Instructions For Form 10 - Nebraska And Local Sales And Use Tax Return - Nebraska Department Of Revenue

ADVERTISEMENT

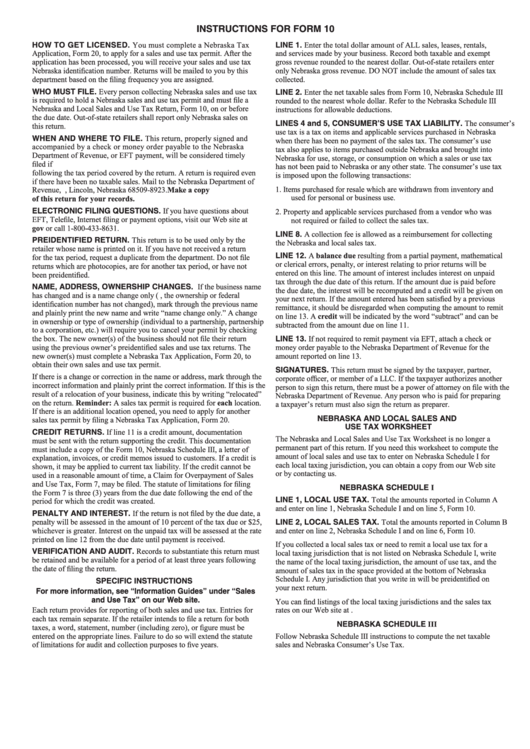

INSTRUCTIONS FOR FORM 10

HOW TO GET LICENSED. You must complete a Nebraska Tax

LINE 1. Enter the total dollar amount of ALL sales, leases, rentals,

Application, Form 20, to apply for a sales and use tax permit. After the

and services made by your business. Record both taxable and exempt

application has been processed, you will receive your sales and use tax

gross revenue rounded to the nearest dollar. Out-of-state retailers enter

Nebraska identification number. Returns will be mailed to you by this

only Nebraska gross revenue. DO NOT include the amount of sales tax

department based on the filing frequency you are assigned.

collected.

WHO MUST FILE. Every person collecting Nebraska sales and use tax

LINE 2. Enter the net taxable sales from Form 10, Nebraska Schedule III

is required to hold a Nebraska sales and use tax permit and must file a

rounded to the nearest whole dollar. Refer to the Nebraska Schedule III

Nebraska and Local Sales and Use Tax Return, Form 10, on or before

instructions for allowable deductions.

the due date. Out-of-state retailers shall report only Nebraska sales on

LINES 4 and 5, CONSUMER’S USETAX LIABILITY. The consumer’s

this return.

use tax is a tax on items and applicable services purchased in Nebraska

WHEN AND WHERE TO FILE. This return, properly signed and

when there has been no payment of the sales tax. The consumer’s use

accompanied by a check or money order payable to the Nebraska

tax also applies to items purchased outside Nebraska and brought into

Department of Revenue, or EFT payment, will be considered timely

Nebraska for use, storage, or consumption on which a sales or use tax

filed if U.S. postmarked on or before the twenty-fifth day of the month

has not been paid to Nebraska or any other state. The consumer’s use tax

following the tax period covered by the return. A return is required even

is imposed upon the following transactions:

if there have been no taxable sales. Mail to the Nebraska Department of

1.

Items purchased for resale which are withdrawn from inventory and

Revenue, P.O. Box 98923, Lincoln, Nebraska 68509-8923. Make a copy

used for personal or business use.

of this return for your records.

ELECTRONIC FILING QUESTIONS. If you have questions about

2.

Property and applicable services purchased from a vendor who was

EFT, Telefile, Internet filing or payment options, visit our Web site at

not required or failed to collect the sales tax.

or call 1-800-433-8631.

