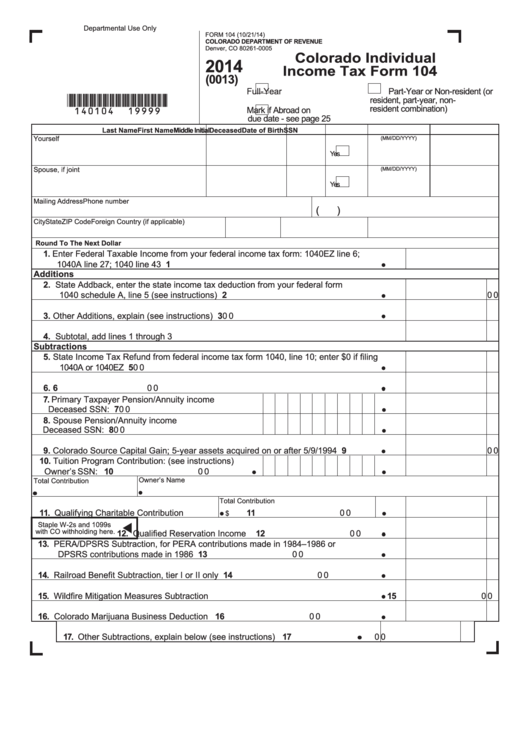

Departmental Use Only

FORM 104 (10/21/14)

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0005

Colorado Individual

2014

Income Tax Form 104

(0013)

Full-Year

Part-Year or Non-resident (or

*140104==19999*

resident, part-year, non-

resident combination)

Mark if Abroad on

due date - see page 25

Last Name

First Name

Middle Initial Deceased

Date of Birth

SSN

Yourself

(MM/DD/YYYY)

Yes

Spouse, if joint

(MM/DD/YYYY)

Yes

Mailing Address

Phone number

(

)

City

State

ZIP Code

Foreign Country (if applicable)

Round To The Next Dollar

1. Enter Federal Taxable Income from your federal income tax form: 1040EZ line 6;

1040A line 27; 1040 line 43

1

Additions

2. State Addback, enter the state income tax deduction from your federal form

1040 schedule A, line 5 (see instructions)

2

0 0

3. Other Additions, explain (see instructions)

3

0 0

4. Subtotal, add lines 1 through 3

4

0 0

Subtractions

5. State Income Tax Refund from federal income tax form 1040, line 10; enter $0 if filing

1040A or 1040EZ

5

0 0

6. U.S. Government Interest

6

0 0

7.

Primary Taxpayer Pension/Annuity income

Deceased SSN:

7

0 0

8.

Spouse Pension/Annuity income

Deceased SSN:

8

0 0

9. Colorado Source Capital Gain; 5-year assets acquired on or after 5/9/1994

9

0 0

10. Tuition Program Contribution: (see instructions)

Owner’s SSN:

10

0 0

Owner’s Name

Total Contribution

Total Contribution

11. Qualifying Charitable Contribution

11

0 0

$

Staple W-2s and 1099s

with CO withholding here.

12. Qualified Reservation Income

12

0 0

13. PERA/DPSRS Subtraction, for PERA contributions made in 1984–1986 or

DPSRS contributions made in 1986

13

0 0

14. Railroad Benefit Subtraction, tier I or II only

14

0 0

15. Wildfire Mitigation Measures Subtraction

15

0 0

16. Colorado Marijuana Business Deduction

16

0 0

17. Other Subtractions, explain below (see instructions)

17

0 0

1

1 2

2 3

3