RESET

PRINT

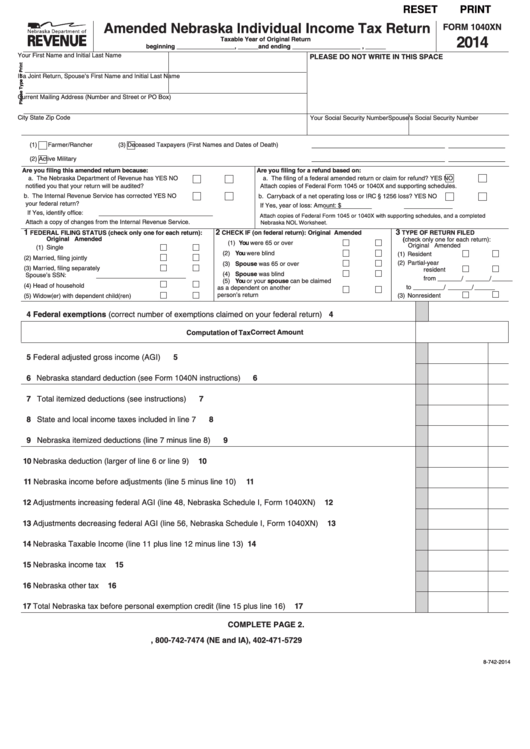

Amended Nebraska Individual Income Tax Return

FORM 1040XN

2014

Taxable Year of Original Return

beginning _________________, ______and ending ____________________ , ______

Your First Name and Initial

Last Name

PLEASE DO NOT WRITE IN THIS SPACE

If a Joint Return, Spouse’s First Name and Initial

Last Name

Current Mailing Address (Number and Street or PO Box)

City

State

Zip Code

Your Social Security Number

Spouse’s Social Security Number

(1)

Farmer/Rancher

(3)

Deceased Taxpayers (First Names and Dates of Death)

(2)

Active Military

Are you filing this amended return because:

Are you filing for a refund based on:

a . The Nebraska Department of Revenue has

YES

NO

a . The filing of a federal amended return or claim for refund?

YES

NO

notified you that your return will be audited?

Attach copies of Federal Form 1045 or 1040X and supporting schedules .

b . The Internal Revenue Service has corrected

YES

NO

b . Carryback of a net operating loss or IRC § 1256 loss?

YES

NO

your federal return?

If Yes, year of loss:

Amount: $

If Yes, identify office:

Attach copies of Federal Form 1045 or 1040X with supporting schedules, and a completed

Attach a copy of changes from the Internal Revenue Service .

Nebraska NOL Worksheet .

2

3

1

CHECK IF (on federal return):

Original Amended

TYPE OF RETURN FILED

FEDERAL FILING STATUS (check only one for each return):

Original

Amended

(check only one for each return):

(1) You were 65 or over

Original

Amended

(1) Single

(2) You were blind

(1) Resident

(2) Married, filing jointly

(2) Partial-year

(3) Spouse was 65 or over

(3) Married, filing separately

resident

(4) Spouse was blind

Spouse’s SSN:

from _______ / _______ / ______

(5) You or your spouse can be claimed

(4) Head of household

to _________ / _______ / ______

as a dependent on another

person’s return

(3) Nonresident

(5) Widow(er) with dependent child(ren)

4 Federal exemptions (correct number of exemptions claimed on your federal return) . . . . . . . . . . . . . . . . . . . . . 4

Computation of Tax

Correct Amount

5 Federal adjusted gross income (AGI) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Nebraska standard deduction (see Form 1040N instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Total itemized deductions (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 State and local income taxes included in line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Nebraska itemized deductions (line 7 minus line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Nebraska deduction (larger of line 6 or line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Nebraska income before adjustments (line 5 minus line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 Adjustments increasing federal AGI (line 48, Nebraska Schedule I, Form 1040XN) . . . . . . . . . . . . . . . . . . . . .

12

13 Adjustments decreasing federal AGI (line 56, Nebraska Schedule I, Form 1040XN) . . . . . . . . . . . . . . . . . . . . .

13

14 Nebraska Taxable Income (line 11 plus line 12 minus line 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15 Nebraska income tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16 Nebraska other tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17 Total Nebraska tax before personal exemption credit (line 15 plus line 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

COMPLETE PAGE 2.

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

8-742-2014

1

1 2

2 3

3