LINE 8. A collection fee is allowed as a reimbursement for collecting

PREIDENTIFIED RETURN. This return is to be used only by the

the Nebraska and local sales tax.

retailer whose name is printed on it. If you have not received a return

LINE 12. A balance due resulting from a partial payment, mathematical

for the tax period, request a duplicate from the department. Do not file

or clerical errors, penalty, or interest relating to prior returns will be

returns which are photocopies, are for another tax period, or have not

entered on this line. The amount of interest includes interest on unpaid

been preidentified.

tax through the due date of this return. If the amount due is paid before

NAME, ADDRESS, OWNERSHIP CHANGES. If the business name

the due date, the interest will be recomputed and a credit will be given on

has changed and is a name change only (i.e., the ownership or federal

your next return. If the amount entered has been satisfied by a previous

identification number has not changed), mark through the previous name

remittance, it should be disregarded when computing the amount to remit

and plainly print the new name and write “name change only.” A change

on line 13. A credit will be indicated by the word “subtract” and can be

in ownership or type of ownership (individual to a partnership, partnership

subtracted from the amount due on line 11.

to a corporation, etc.) will require you to cancel your permit by checking

the box. The new owner(s) of the business should not file their return

LINE 13. If not required to remit payment via EFT, attach a check or

using the previous owner’s preidentified sales and use tax returns. The

money order payable to the Nebraska Department of Revenue for the

new owner(s) must complete a Nebraska Tax Application, Form 20, to

amount reported on line 13.

obtain their own sales and use tax permit.

SIGNATURES. This return must be signed by the taxpayer, partner,

If there is a change or correction in the name or address, mark through the

corporate officer, or member of a LLC. If the taxpayer authorizes another

incorrect information and plainly print the correct information. If this is the

person to sign this return, there must be a power of attorney on file with the

result of a relocation of your business, indicate this by writing “relocated”

Nebraska Department of Revenue. Any person who is paid for preparing

on the return. Reminder: A sales tax permit is required for each location.

a taxpayer’s return must also sign the return as preparer.

If there is an additional location opened, you need to apply for another

NEBRASKA AND LOCAL SALES AND

sales tax permit by filing a Nebraska Tax Application, Form 20.

USE TAX WORKSHEET

CREDIT RETURNS. If line 11 is a credit amount, documentation

The Nebraska and Local Sales and Use Tax Worksheet is no longer a

must be sent with the return supporting the credit. This documentation

permanent part of this return. If you need this worksheet to compute the

must include a copy of the Form 10, Nebraska Schedule III, a letter of

amount of local sales and use tax to enter on Nebraska Schedule I for

explanation, invoices, or credit memos issued to customers. If a credit is

each local taxing jurisdiction, you can obtain a copy from our Web site

shown, it may be applied to current tax liability. If the credit cannot be

or by contacting us.

used in a reasonable amount of time, a Claim for Overpayment of Sales

and Use Tax, Form 7, may be filed. The statute of limitations for filing

NEBRASKA SCHEDULE I

the Form 7 is three (3) years from the due date following the end of the

LINE 1, LOCAL USE TAX. Total the amounts reported in Column A

period for which the credit was created.

and enter on line 1, Nebraska Schedule I and on line 5, Form 10.

PENALTY AND INTEREST. If the return is not filed by the due date, a

penalty will be assessed in the amount of 10 percent of the tax due or $25,

LINE 2, LOCAL SALES TAX. Total the amounts reported in Column B

whichever is greater. Interest on the unpaid tax will be assessed at the rate

and enter on line 2, Nebraska Schedule I and on line 6, Form 10.

printed on line 12 from the due date until payment is received.

If you collected a local sales tax or need to remit a local use tax for a

VERIFICATION AND AUDIT. Records to substantiate this return must

local taxing jurisdiction that is not listed on Nebraska Schedule I, write

be retained and be available for a period of at least three years following

the name of the local taxing jurisdiction, the amount of use tax, and the

the date of filing the return.

amount of sales tax in the space provided at the bottom of Nebraska

Schedule I. Any jurisdiction that you write in will be preidentified on

SPECIFIC INSTRUCTIONS

your next return.

For more information, see “Information Guides” under “Sales

and Use Tax” on our Web site.

You can find listings of the local taxing jurisdictions and the sales tax

rates on our Web site at .

Each return provides for reporting of both sales and use tax. Entries for

each tax remain separate. If the retailer intends to file a return for both

NEBRASKA SCHEDULE III

taxes, a word, statement, number (including zero), or figure must be

entered on the appropriate lines. Failure to do so will extend the statute

Follow Nebraska Schedule III instructions to compute the net taxable

of limitations for audit and collection purposes to five years.

sales and Nebraska Consumer’s Use Tax.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1