________________________

Social Security Number______________________ Tax ID Number ____________________

State-Agent Code ___________________________ Phone (______) ___________________

Email address________________________________________________________________

□ Check if you would like an email confirmation when this form is received

Required Documentation

(Please note: This form cannot be processed

without the following documentation.)

**For a deposit to a checking account, please submit a voided check, photocopied check or

a certified letter from your financial institution along with this completed authorization

form (a deposit slip is not acceptable).

**For a deposit to a savings account, please submit a deposit slip or a certified letter from

your financial institution along with this completed authorization form.

Select One

□ Retired or Inactive Agent

□ Legal Heir or Trust

□ TICA

(Individual earnings must be deposited into a Personal or a Non-Corporation Business account)

□ MOA

(Individual earnings must be deposited into a Personal or a Non-Corporation Business account)

Please note: (State Farm does not recognize Corporations under the TICA or MOA contracts)

I hereby authorize State Farm Mutual Automobile Insurance Company, its affiliates and

subsidiaries (“State Farm”) to initiate credit entries and to initiate, if necessary, adjustments for

any credit entries made in error to the accounts listed below:

Section 1

□

□

Are you incorporated?

YES

NO (please proceed to Section 2 for account

information)

Please Note: State Farm must recognize your corporation.

□

□

Are you the President of the Corporation?

YES

NO

If NO, do not continue; this form must be completed by the President of the Corporation

Section 2

Please note:

• Corporation earnings may be deposited into a Corporation (TIN), Business (SSN) or Personal

(SSN) account

• Securities earnings must be deposited into a Personal (SSN) account

• Bank earnings, state regulations require Bank earnings paid to incorporated agents be

deposited into a Personal (SSN) account in the following states:

AL,AK,AR,CO,CT,DC,FL,GA,HI,ID,IN,IA,KS,ME,MD,MI,MN, MS,NV,NH,NJ,NC,ND,OK,OR,SC,

TX,UT,VT,VA,WA,WV,WI,WY)

• Individual earnings must be deposited into a Personal (SSN) or a Business (SSN) account

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2