Print Form

Reset Form

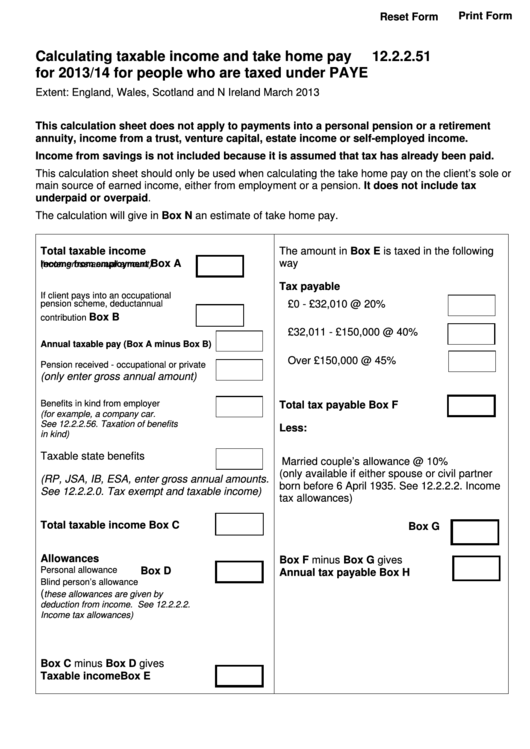

Calculating taxable income and take home pay

12.2.2.51

for 2013/14 for people who are taxed under PAYE

Extent: England, Wales, Scotland and N Ireland

March 2013

This calculation sheet does not apply to payments into a personal pension or a retirement

annuity, income from a trust, venture capital, estate income or self-employed income.

Income from savings is not included because it is assumed that tax has already been paid.

This calculation sheet should only be used when calculating the take home pay on the client’s sole or

main source of earned income, either from employment or a pension. It does not include tax

underpaid or overpaid.

The calculation will give in Box N an estimate of take home pay.

Total taxable income

The amount in Box E is taxed in the following

Box A

way

Income from employment

(enter gross annual amount)

Tax payable

If client pays into an occupational

£0 - £32,010 @ 20%

pension scheme, deduct annual

Box B

contribution

£32,011 - £150,000 @ 40%

Annual taxable pay (Box A minus Box B)

Over £150,000 @ 45%

Pension received - occupational or private

(only enter gross annual amount)

Benefits in kind from employer

Total tax payable

Box F

(for example, a company car.

See 12.2.2.56. Taxation of benefits

Less:

in kind)

Taxable state benefits

Married couple’s allowance @ 10%

(only available if either spouse or civil partner

(RP, JSA, IB, ESA, enter gross annual amounts.

born before 6 April 1935. See 12.2.2.2. Income

See 12.2.2.0. Tax exempt and taxable income)

tax allowances)

Total taxable income

Box C

Box G

Allowances

Box F minus Box G gives

Box D

Personal allowance

Annual tax payable

Box H

Blind person’s allowance

(

these allowances are given by

deduction from income. See 12.2.2.2.

Income tax allowances)

Box C minus Box D gives

Taxable income

Box E

1

1 2

2