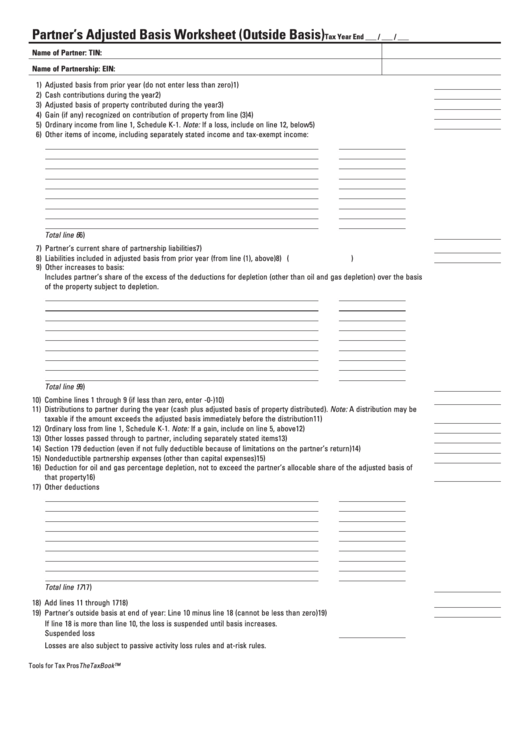

Partner’s Adjusted Basis Worksheet (Outside Basis)

Tax Year End ___ / ___ / ___

Name of Partner:

TIN:

Name of Partnership:

EIN:

1) Adjusted basis from prior year (do not enter less than zero)

1)

.. ..... .... ..... .... ... . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .

2) Cash contributions during the year

2)

.................................... .... ..... .... ..... ..... ... . .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .

3) Adjusted basis of property contributed during the year

3)

...... .... ..... .... ..... ..... .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .

4) Gain (if any) recognized on contribution of property from line (3)

4)

. ..... ..... ... . .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .

5) Ordinary income from line 1, Schedule K-1. Note: If a loss, include on line 12, below

5)

.. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . ..

6) Other items of income, including separately stated income and tax-exempt income:

Total line 6

6)

.. .. . .. . .. .. . .. . .......................................................... ..... .... ..... ..... .... ... .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. .

7) Partner’s current share of partnership liabilities

7)

................ ..... .... ..... .... ..... .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. ..

8) Liabilities included in adjusted basis from prior year (from line (1), above)

8) (

)

. .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. ..

9) Other increases to basis:

Includes partner’s share of the excess of the deductions for depletion (other than oil and gas depletion) over the basis

of the property subject to depletion.

Total line 9

9)

.. .. . .. . .. .. . .. . .......................................................... ..... .... ..... ..... .... ... .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. .

10) Combine lines 1 through 9 (if less than zero, enter -0-)

10)

..... .... ..... ..... .... ..... ... . .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .

11) Distributions to partner during the year (cash plus adjusted basis of property distributed). Note: A distribution may be

taxable if the amount exceeds the adjusted basis immediately before the distribution

11)

.. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .

12) Ordinary loss from line 1, Schedule K-1. Note: If a gain, include on line 5, above

12)

.. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . ..

13) Other losses passed through to partner, including separately stated items

13)

.. . .. . .. .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .

14) Section 179 deduction (even if not fully deductible because of limitations on the partner’s return)

14)

. .. .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . ..

15) Nondeductible partnership expenses (other than capital expenses)

15)

.... .... .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. ..

16) Deduction for oil and gas percentage depletion, not to exceed the partner’s allocable share of the adjusted basis of

that property

16)

. .. . .. .. . .. . .............................................................. ..... .... ..... .... ..... . . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .

17) Other deductions

Total line 17

17)

.. . .. . .. .. . .. ............................................................ ..... .... ..... ..... .... ... . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. .

18) Add lines 11 through 17

18)

..................................................... ..... ..... .... ..... ..... ... .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. .

19) Partner’s outside basis at end of year: Line 10 minus line 18 (cannot be less than zero)

19)

. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. .. . .. . .. ..

If line 18 is more than line 10, the loss is suspended until basis increases.

Suspended loss

. . .. .. . ............................................................... ..... .... ..... ..... ... . .. . .. .. . .. .. . .. . .. .. . .. .. .

Losses are also subject to passive activity loss rules and at-risk rules.

Tools for Tax Pros

TheTaxBook™

1

1