Vt Form Co-420 Instructions - Foreign Dividend Factor Increments - Vermont Department Of Taxes - 2006

ADVERTISEMENT

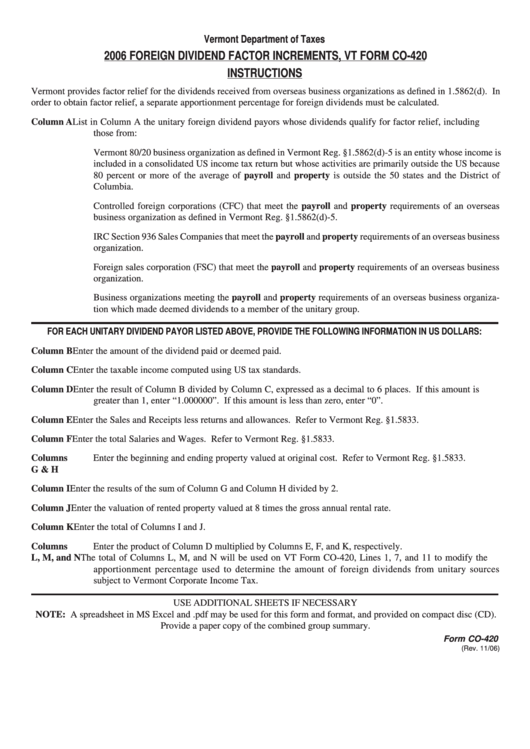

Vermont Department of Taxes

2006 FOREIGN DIVIDEND FACTOR INCREMENTS, VT FORM CO-420

INSTRUCTIONS

Vermont provides factor relief for the dividends received from overseas business organizations as defined in 1.5862(d). In

order to obtain factor relief, a separate apportionment percentage for foreign dividends must be calculated.

Column A

List in Column A the unitary foreign dividend payors whose dividends qualify for factor relief, including

those from:

Vermont 80/20 business organization as defined in Vermont Reg. §1.5862(d)-5 is an entity whose income is

included in a consolidated US income tax return but whose activities are primarily outside the US because

80 percent or more of the average of payroll and property is outside the 50 states and the District of

Columbia.

Controlled foreign corporations (CFC) that meet the payroll and property requirements of an overseas

business organization as defined in Vermont Reg. §1.5862(d)-5.

IRC Section 936 Sales Companies that meet the payroll and property requirements of an overseas business

organization.

Foreign sales corporation (FSC) that meet the payroll and property requirements of an overseas business

organization.

Business organizations meeting the payroll and property requirements of an overseas business organiza-

tion which made deemed dividends to a member of the unitary group.

FOR EACH UNITARY DIVIDEND PAYOR LISTED ABOVE, PROVIDE THE FOLLOWING INFORMATION IN US DOLLARS:

Column B

Enter the amount of the dividend paid or deemed paid.

Column C

Enter the taxable income computed using US tax standards.

Column D

Enter the result of Column B divided by Column C, expressed as a decimal to 6 places. If this amount is

greater than 1, enter “1.000000”. If this amount is less than zero, enter “0”.

Column E

Enter the Sales and Receipts less returns and allowances. Refer to Vermont Reg. §1.5833.

Column F

Enter the total Salaries and Wages. Refer to Vermont Reg. §1.5833.

Columns

Enter the beginning and ending property valued at original cost. Refer to Vermont Reg. §1.5833.

G & H

Column I

Enter the results of the sum of Column G and Column H divided by 2.

Column J

Enter the valuation of rented property valued at 8 times the gross annual rental rate.

Column K

Enter the total of Columns I and J.

Columns

Enter the product of Column D multiplied by Columns E, F, and K, respectively.

L, M, and N

The total of Columns L, M, and N will be used on VT Form CO-420, Lines 1, 7, and 11 to modify the

apportionment percentage used to determine the amount of foreign dividends from unitary sources

subject to Vermont Corporate Income Tax.

USE ADDITIONAL SHEETS IF NECESSARY

NOTE: A spreadsheet in MS Excel and .pdf may be used for this form and format, and provided on compact disc (CD).

Provide a paper copy of the combined group summary.

Form CO-420

(Rev. 11/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1