Form Cg-6 - Resident Agent Cigarette Tax Report

ADVERTISEMENT

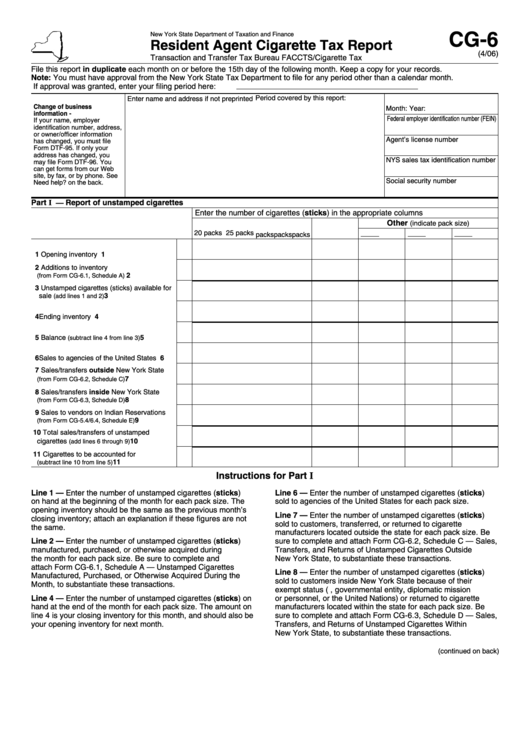

CG-6

New York State Department of Taxation and Finance

Resident Agent Cigarette Tax Report

(4/06)

Transaction and Transfer Tax Bureau FACCTS/Cigarette Tax

File this report in duplicate each month on or before the 15th day of the following month. Keep a copy for your records.

Note: You must have approval from the New York State Tax Department to file for any period other than a calendar month.

If approval was granted, enter your filing period here:

Period covered by this report:

Enter name and address if not preprinted

Change of business

Month:

Year:

information -

Federal employer identification number (FEIN)

If your name, employer

identification number, address,

or owner/officer information

Agent’s license number

has changed, you must file

Form DTF‑95. If only your

address has changed, you

NYS sales tax identification number

may file Form DTF‑96. You

can get forms from our Web

site, by fax, or by phone. See

Social security number

Need help? on the back.

Part I — Report of unstamped cigarettes

Enter the number of cigarettes (sticks) in the appropriate columns

Other

(indicate pack size)

20 packs

25 packs

packs

packs

packs

1 Opening inventory .......................................

1

2 Additions to inventory

..................

2

(from Form CG-6.1, Schedule A)

3 Unstamped cigarettes (sticks) available for

3

sale

..............................

(add lines 1 and 2)

4 Ending inventory .........................................

4

5 Balance

................

5

(subtract line 4 from line 3)

6 Sales to agencies of the United States .......

6

7 Sales/transfers outside New York State

..................

7

(from Form CG-6.2, Schedule C)

8 Sales/transfers inside New York State

8

..................

(from Form CG-6.3, Schedule D)

9 Sales to vendors on Indian Reservations

.............

9

(from Form CG-5.4/6.4, Schedule E)

10 Total sales/transfers of unstamped

cigarettes

................ 10

(add lines 6 through 9)

11 Cigarettes to be accounted for

......................... 11

(subtract line 10 from line 5)

Instructions for Part I

Line 1 — Enter the number of unstamped cigarettes (sticks)

Line 6 — Enter the number of unstamped cigarettes (sticks)

on hand at the beginning of the month for each pack size. The

sold to agencies of the United States for each pack size.

opening inventory should be the same as the previous month’s

Line 7 — Enter the number of unstamped cigarettes (sticks)

closing inventory; attach an explanation if these figures are not

sold to customers, transferred, or returned to cigarette

the same.

manufacturers located outside the state for each pack size. Be

Line 2 — Enter the number of unstamped cigarettes (sticks)

sure to complete and attach Form CG‑6.2, Schedule C — Sales,

manufactured, purchased, or otherwise acquired during

Transfers, and Returns of Unstamped Cigarettes Outside

the month for each pack size. Be sure to complete and

New York State, to substantiate these transactions.

attach Form CG‑6.1, Schedule A — Unstamped Cigarettes

Line 8 — Enter the number of unstamped cigarettes (sticks)

Manufactured, Purchased, or Otherwise Acquired During the

sold to customers inside New York State because of their

Month, to substantiate these transactions.

exempt status (e.g., governmental entity, diplomatic mission

Line 4 — Enter the number of unstamped cigarettes (sticks) on

or personnel, or the United Nations) or returned to cigarette

hand at the end of the month for each pack size. The amount on

manufacturers located within the state for each pack size. Be

line 4 is your closing inventory for this month, and should also be

sure to complete and attach Form CG‑6.3, Schedule D — Sales,

your opening inventory for next month.

Transfers, and Returns of Unstamped Cigarettes Within

New York State, to substantiate these transactions.

(continued on back)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2