Instructions For Form Ct-8508 - Request For Waiver From Filing Informational Returns On Magnetic Media - State Of Connecticut Department Of Revenue Services

ADVERTISEMENT

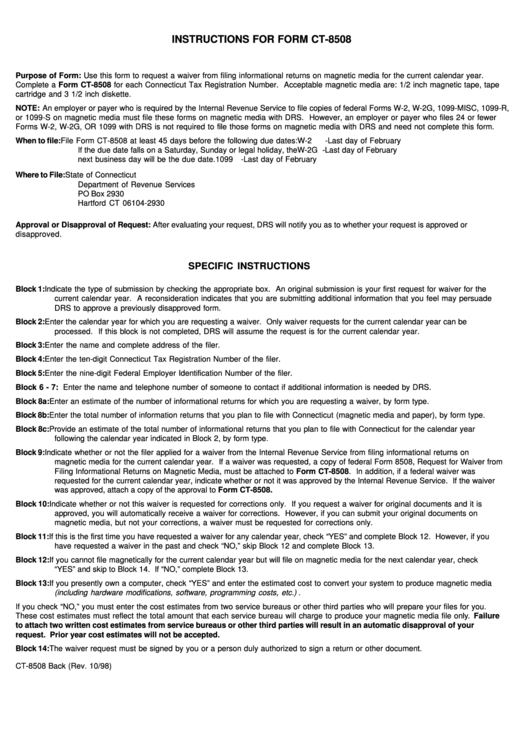

INSTRUCTIONS FOR FORM CT-8508

Purpose of Form: Use this form to request a waiver from filing informational returns on magnetic media for the current calendar year.

Complete a Form CT-8508 for each Connecticut Tax Registration Number. Acceptable magnetic media are: 1/2 inch magnetic tape, tape

cartridge and 3 1/2 inch diskette.

NOTE: An employer or payer who is required by the Internal Revenue Service to file copies of federal Forms W-2, W-2G, 1099-MISC, 1099-R,

or 1099-S on magnetic media must file these forms on magnetic media with DRS. However, an employer or payer who files 24 or fewer

Forms W-2, W-2G, OR 1099 with DRS is not required to file those forms on magnetic media with DRS and need not complete this form.

When to file:

File Form CT-8508 at least 45 days before the following due dates:

W-2

- Last day of February

If the due date falls on a Saturday, Sunday or legal holiday, the

W-2G - Last day of February

next business day will be the due date.

1099 - Last day of February

Where to File:

State of Connecticut

Department of Revenue Services

PO Box 2930

Hartford CT 06104-2930

Approval or Disapproval of Request: After evaluating your request, DRS will notify you as to whether your request is approved or

disapproved.

SPECIFIC INSTRUCTIONS

Block 1:

Indicate the type of submission by checking the appropriate box. An original submission is your first request for waiver for the

current calendar year. A reconsideration indicates that you are submitting additional information that you feel may persuade

DRS to approve a previously disapproved form.

Block 2:

Enter the calendar year for which you are requesting a waiver. Only waiver requests for the current calendar year can be

processed. If this block is not completed, DRS will assume the request is for the current calendar year.

Block 3:

Enter the name and complete address of the filer.

Block 4:

Enter the ten-digit Connecticut Tax Registration Number of the filer.

Block 5:

Enter the nine-digit Federal Employer Identification Number of the filer.

Block 6 - 7: Enter the name and telephone number of someone to contact if additional information is needed by DRS.

Block 8a: Enter an estimate of the number of informational returns for which you are requesting a waiver, by form type.

Block 8b: Enter the total number of information returns that you plan to file with Connecticut (magnetic media and paper), by form type.

Block 8c: Provide an estimate of the total number of informational returns that you plan to file with Connecticut for the calendar year

following the calendar year indicated in Block 2, by form type.

Block 9:

Indicate whether or not the filer applied for a waiver from the Internal Revenue Service from filing informational returns on

magnetic media for the current calendar year. If a waiver was requested, a copy of federal Form 8508, Request for Waiver from

Filing Informational Returns on Magnetic Media, must be attached to Form CT-8508. In addition, if a federal waiver was

requested for the current calendar year, indicate whether or not it was approved by the Internal Revenue Service. If the waiver

was approved, attach a copy of the approval to Form CT-8508.

Block 10: Indicate whether or not this waiver is requested for corrections only. If you request a waiver for original documents and it is

approved, you will automatically receive a waiver for corrections. However, if you can submit your original documents on

magnetic media, but not your corrections, a waiver must be requested for corrections only.

Block 11: If this is the first time you have requested a waiver for any calendar year, check “YES” and complete Block 12. However, if you

have requested a waiver in the past and check “NO,” skip Block 12 and complete Block 13.

Block 12: If you cannot file magnetically for the current calendar year but will file on magnetic media for the next calendar year, check

“YES” and skip to Block 14. If “NO,” complete Block 13.

Block 13: If you presently own a computer, check “YES” and enter the estimated cost to convert your system to produce magnetic media

(including hardware modifications, software, programming costs, etc.) .

If you check “NO,” you must enter the cost estimates from two service bureaus or other third parties who will prepare your files for you.

These cost estimates must reflect the total amount that each service bureau will charge to produce your magnetic media file only. Failure

to attach two written cost estimates from service bureaus or other third parties will result in an automatic disapproval of your

request. Prior year cost estimates will not be accepted.

Block 14: The waiver request must be signed by you or a person duly authorized to sign a return or other document.

CT-8508 Back (Rev. 10/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1