Form 718-U - Residential And Commercial Utility Services - State Of New York

ADVERTISEMENT

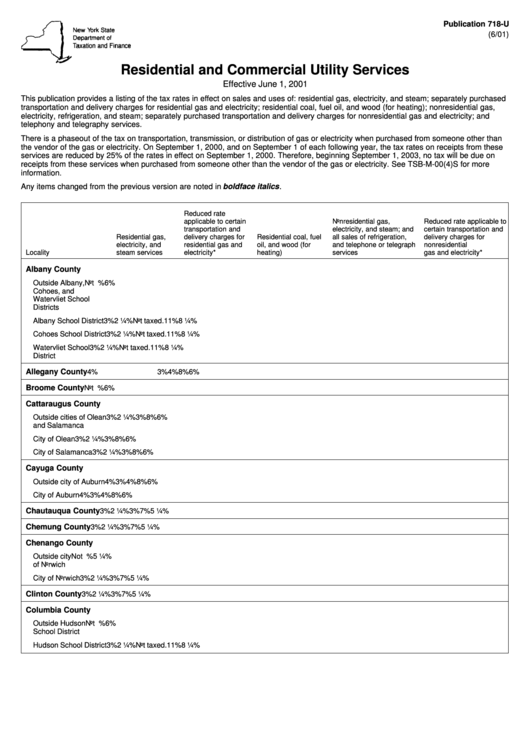

Publication 718-U

(6/01)

Residential and Commercial Utility Services

Effective June 1, 2001

This publication provides a listing of the tax rates in effect on sales and uses of: residential gas, electricity, and steam; separately purchased

transportation and delivery charges for residential gas and electricity; residential coal, fuel oil, and wood (for heating); nonresidential gas,

electricity, refrigeration, and steam; separately purchased transportation and delivery charges for nonresidential gas and electricity; and

telephony and telegraphy services.

There is a phaseout of the tax on transportation, transmission, or distribution of gas or electricity when purchased from someone other than

the vendor of the gas or electricity. On September 1, 2000, and on September 1 of each following year, the tax rates on receipts from these

services are reduced by 25% of the rates in effect on September 1, 2000. Therefore, beginning September 1, 2003, no tax will be due on

receipts from these services when purchased from someone other than the vendor of the gas or electricity. See TSB-M-00(4)S for more

information.

Any items changed from the previous version are noted in boldface italics .

Reduced rate

applicable to certain

Nonresidential gas,

Reduced rate applicable to

transportation and

electricity, and steam; and

certain transportation and

Residential gas,

delivery charges for

Residential coal, fuel

all sales of refrigeration,

delivery charges for

electricity, and

residential gas and

oil, and wood (for

and telephone or telegraph

nonresidential

Locality

steam services

electricity*

heating)

services

gas and electricity*

Albany County

Outside Albany,

Not taxed.

Not taxed.

Not taxed.

8%

6%

Cohoes, and

Watervliet School

Districts

Albany School District

3%

2 ¼%

Not taxed.

11%

8 ¼%

Cohoes School District 3%

2 ¼%

Not taxed.

11%

8 ¼%

Watervliet School

3%

2 ¼%

Not taxed.

11%

8 ¼%

District

Allegany County

4%

3%

4%

8%

6%

Broome County

Not taxed.

Not taxed.

Not taxed.

8%

6%

Cattaraugus County

Outside cities of Olean 3%

2 ¼%

3%

8%

6%

and Salamanca

City of Olean

3%

2 ¼%

3%

8%

6%

City of Salamanca

3%

2 ¼%

3%

8%

6%

Cayuga County

Outside city of Auburn

4%

3%

4%

8%

6%

City of Auburn

4%

3%

4%

8%

6%

Chautauqua County

3%

2 ¼%

3%

7%

5 ¼%

Chemung County

3%

2 ¼%

3%

7%

5 ¼%

Chenango County

Outside city

Not taxed.

Not taxed.

Not taxed.

7%

5 ¼%

of Norwich

City of Norwich

3%

2 ¼%

3%

7%

5 ¼%

Clinton County

3%

2 ¼%

3%

7%

5 ¼%

Columbia County

Outside Hudson

Not taxed.

Not taxed.

Not taxed.

8%

6%

School District

Hudson School District 3%

2 ¼%

Not taxed.

11%

8 ¼%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5