Form 7577022 - Instructions For Preparing The Vehicle Fuel Tax Return - 7577

ADVERTISEMENT

B

ACCOUNT NUMBER

.,..., . . . . . -

, . . . . . . . . H . . , . ,

. .

•

, . . , . . . . . . . H . . , . .

: . . . H .

_ . . . - . . : .

,,.

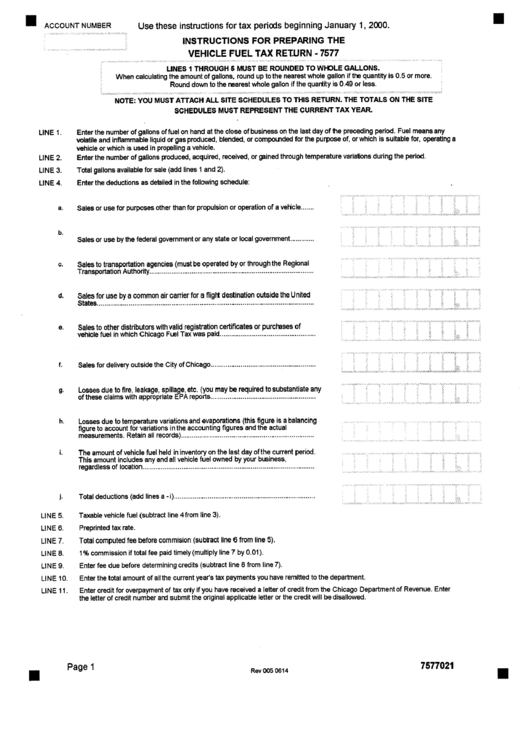

Use these instructions for tax periods beginning January 1, 2000.

INSTRUCTIONS FOR PREPARING THE

VEHICLE FUEL TAX RETURN - 7577

LINES 1 THROUGH 5 MUST BE ROUNDED TO WHOLE GALLONS.

When calculating the amount of gallons, round up to the nearest whole gallon if the quantity is 0.5 or more.

Round down to the nearest whole gallon if the quantity is 0.49 or less.

NOTE: YOU MUST ATTACH ALL SITE SCHEDULES TO THIS RETURN. THE TOTALS ON THE SITE

SCHEDULES MUST REPRESENT THE CURRENT TAX YEAR.

LINE 1.

LINE 2.

LINE 3.

LINE 4.

a .

Enter the number of gallons of fuel on hand at the close of business on the last day of me preceding period. Fuel means any

volatile and inflammable liquid or gas produced, blended, or compounded for the purpose of, orwhich is suitable for, operating a

vehicle or which is used in propelling a vehicle.

Enter the number of gallons produced, acquired, received, or gained through temperature varia~ons during the period.

Total gallons available for sale (add lines 1 and 2).

Enter the deductions as detailed in the following schedule:

_ H _ : . . . _ .

_ . . . . . _ . .

. . . . . . .

. . -

. . . . : . . . . H , . . . . . . . . . . .

_ .

_ . . , . . . . . ,

. . . . . . - . . . . . . . . ,

. H . . .

Sales or use for purposes other than for propulsion or operation of a veticle .......

............ ~ ............. ~i ! ~ .............................................................. ........................ :::;::; ....................

Sales or use by the federal government or any state or local government

. . . . . . . . . . . . .

Sales to transportation agencies (must be operated by or throughthe Regional

Transportation Authority

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Sales for use by a common air carrier for a flight destination outside the United

States

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

i ....... i ........ i

.................

............... !

...............

i

............................

:,,........,.::,

. . . . . . . : . . , . : . . . . . , . . : . . , . . . , . , . , : , . . , , . . . . . : . . . , . , , . . . : . . . , , . . . , . . , . . : . . . , . , , , ; ; ; : ; ; . , . . . , , . . : : . . . . . . . . . . : :

e .

Sales to other distributors with valid registration certificates or purchases of

vehicle fuel in which Chicago Fuel Tax was paid

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

f.

Sales for delivery outside the City of Chicago

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

g.

Losses due to fire, leakage, spillage, etc. (you may be required to substantiate any

of these claims with appropriate EPA reports ........................................................

.

.

.

.

.

.

.

.

h.

Losses due to temperature variations and evaporations (this figure is a balancing

figure to account for variations inthe accounting figures and the actual

measurements. Retain all records)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

The amount of vehicle fuel held in inventory on the last day of the current period.

This amount includes any and all vehicle fuel owned by your business,

regardless of location

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

!!

ii ii

i!

J .

LINE 5.

LINE 6.

LINE 7.

LINE 8.

LINE 9.

LINE 10.

LINE 11.

Total deductions (add lines a - i)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Taxable vehicle fuel (subtract line 4from line 3).

Preprinted tax rate.

Total computed fee before commision (subtract line 6 from line 5).

1% commission if total fee paid timely (multiply line 7 by 0.01 ).

Enter fee due before determining credits (subtract line 8 from line 7).

Enter the total amount of all the currant year's tax payments you have remitted to the department.

Enter credit for overpayment of tax only if you have received a letter of credit from the Chicago Department of Revenue. Enter

the letter of credit number and submit the original applicable letter or the credit will be disallowed.

II

Page 1

Rev 005 0614

7577021

II

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2