Vt Form Co-419 Instructions - Apportionment Of Foreign Dividends - 2006

ADVERTISEMENT

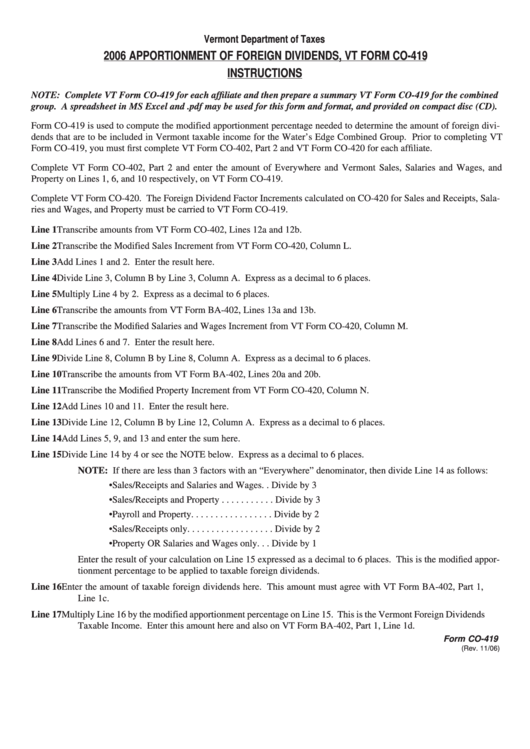

Vermont Department of Taxes

2006 APPORTIONMENT OF FOREIGN DIVIDENDS, VT FORM CO-419

INSTRUCTIONS

NOTE: Complete VT Form CO-419 for each affiliate and then prepare a summary VT Form CO-419 for the combined

group. A spreadsheet in MS Excel and .pdf may be used for this form and format, and provided on compact disc (CD).

Form CO-419 is used to compute the modified apportionment percentage needed to determine the amount of foreign divi-

dends that are to be included in Vermont taxable income for the Water’s Edge Combined Group. Prior to completing VT

Form CO-419, you must first complete VT Form CO-402, Part 2 and VT Form CO-420 for each affiliate.

Complete VT Form CO-402, Part 2 and enter the amount of Everywhere and Vermont Sales, Salaries and Wages, and

Property on Lines 1, 6, and 10 respectively, on VT Form CO-419.

Complete VT Form CO-420. The Foreign Dividend Factor Increments calculated on CO-420 for Sales and Receipts, Sala-

ries and Wages, and Property must be carried to VT Form CO-419.

Line 1

Transcribe amounts from VT Form CO-402, Lines 12a and 12b.

Line 2

Transcribe the Modified Sales Increment from VT Form CO-420, Column L.

Line 3

Add Lines 1 and 2. Enter the result here.

Line 4

Divide Line 3, Column B by Line 3, Column A. Express as a decimal to 6 places.

Line 5

Multiply Line 4 by 2. Express as a decimal to 6 places.

Line 6

Transcribe the amounts from VT Form BA-402, Lines 13a and 13b.

Line 7

Transcribe the Modified Salaries and Wages Increment from VT Form CO-420, Column M.

Line 8

Add Lines 6 and 7. Enter the result here.

Line 9

Divide Line 8, Column B by Line 8, Column A. Express as a decimal to 6 places.

Line 10

Transcribe the amounts from VT Form BA-402, Lines 20a and 20b.

Line 11

Transcribe the Modified Property Increment from VT Form CO-420, Column N.

Line 12

Add Lines 10 and 11. Enter the result here.

Line 13

Divide Line 12, Column B by Line 12, Column A. Express as a decimal to 6 places.

Line 14

Add Lines 5, 9, and 13 and enter the sum here.

Line 15

Divide Line 14 by 4 or see the NOTE below. Express as a decimal to 6 places.

NOTE: If there are less than 3 factors with an “Everywhere” denominator, then divide Line 14 as follows:

• Sales/Receipts and Salaries and Wages . . Divide by 3

• Sales/Receipts and Property . . . . . . . . . . . Divide by 3

• Payroll and Property . . . . . . . . . . . . . . . . . Divide by 2

• Sales/Receipts only . . . . . . . . . . . . . . . . . . Divide by 2

• Property OR Salaries and Wages only . . . Divide by 1

Enter the result of your calculation on Line 15 expressed as a decimal to 6 places. This is the modified appor-

tionment percentage to be applied to taxable foreign dividends.

Line 16

Enter the amount of taxable foreign dividends here. This amount must agree with VT Form BA-402, Part 1,

Line 1c.

Line 17

Multiply Line 16 by the modified apportionment percentage on Line 15. This is the Vermont Foreign Dividends

Taxable Income. Enter this amount here and also on VT Form BA-402, Part 1, Line 1d.

Form CO-419

(Rev. 11/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1