Instructions For Form D-40ez - Tax Returns - Office Of Tax And Revenue

ADVERTISEMENT

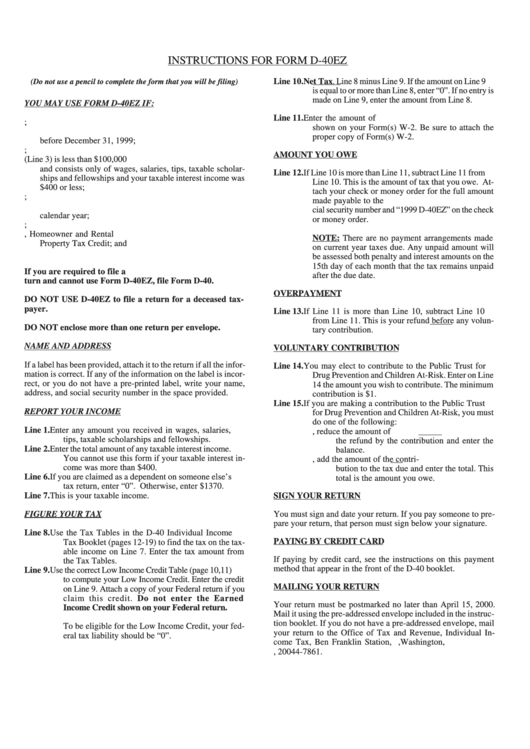

INSTRUCTIONS FOR FORM D-40EZ

Line 10.

Net Tax. Line 8 minus Line 9. If the amount on Line 9

(Do not use a pencil to complete the form that you will be filing)

is equal to or more than Line 8, enter “0”. If no entry is

made on Line 9, enter the amount from Line 8.

YOU MAY USE FORM D-40EZ IF:

Line 11.

Enter the amount of D.C. Income Tax withheld as

1.

Your filing status is single;

shown on your Form(s) W-2. Be sure to attach the

2.

You were under the age of 65 and not legally blind on or

proper copy of Form(s) W-2.

before December 31, 1999;

3.

You do not claim any dependents;

AMOUNT YOU OWE

4.

Your Adjusted Gross Income (Line 3) is less than $100,000

and consists only of wages, salaries, tips, taxable scholar-

Line 12.

If Line 10 is more than Line 11, subtract Line 11 from

ships and fellowships and your taxable interest income was

Line 10. This is the amount of tax that you owe. At-

$400 or less;

tach your check or money order for the full amount

5.

You have no adjustments to income;

made payable to the D.C. Treasurer. Write your so-

6.

You were a resident of the District of Columbia for the full

cial security number and “1999 D-40EZ” on the check

calendar year;

or money order.

7.

You do not itemize your deductions;

8.

You are not filing a Schedule H, Homeowner and Rental

NOTE: There are no payment arrangements made

Property Tax Credit; and

on current year taxes due. Any unpaid amount will

9.

You do not pay estimated tax.

be assessed both penalty and interest amounts on the

15th day of each month that the tax remains unpaid

If you are required to file a D.C. Individual Income Tax re-

after the due date.

turn and cannot use Form D-40EZ, file Form D-40.

OVERPAYMENT

DO NOT USE D-40EZ to file a return for a deceased tax-

payer.

Line 13.

If Line 11 is more than Line 10, subtract Line 10

from Line 11. This is your refund before any volun-

DO NOT enclose more than one return per envelope.

tary contribution.

NAME AND ADDRESS

VOLUNTARY CONTRIBUTION

If a label has been provided, attach it to the return if all the infor-

Line 14.

You may elect to contribute to the Public Trust for

mation is correct. If any of the information on the label is incor-

Drug Prevention and Children At-Risk. Enter on Line

rect, or you do not have a pre-printed label, write your name,

14 the amount you wish to contribute. The minimum

address, and social security number in the space provided.

contribution is $1.

Line 15.

If you are making a contribution to the Public Trust

REPORT YOUR INCOME

for Drug Prevention and Children At-Risk, you must

do one of the following:

Line 1.

Enter any amount you received in wages, salaries,

a.

If you are due a refund, reduce the amount of

tips, taxable scholarships and fellowships.

the refund by the contribution and enter the

Line 2.

Enter the total amount of any taxable interest income.

balance.

You cannot use this form if your taxable interest in-

b.

If you owe tax, add the amount of the contri-

come was more than $400.

bution to the tax due and enter the total. This

Line 6.

If you are claimed as a dependent on someone else’s

total is the amount you owe.

tax return, enter “0”. Otherwise, enter $1370.

Line 7.

This is your taxable income.

SIGN YOUR RETURN

You must sign and date your return. If you pay someone to pre-

FIGURE YOUR TAX

pare your return, that person must sign below your signature.

Line 8.

Use the Tax Tables in the D-40 Individual Income

PAYING BY CREDIT CARD

Tax Booklet (pages 12-19) to find the tax on the tax-

able income on Line 7. Enter the tax amount from

If paying by credit card, see the instructions on this payment

the Tax Tables.

method that appear in the front of the D-40 booklet.

Line 9.

Use the correct Low Income Credit Table (page 10,11)

to compute your Low Income Credit. Enter the credit

MAILING YOUR RETURN

on Line 9. Attach a copy of your Federal return if you

claim this credit. Do not enter the Earned

Your return must be postmarked no later than April 15, 2000.

Income Credit shown on your Federal return.

Mail it using the pre-addressed envelope included in the instruc-

tion booklet. If you do not have a pre-addressed envelope, mail

To be eligible for the Low Income Credit, your fed-

your return to the Office of Tax and Revenue, Individual In-

eral tax liability should be “0”.

come Tax, Ben Franklin Station, P.O. Box 7861,Washington,

D.C., 20044-7861.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1