Debt Payoff Worksheet

ADVERTISEMENT

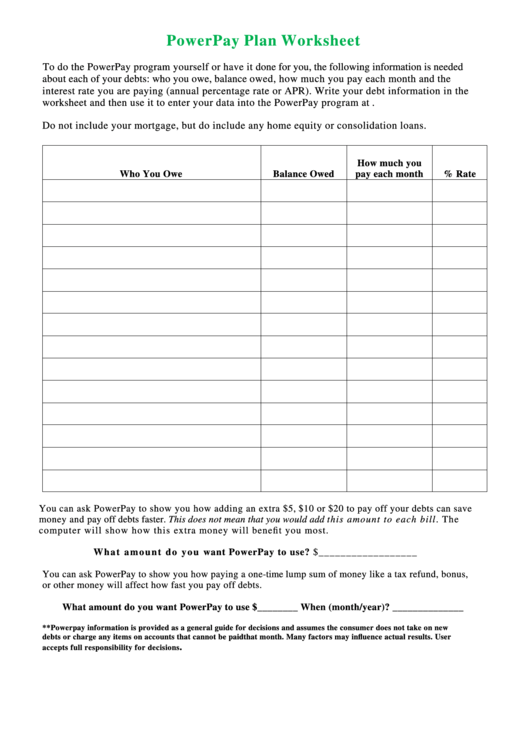

PowerPay Plan Worksheet

To do the PowerPay program yourself or have it done for you, the following information is needed

about each of your debts: who you owe, balance owed, how much you pay each month and the

interest rate you are paying (annual percentage rate or APR). Write your debt information in the

worksheet and then use it to enter your data into the PowerPay program at

Do not include your mortgage, but do include any home equity or consolidation loans.

How much you

Who You Owe

Balance Owed

pay each month

% Rate

You can ask PowerPay to show you how adding an extra $5, $10 or $20 to pay off your debts can save

money and pay off debts faster. This does not mean that you would add this amount to each bill. The

computer will show how this extra money will benefit you most.

W h a t a m o u n t d o y o u want PowerPay to use? $__________________

You can ask PowerPay to show you how paying a one-time lump sum of money like a tax refund, bonus,

or other money will affect how fast you pay off debts.

What amount do you want PowerPay to use $________ When (month/year)? ______________

**Powerpay information is provided as a general guide for decisions and assumes the consumer does not take on new

debts or charge any items on accounts that cannot be paid that month. Many factors may influence actual results. User

.

accepts full responsibility for decisions

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1